San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act Title: Understanding the San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts under Section 342b of the 2005 Act Introduction: If you reside in San Bernardino, California, and find yourself in a situation where you have primarily consumer debts, it is essential to familiarize yourself with the Notice to Individual Debtor requirements under Section 342b of the 2005 Act. This notice serves as an important legal document that provides information on your rights and obligations regarding your consumer debts. In this article, we will delve into the details of San Bernardino California's Notice to Individual Debtor with Primarily Consumer Debts, emphasizing the relevance of Section 342b and its implications. Understanding the San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts: The San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts is a crucial document governed by Section 342b of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. This notice aims to inform individual debtors residing in San Bernardino about the critical elements of the 2005 Act, ensuring their understanding of their rights and responsibilities as consumers with outstanding debts. Key Elements of the Notice: 1. Rights and Protections: The notice highlights the rights and protections available to debtors under the 2005 Act. It educates individuals about their entitlement to fair treatment by creditors, protection against abusive practices, and their right to dispute debts and obtain accurate information regarding their accounts. 2. Required Actions and Obligations: The notice clearly outlines the actions and obligations debtors must undertake throughout the debt repayment process. It explains the importance of fulfilling financial obligations, making timely payments, and cooperating during debt collection proceedings. 3. Available Resources and Assistance: Debtors are informed about various resources and assistance programs that they can utilize to understand their rights and seek guidance regarding their consumer debts. These resources may include credit counseling services, legal aid organizations, and bankruptcy attorneys who can provide professional assistance and advice tailored to their specific circumstances. 4. Financial Education: The notice emphasizes the significance of financial literacy and education in managing consumer debts effectively. Debtors are encouraged to participate in financial education courses or workshops that can enhance their understanding of budgeting, debt management strategies, and responsible financial practices, thus empowering them to make informed decisions regarding their debts. Types of San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts: While there may not be specific types of notices under Section 342b targeting different debtor categories, variations may arise depending on the nature of the consumer debts involved and the legal frameworks applicable to each situation. Some common scenarios where debtors may receive these notices include: 1. Notice to Individual Debtor with Primarily Credit Card Debts: This notice specifically focuses on individual debtors in San Bernardino who have primarily outstanding credit card debts. 2. Notice to Individual Debtor with Primarily Medical Debts: This type of notice caters to individuals facing predominantly medical debts and serves to inform them about their rights and obligations under the 2005 Act. 3. Notice to Individual Debtor with Primarily Student Loan Debts: Aimed at individuals burdened with primarily student loan debts, this notice provides important information on managing student loan obligations and exploring available repayment options. Conclusion: The San Bernardino California Notice to Individual Debtor with Primarily Consumer Debts is a significant legal instrument that ensures debtors are fully informed about their rights and responsibilities under the 2005 Act. By understanding the implications and complying with the obligations outlined in this notice, individuals can navigate the realm of consumer debts more confidently and proactively. Seeking professional advice and utilizing available resources can empower debtors to make better financial decisions and strive towards effective debt management.

San Bernardino California Voluntary Petition for Non-Individuals Filing for Bankruptcy

Description

How to fill out San Bernardino California Voluntary Petition For Non-Individuals Filing For Bankruptcy?

