Hillsborough Florida Order Conditionally Approving Disclosure Statement (B 13S): A Comprehensive Overview In Hillsborough County, Florida, a unique legal procedure known as an Order Conditionally Approving Disclosure Statement (B 13S) is employed to facilitate the reorganization or liquidation of businesses or individuals facing financial distress. This detailed description aims to shed light on the different aspects of the Hillsborough Florida Order Conditionally Approving Disclosure Statement, highlighting its purpose, process, and types of applications. Purpose: The primary objective of a Hillsborough Florida Order Conditionally Approving Disclosure Statement (B 13S) is to provide a structured framework that allows debtors to develop and present their proposed plan of action for minimizing financial obligations. This court-approved disclosure statement is an integral part of Chapter 11 bankruptcy proceedings, enabling the debtor to propose a feasible repayment plan to creditors while protecting their interests. Process: 1. Filing: The debtor initiates the process by filing a petition with the Hillsborough County Bankruptcy Court, specifically requesting conditionally approving disclosure statement relief. 2. Preparation of Disclosure Statement: In conjunction with professional advisors, the debtor drafts a comprehensive disclosure statement detailing their financial situation, assets, liabilities, and proposed repayment plan. 3. Conditional Approval: Upon submission of the disclosure statement to the court, an order conditionally approving the disclosure statement may be granted. This preliminary approval allows the debtor to distribute the disclosure statement to creditors for their evaluation and approval. 4. Creditor Evaluation: Creditors assess the disclosure statement to determine whether the proposed repayment plan adequately addresses their claims and offers a feasible path towards debt recovery. Creditors have the opportunity to object to the disclosure statement if they find it unsatisfactory or non-compliant with bankruptcy laws. 5. Plan Confirmation: If creditors approve the disclosure statement and the court finds it satisfactory, the debtor proceeds to the plan confirmation phase. This entails seeking final court approval for the proposed plan, ensuring all stakeholders' interests are adequately protected. Types: While the core purpose remains the same, there are various types of Hillsborough Florida Order Conditionally Approving Disclosure Statements (B 13S) based on the nature and circumstances of the debtors' cases. Some commonly encountered types include: 1. Individual Chapter 11 B 13S: Pertains to individual debtors who wish to reorganize their financial obligations and propose a repayment plan under Chapter 11 bankruptcy. 2. Corporate Chapter 11 B 13S: Applicable to corporate entities looking to restructure their debts, maintain operations, and return to profitability through a court-approved repayment plan. 3. Liquidation Chapter 11 B 13S: When a debtor is unable to formulate a viable repayment plan, this type of disclosure statement aims to outline an orderly liquidation process that maximizes asset value and distributes proceeds to creditors accordingly. In short, the Hillsborough Florida Order Conditionally Approving Disclosure Statement (B 13S) is a pivotal legal instrument utilized in bankruptcy proceedings to provide an organized framework for debtors to propose repayment plans while accommodating the interests of creditors. Whether it involves individuals, corporations, or liquidation scenarios, this court-approved document plays a fundamental role in facilitating financial rehabilitation and ensuring a fair distribution of resources.

Hillsborough Florida Order Conditionally Approving Disclosure Statement, etc - B 13S

Description

How to fill out Hillsborough Florida Order Conditionally Approving Disclosure Statement, Etc - B 13S?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Hillsborough Order Conditionally Approving Disclosure Statement, etc - B 13S without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Hillsborough Order Conditionally Approving Disclosure Statement, etc - B 13S on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Hillsborough Order Conditionally Approving Disclosure Statement, etc - B 13S:

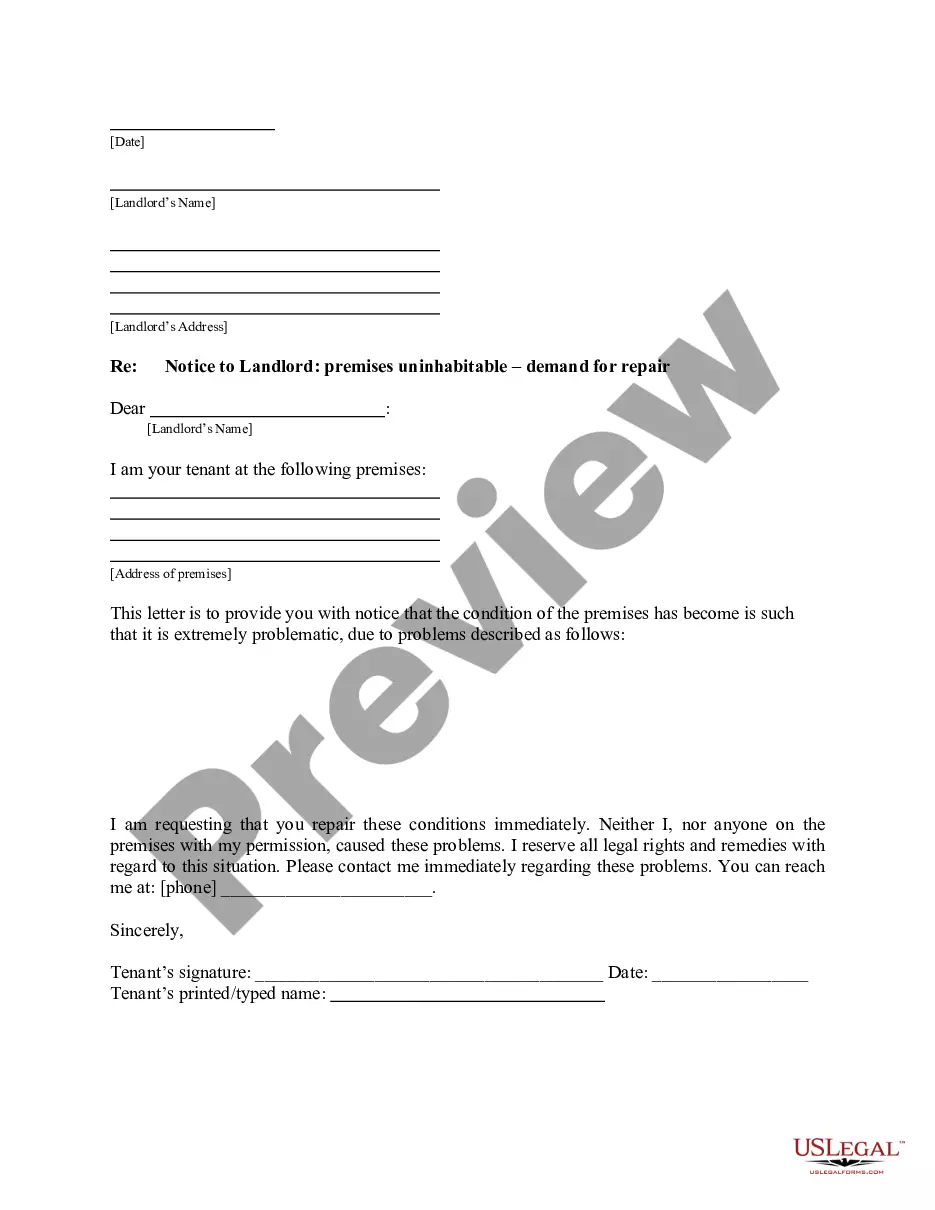

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!