The Wake North Carolina Discharge of Joint Debtors — Chapter 7 – updated 2005 Act form is a legal document used in the state of North Carolina to request the discharge of joint debtors under Chapter 7 bankruptcy proceedings. This form is an important tool in the bankruptcy process, allowing joint debtors to seek relief from their financial obligations. Filing for bankruptcy under Chapter 7 can provide individuals with a fresh start by eliminating most of their unsecured debts, such as credit card bills, medical expenses, and personal loans. However, it's important to note that certain debts, such as child support, alimony, student loans, and some tax obligations, may not be discharged. The Wake North Carolina Discharge of Joint Debtors form complies with the updated 2005 Act, which refers to the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) passed by Congress in 2005. This act brought significant changes to the bankruptcy laws, aiming to prevent abuse and provide a fair process for debtors seeking relief. To ensure accuracy and effectiveness, there may be different versions or revisions of the Wake North Carolina Discharge of Joint Debtors — Chapter 7 form, depending on the implementation or changes made over time. These revisions can address improvements in the bankruptcy laws or necessary updates to comply with new legal requirements. Therefore, it's crucial to use the updated form and stay informed about any changes in bankruptcy regulations in Wake County, North Carolina. When completing the Wake North Carolina Discharge of Joint Debtors form, it's essential to provide accurate and detailed information about both debtors, including their full legal names, social security numbers, addresses, and contact information. Moreover, the form might require disclosing specific details regarding the joint debts, such as account numbers, creditors' names, and outstanding balances. To ensure a successful discharge, debtors must pay close attention to the instructions provided with the form and consult with a qualified bankruptcy attorney if needed. Hiring professional legal assistance can help ensure the proper completion and filing of all necessary documents, increasing the chances of a positive outcome in the bankruptcy process. In summary, the Wake North Carolina Discharge of Joint Debtors — Chapter — - updated 2005 Act form is crucial in seeking relief from joint debts through Chapter 7 bankruptcy. It is designed to adhere to the provisions of the 2005 Act, and its proper completion is essential to achieve a successful discharge. Keep in mind that there might be different versions or revisions of this form, tailored to any changes or updates in bankruptcy laws over time.

Wake North Carolina Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Wake North Carolina Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Wake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Wake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Wake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form:

- Ensure you have opened the right page with your localised form.

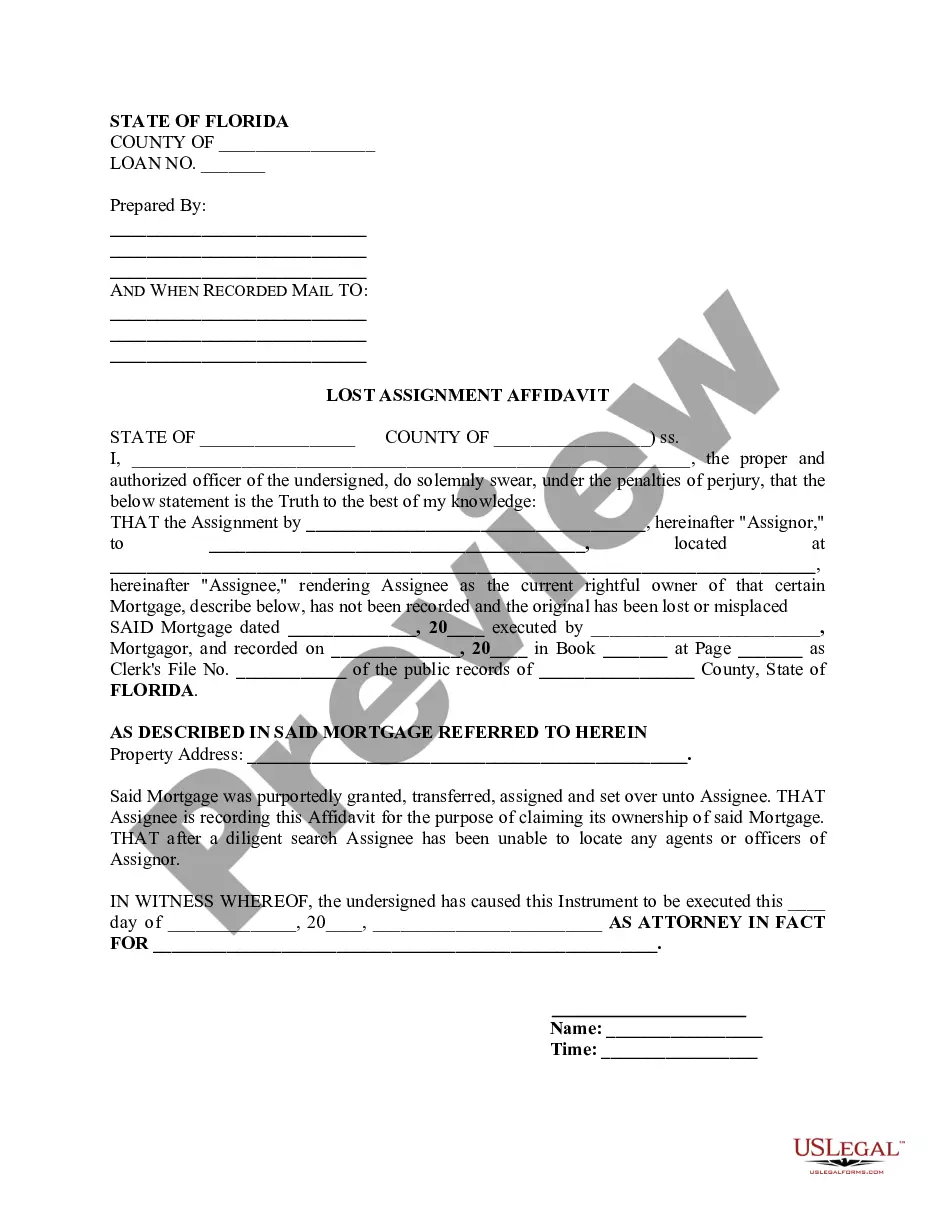

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Wake Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!