Maricopa, Arizona summons to debtor in an involuntary case is a legal document issued by the court to notify a debtor of a pending involuntary case. Involuntary cases usually occur when creditors come together to force a debtor into bankruptcy. The summons informs the debtor of the lawsuit filed against them and provides details of the claims made by the creditors. This document is governed by the Bankruptcy Code and is a crucial step in the legal process. Keywords: Maricopa, Arizona; summons to debtor; involuntary case; B 250E; bankruptcy; legal document; court; creditors; debtor; claims; Bankruptcy Code. Types of Maricopa, Arizona Summons to Debtor in Involuntary Case — B 250E: 1. Preliminary Summons to Debtor: This is the initial summons that is served to the debtor at the beginning of an involuntary case. It notifies the debtor of the lawsuit filed against them by the creditors and provides information regarding the court hearing and the deadline for responding. 2. Notice of Hearing Summons: This type of summons is issued when a court hearing is scheduled to determine the validity of the claims made in the involuntary case. It informs the debtor of the date, time, and location of the hearing, as well as their rights to present their defense and any supporting evidence. 3. Amended Summons: An amended summons may be issued if any changes or corrections need to be made to the original summons. This can occur due to errors in the initial document or if there are additional claims or parties involved in the case. 4. Final Summons to Debtor: This summons is sent to the debtor once the court has reached a decision in the involuntary case. It outlines the court's ruling and any further action required by the debtor, such as complying with the court's orders or meeting specific obligations. It is important for debtors to carefully review and respond to the summons within the specified time frame to protect their rights and interests in the case. Seeking legal advice and representation is highly recommended navigating the complex bankruptcy process and ensure compliance with all legal requirements.

Maricopa Arizona Summons to Debtor in Involuntary Case - B 250E

Description

How to fill out Maricopa Arizona Summons To Debtor In Involuntary Case - B 250E?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Maricopa Summons to Debtor in Involuntary Case - B 250E.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Maricopa Summons to Debtor in Involuntary Case - B 250E will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Maricopa Summons to Debtor in Involuntary Case - B 250E:

- Make sure you have opened the right page with your local form.

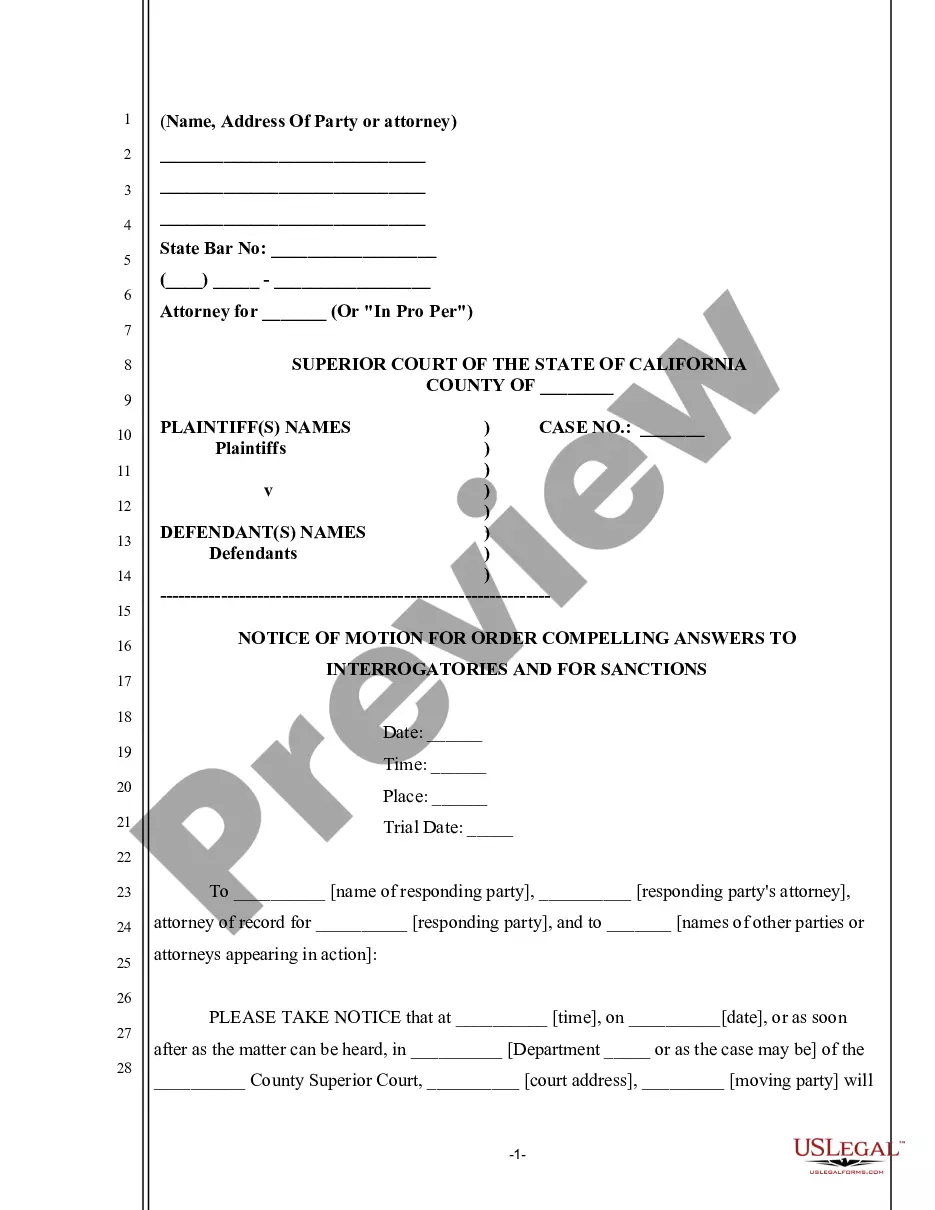

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Maricopa Summons to Debtor in Involuntary Case - B 250E on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!