Salt Lake Utah Discharge of Joint Debtors — Chapter — - Updated 2005 Act Form: A Comprehensive Guide The Salt Lake Utah Discharge of Joint Debtors — Chapter — - Updated 2005 Act form is a crucial legal document that outlines the process and requirements for joint debtors seeking relief under Chapter 7 bankruptcy in Salt Lake City, Utah. This form, updated in 2005, is designed to comply with the latest laws and regulations governing bankruptcy proceedings. In Utah, Chapter 7 bankruptcy provides individuals or joint debtors with a fresh financial start by liquidating their non-exempt assets to pay off outstanding debts, thereby providing relief from overwhelming financial obligations. The Discharge of Joint Debtors form enables both spouses to apply for a discharge of their joint debts, giving them the opportunity to rebuild their financial lives. Key Information and Sections: 1. Basic Identification: The form begins with general information and identification details for the joint debtors, including names, addresses, social security numbers, and attorney information. Providing accurate information is crucial to ensure the application is processed smoothly. 2. Statement of Intention: Debtors are required to choose their intention for treating secured debts. They can indicate whether they intend to surrender the collateral, redeem it, or reaffirm the debt by continuing to make payments on it. 3. Statement of Financial Affairs: This section requires detailed information about the debtors' financial situation, including income, expenses, assets, liabilities, and any previous bankruptcy filings. Providing an accurate and comprehensive list of assets and liabilities is crucial for a successful discharge. 4. Statement of Individual Debtors: This section collects information about each individual debtor, including their income, expenses, and property exemptions. It also includes a statement of current monthly income and means test calculation, which helps determine eligibility for Chapter 7 bankruptcy. Different Types of Salt Lake Utah Discharge of Joint Debtors — Chapter — - Updated 2005 Act Forms: 1. Form 22A: This is specifically designed for individual debtor(s) filing for bankruptcy under Chapter 7. It focuses on means testing and helps determine if the debtor's income is below or above the state median income. 2. Form 22B: This form is used when the debtor(s) have primarily consumer debts rather than business debts. It provides additional calculations and information to determine the debtor's discretion to file under Chapter 7. 3. Form 106Sum: This form is used to summarize all the schedules, forms, and documents filed by the joint debtors. It aids in providing an overview of the bankruptcy case for the courts and interested parties. 4. Form 106Sum2: This form serves as a summary for assets and liabilities when multiple joint debtors are involved. It provides a consolidated view of the financial situation for all parties involved. Conclusion: The Salt Lake Utah Discharge of Joint Debtors — Chapter — - Updated 2005 Act form is a critical tool in the bankruptcy process for joint debtors seeking relief under Chapter 7 in Salt Lake City, Utah. By accurately completing this form and its accompanying schedules, debtors can present a comprehensive overview of their financial situation and work towards obtaining a discharge of joint debts. It's essential to consult with an experienced bankruptcy attorney to ensure proper completion of the form and compliance with all legal requirements.

Salt Lake Utah Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Salt Lake Utah Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Salt Lake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Salt Lake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form:

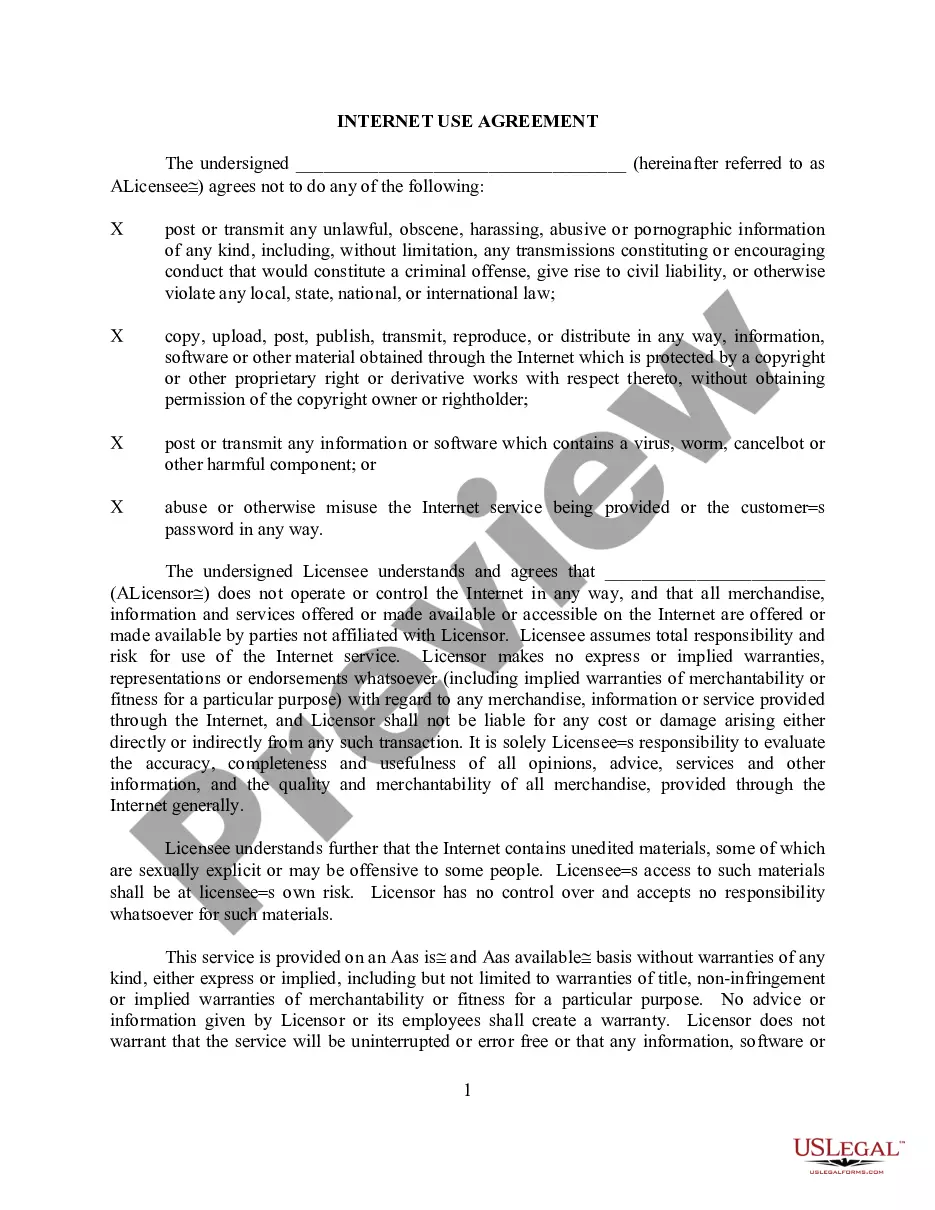

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!