The Fulton Georgia Employment Status Form is a crucial document used by employers in Fulton County, Georgia, to gather comprehensive information regarding an individual's employment status. This form serves as a means for employers to ensure compliance with employment regulations, tax laws, and provide accurate reporting to regulatory agencies. The main purpose of the Fulton Georgia Employment Status Form is to obtain precise details about an employee or prospective employee's working arrangement, including their employment classification, wages, benefits, and tax withholding information. The form captures essential data that helps employers make informed decisions, maintain accurate records, and execute appropriate payroll procedures. This employment status form includes several sections that require the employee's personal information, such as full name, address, social security number, and contact details. Additionally, the form gathers specifics about the employee's classification, which may include options such as full-time, part-time, contract worker, seasonal worker, or independent contractor. Furthermore, the Fulton Georgia Employment Status Form requires information about the employee's compensation, such as hourly wage or salary, commission rates, bonuses, or any other remuneration received. This section ensures proper calculation of payroll taxes, benefits entitlements, and overall employee compensation management. Another critical component of the form pertains to tax-related information. Employers require details about an employee's federal tax withholding status, state tax withholding preferences, and any additional voluntary deductions the employee may choose to make (e.g., retirement contributions, health insurance premiums, etc.). This helps employers calculate accurate tax withholding and fulfill their obligations as per state and federal tax laws. It is important to note that the Fulton Georgia Employment Status Form may have additional variations or adaptations, depending on the specific purposes or industries. For instance, there might be separate versions of the form for government employees, educators, healthcare professionals, or individuals hired for temporary positions. These variations are developed to cater to the unique requirements and regulations associated with different employment sectors. In conclusion, the Fulton Georgia Employment Status Form is a vital document used by employers in Fulton County, Georgia, to gather detailed information about an employee's working arrangement, compensation, tax withholding preferences, and personal details. This form aids businesses in adhering to legal and financial obligations, maintaining accurate records, and ensuring compliance with employment regulations. Various types of the form may exist to cater to specific industries or employment classifications.

Fulton Georgia Employment Status Form

Description

How to fill out Fulton Georgia Employment Status Form?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Fulton Employment Status Form, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fulton Employment Status Form from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Fulton Employment Status Form:

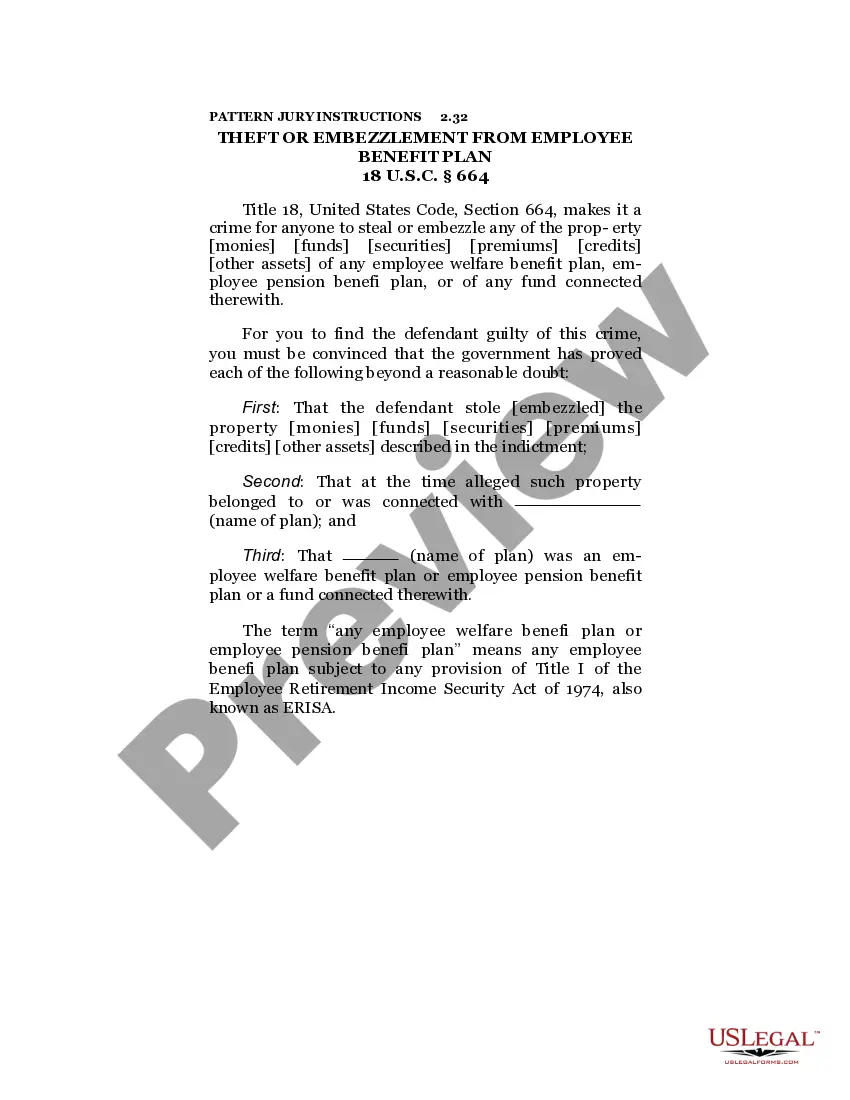

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!