The Orange California Employment Status Form is a crucial document used by employers and employees in Orange, California, to gather necessary information related to the job status of individuals. This form is instrumental in determining various aspects of employment, including employee benefits, tax withholding, and eligibility verification. In regard to the different types, there are primarily two types of Orange California Employment Status Forms: 1. Orange California Employee Information Form: This form gathers essential information about the employees, such as their full name, contact details, Social Security Number (SSN), date of birth, and home address. Additionally, it may also require the disclosure of emergency contact details, educational background, previous work history, and references. Providing accurate information on this form is crucial for proper record-keeping and efficient communication between employers and employees in Orange, California. 2. Orange California Tax Withholding Form: This document focuses specifically on tax-related information. It requires employees to provide their filing status (e.g., single, married filing jointly, etc.), the number of withholding allowances they are claiming, and any additional amount they wish to withhold from their paycheck for tax purposes. Filling out this form correctly ensures proper calculation of the employee's federal and state income tax withholding, ensuring compliance with taxation regulations in Orange, California. 3. Orange California Benefit Enrollment Form: Although not a separate employment status form, the benefit enrollment form is often considered an extension of the employment status paperwork. It helps employees in Orange, California, select their preferred benefits, such as health insurance, dental coverage, retirement plans, and other perks, offered by their employers. The employee's choices may impact deductions from their paychecks or their eligibility for specific benefits, making this form vital for both employees and employers. Completing the Orange California Employment Status Form(s) accurately and comprehensively is crucial to ensure legal compliance and maintain smooth employment processes. Failure to provide truthful and up-to-date information may result in administrative issues, delays in salary, tax penalties, or ineligibility for certain benefits. Therefore, employees should diligently fill out these forms, while employers must handle and secure the submitted data with utmost confidentiality and in compliance with privacy laws.

