The Allegheny Pennsylvania Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act serves as an essential legal document in the state's bankruptcy proceedings. This notice is designed to inform individual debtors about their rights and responsibilities under the bankruptcy code, specifically focusing on provisions outlined in Section 342b of the 2005 Act. Section 342b of the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) aims to ensure that debtors have a clear understanding of the bankruptcy process, their rights, and the available alternatives. The notice outlines key information, often provided by the bankruptcy court or appointed trustee, to assist debtors in navigating their financial crisis and making informed decisions. Key elements included in the Allegheny Pennsylvania Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act may include: 1. Bankruptcy overview: The notice provides a comprehensive overview of the bankruptcy process, explaining the different chapters available to debtors, such as Chapter 7, Chapter 11, and Chapter 13. It outlines the significance of each chapter and its implications for individuals seeking debt relief. 2. Filing requirements: Debtors are informed about their obligations and responsibilities when filing for bankruptcy. This section covers essential details, including required forms, documentation, and deadlines. It emphasizes the importance of accurate and complete disclosures to ensure a fair and efficient resolution. 3. Automatic stay: This notice highlights the automatic stay provision, which goes into effect immediately upon filing for bankruptcy. It explains that the automatic stay protects debtors from most collection efforts and foreclosure actions, giving them a much-needed reprieve from the constant financial pressures. 4. Means test: Debtors with primarily consumer debts should be made aware of the means test, a key component of the 2005 Act. This test assists in determining a debtor's eligibility to file for Chapter 7 bankruptcy, focusing on their income, expenses, and overall financial situation. The notice may provide information on how to calculate and complete the means test accurately. 5. Credit counseling requirement: Under the 2005 Act, individuals filing for bankruptcy must undergo credit counseling before their debts can be discharged. The notice informs debtors about the approved agencies they can contact for this mandatory counseling and how to obtain a certificate of completion. 6. Debtor education requirement: Once the bankruptcy petition is filed, debtors must also complete a debtor education course. The notice provides details on approved educational providers, highlighting the importance of this course in promoting financial literacy and responsible financial management. It is crucial to note that while the content of the notice may vary slightly across different jurisdictions, its primary objective remains consistent — to educate and empower debtors with knowledge about the bankruptcy process and their rights as borrowers. Therefore, the Allegheny Pennsylvania Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act mainly focuses on providing accurate and relevant information tailored to the local bankruptcy laws and regulations.

Allegheny Pennsylvania Voluntary Petition for Non-Individuals Filing for Bankruptcy

Description

How to fill out Allegheny Pennsylvania Voluntary Petition For Non-Individuals Filing For Bankruptcy?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Allegheny Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act without expert assistance.

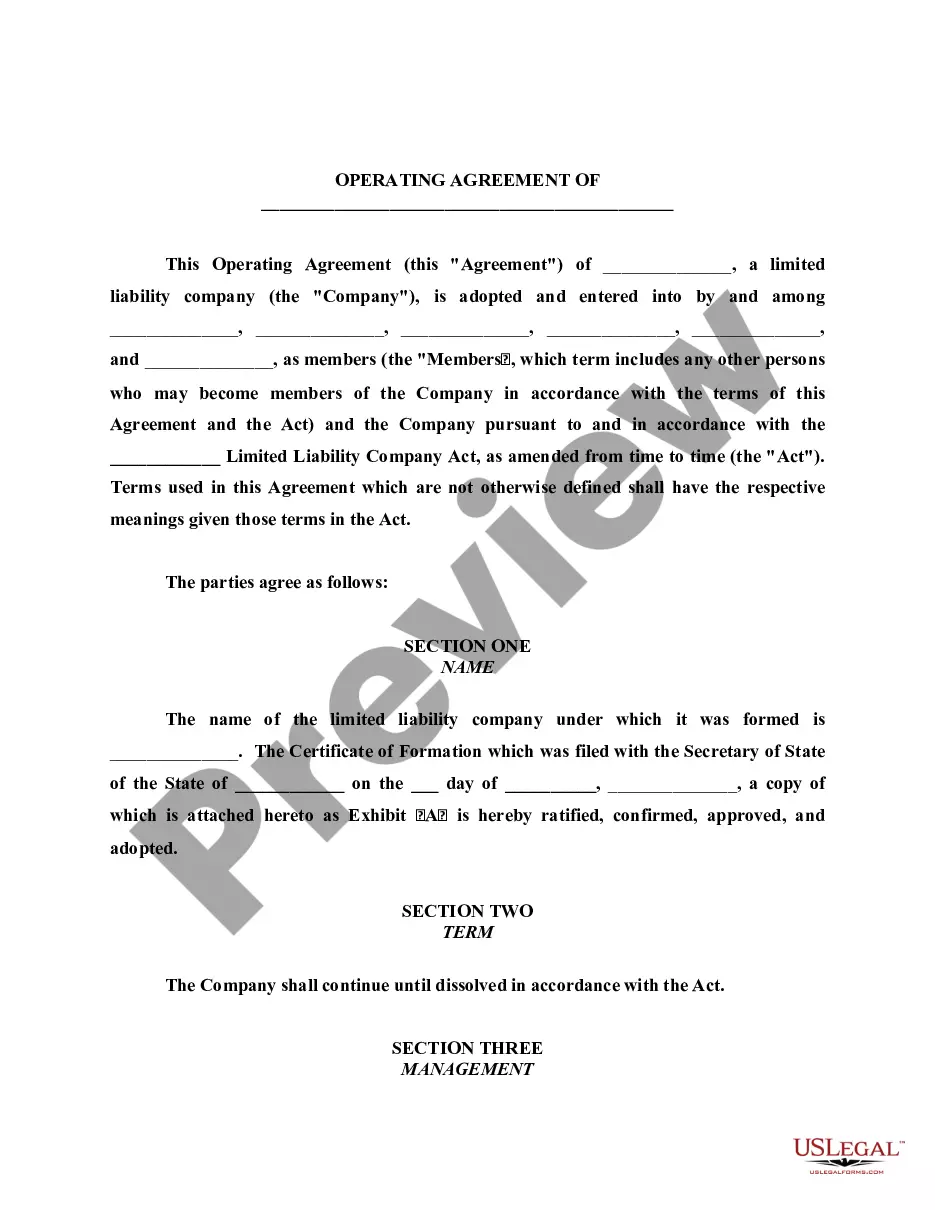

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Allegheny Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Allegheny Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!