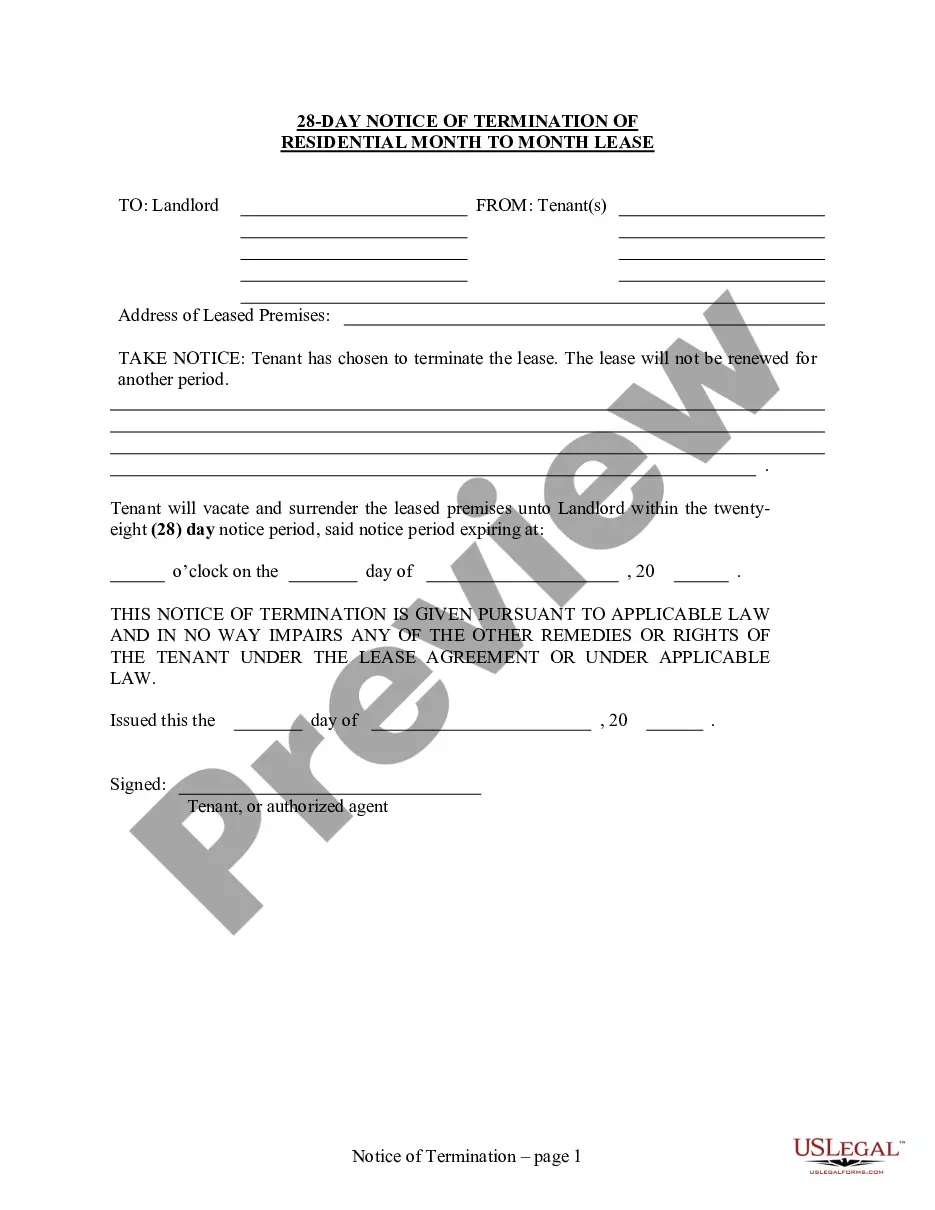

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Bernardino Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the recent version of the San Bernardino Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Bernardino Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your San Bernardino Notice to Individual Debtor with Primarily Consumer Debts regarding Section 342b for 2005 Act and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

(the legal process by which the assets of a debtor are sold to pay off creditors so that the debtor can make a fresh start financially). a proceeding designed to liquidate a debtor's property, pay off creditors, and discharge the debtor from most debts. also called liquidation and straight bankruptcy.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

(the legal process by which the assets of a debtor are sold to pay off creditors so that the debtor can make a fresh start financially). a proceeding designed to liquidate a debtor's property, pay off creditors, and discharge the debtor from most debts. also called liquidation and straight bankruptcy.

In bankruptcy court, when a debtor being discharged of debts, he will be no longer liable for the debts, and the lender is no longer allowed to make attempts to collect the debts. The court will issue a decision to discharge debts.

The Code's Order of Priority In general, the Code provides that secured creditors are entitled to receive the entire value of the collateral securing their claims up to the full amount they are owed. Unsecured creditors, then, get to look to any remaining assets of the estate.

Bankruptcy is a legal proceeding carried out to allow individuals or businesses freedom from their debts, while simultaneously providing creditors an opportunity for repayment.

Dischargeable debt is debt that can be eliminated after a person files for bankruptcy. The debtor will no longer be personally liable for the debts and therefore has no legal obligation to pay discharged debt.

What Is a Default? Default is the failure to make required interest or principal repayments on a debt, whether that debt is a loan or a security. Individuals, businesses, and even countries can default on their debt obligations. Default risk is an important consideration for creditors.

Chapter 13 bankruptcy typically takes three to five years. During that time, you'll be on a repayment plan to repay some or a portion of your debts. There are a few factors that will determine how long your Chapter 13 repayment plan will last, including your income.