The Travis Texas AO-133 Bill of Costs is an essential document used in the Federal District Court to claim the expenses incurred during legal proceedings. This form serves to itemize and seek reimbursement for various costs that were reasonably necessary for the case. The Travis Texas AO-133 Bill of Costs is a standardized official form specifically designed for the Federal District Court of Travis County, Texas. It follows the guidelines and regulations imposed by the court, ensuring consistency and accuracy in documenting the costs. This form carries significant weight as it is used to request reimbursement from the opposing party, which may include a successful litigant's attorney's fees, deposition fees, witness and expert fees, copying and printing costs, court fees, and other necessary expenses. Some different types of Travis Texas AO-133 Bill of Costs in the Federal District Court include: 1. General Costs: These are expenses that are directly related to the litigation process, such as filing fees, court reporter fees, and document retrieval fees. 2. Expert Witness Costs: In cases where expert witnesses were retained, their fees and expenses can be included. This may cover their consultation fees, travel expenses, research materials, and other related costs. 3. Deposition Costs: Costs associated with conducting depositions, such as the court reporter's fees, transcripts, and video recording fees, can be detailed in this section. 4. Copying and Printing Costs: This category includes expenses incurred for making copies of documents, exhibits, and other materials necessary for the case, as well as the fees for printing and binding. 5. Travel Costs: If travel was required for the case, such as attending hearings, collecting evidence, or meeting with key individuals, transportation expenses, accommodation, meals, and other related costs can be itemized. 6. Witness Fees: If witnesses were subpoenaed or required to testify, their compensation, including travel expenses, stipends, and any other reasonable expenses, can be outlined separately. 7. Miscellaneous Costs: This section can be used to list any other reasonable and necessary expenses that are not covered within the aforementioned categories, such as postage, courier services, telephone charges, and research materials. It is crucial to accurately complete the Travis Texas AO-133 Bill of Costs form, ensuring that all costs are clearly documented, supported by receipts and invoices, and properly categorized. Any requested reimbursement should be justified and adhere to the rules set forth by the court. By utilizing the Travis Texas AO-133 Bill of Costs — Federal District Court Official Form, litigants can successfully recover the expenses incurred throughout their legal proceedings, promoting fairness and accountability in the judicial system.

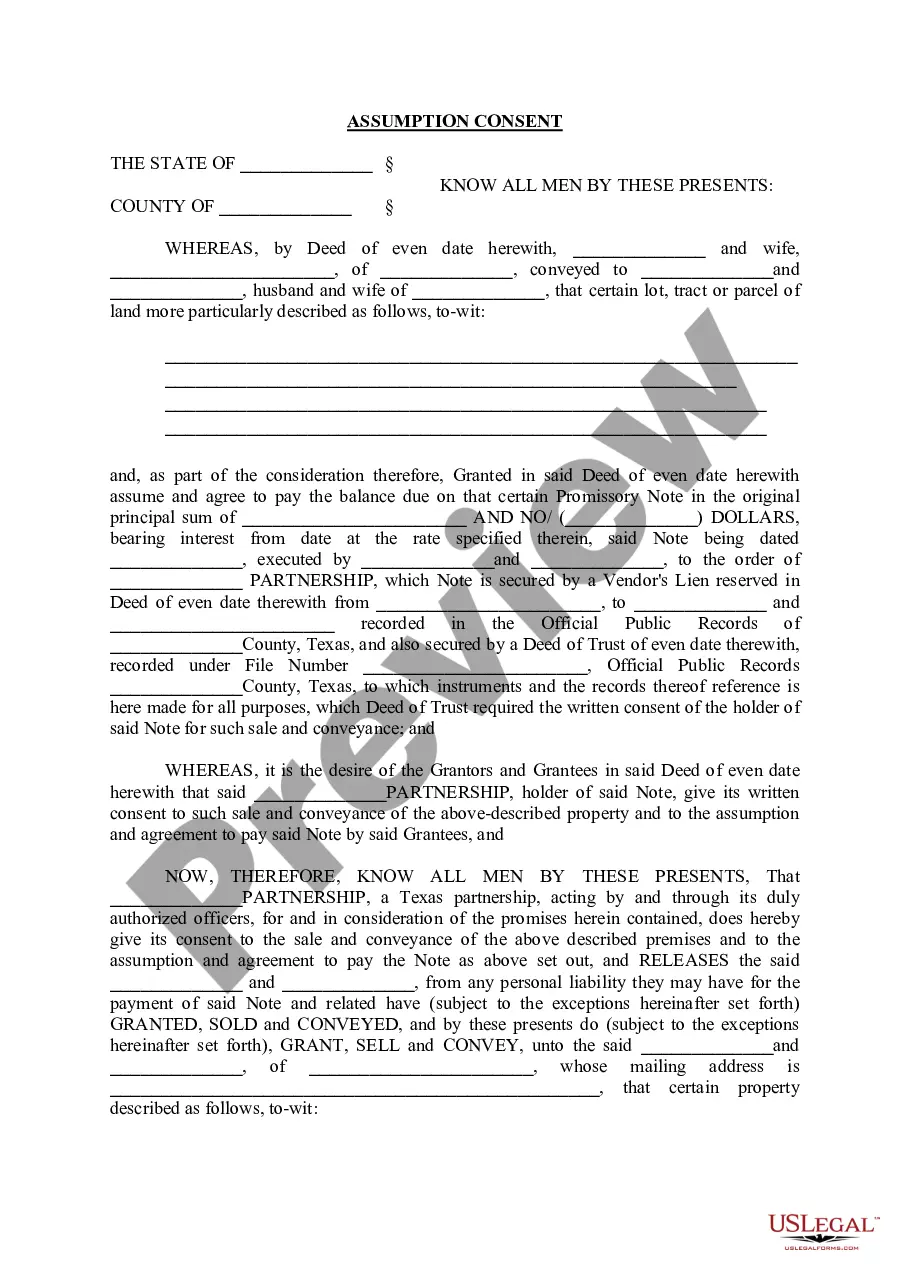

Travis Texas Bill of Costs (District Court)

Description

How to fill out Travis Texas Bill Of Costs (District Court)?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Travis AO-133 Bill of Costs - Federal District Court Official Form, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Travis AO-133 Bill of Costs - Federal District Court Official Form, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Travis AO-133 Bill of Costs - Federal District Court Official Form:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Travis AO-133 Bill of Costs - Federal District Court Official Form and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!