Orange California Employment Status Form

Description

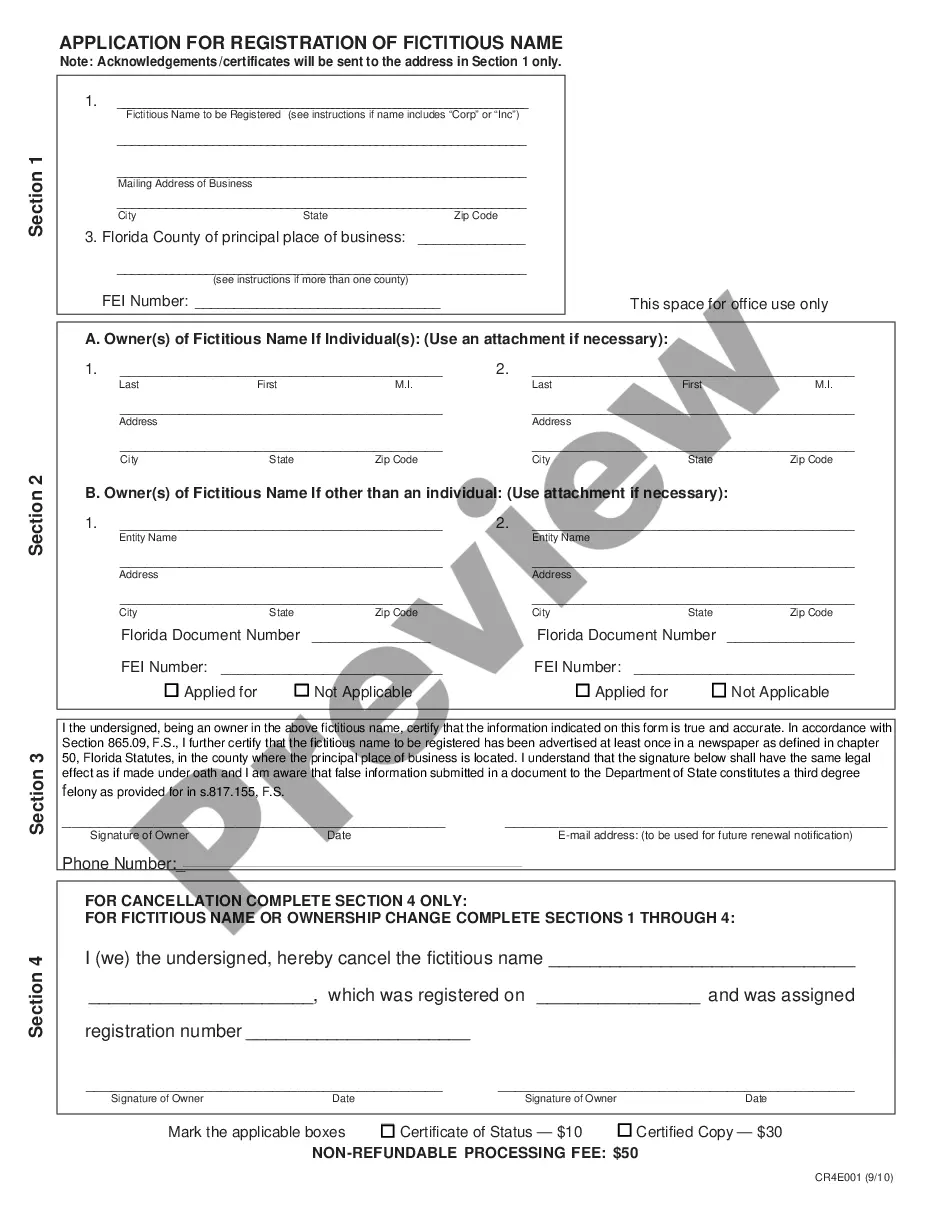

How to fill out Orange California Employment Status Form?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Employment Status Form, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Orange Employment Status Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Employment Status Form:

- Look through the page and verify there is a sample for your area.

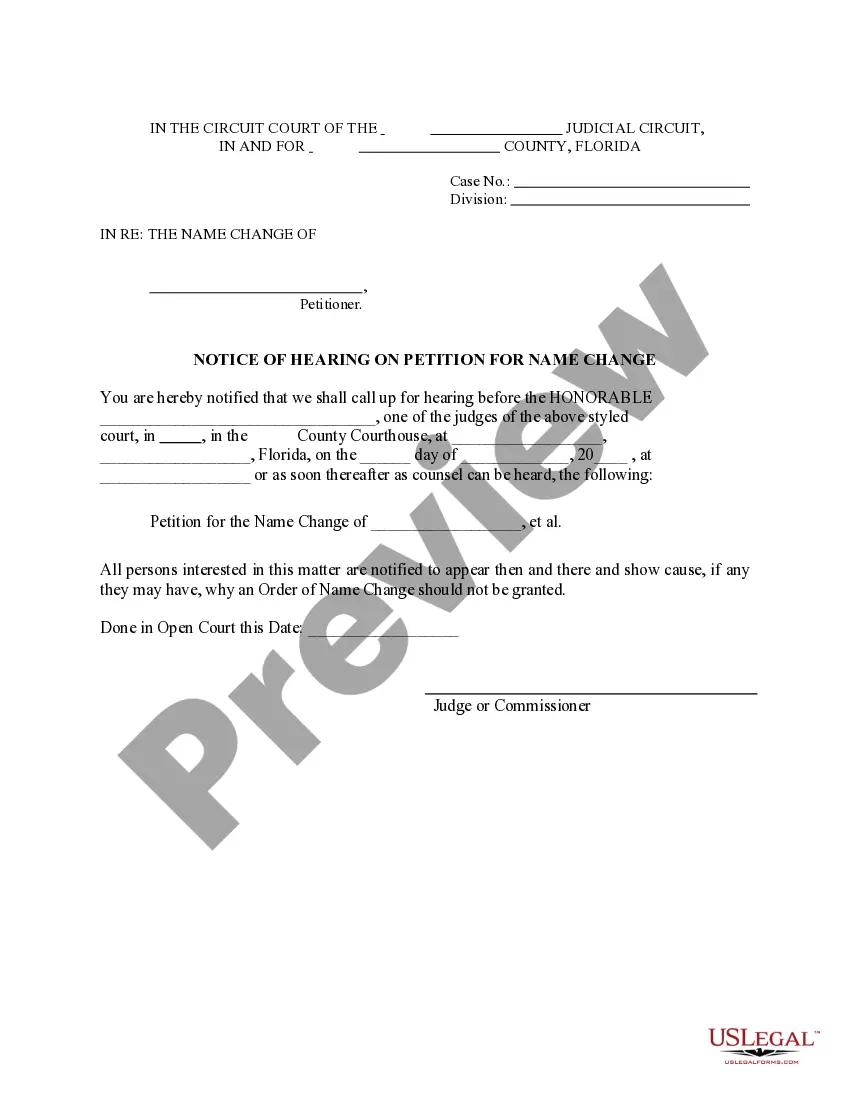

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Orange Employment Status Form and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!