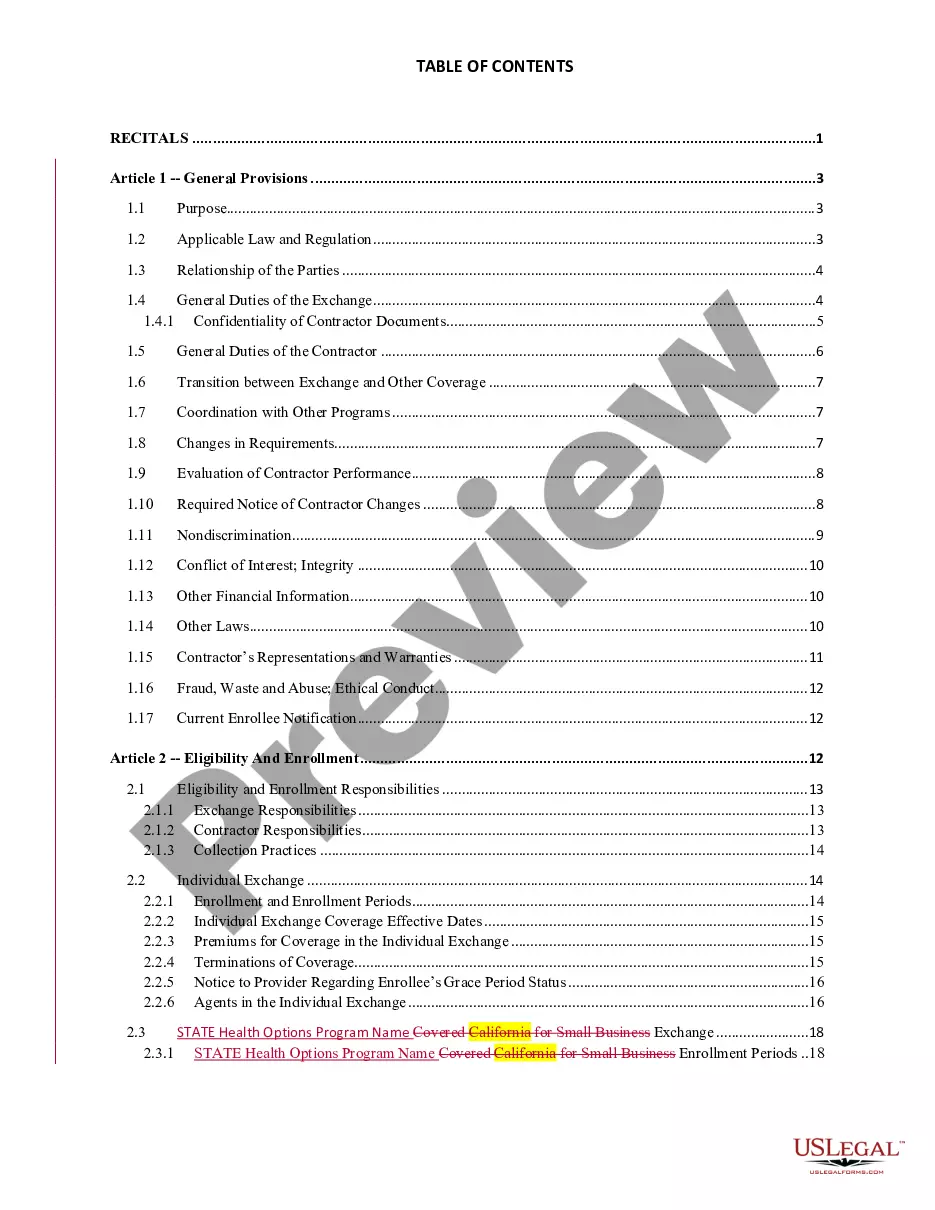

Cuyahoga Ohio Bankruptcy Proof of Claim — Form 410 is a legal document used in bankruptcy cases to assert a creditor's claim against the debtor's estate. This form allows creditors to specify the amount owed to them and provide supporting evidence for their claim. The Cuyahoga Ohio Bankruptcy Proof of Claim — Form 410 is a standardized document that must be completed accurately and submitted to the bankruptcy court within the specified deadline. Failing to file this form may result in the creditor being denied their right to payment. There are different types of Cuyahoga Ohio Bankruptcy Proof of Claim — Form 410, depending on the creditor's status and nature of the claim. Some common variations include: 1. Unsecured Claim: This type of claim is submitted by creditors who do not hold any collateral or security against the debt owed to them. It typically includes credit card debts, personal loans, medical bills, or other unsecured obligations. 2. Secured Claim: Secured creditors, such as mortgage lenders or automobile finance companies, use this form to assert their rights on collateral that secures the debt. They must provide detailed information about the collateral and its estimated value. 3. Priority Claim: Certain obligations, such as unpaid taxes, child support, or alimony, are considered priority claims. This form is used to specify these priority debts and establish their precedence over other claims. 4. Administrative Claim: This type of claim is filed by individuals or entities who have provided goods, services, or employee wages to the debtor after they filed for bankruptcy. They are entitled to be reimbursed for these ongoing expenses. When completing the Cuyahoga Ohio Bankruptcy Proof of Claim — Form 410, it is essential to provide accurate information and supporting documentation. Creditors must include details such as the debtor's name, bankruptcy case number, type of claim, amount owed, and any applicable interest or fees. Additionally, creditors should attach relevant documents, such as invoices, loan agreements, or contracts, to substantiate their claim. Any discrepancies or false claims on this form can result in legal consequences for the creditor. In conclusion, the Cuyahoga Ohio Bankruptcy Proof of Claim — Form 410 is a crucial document in bankruptcy proceedings, allowing creditors to assert their rights and seek reimbursement for outstanding debts. It is crucial to understand the specific type of claim being filed and provide accurate and supporting information to increase the chances of successful recovery.

Cuyahoga Ohio Bankruptcy Proof of Claim - Form 410

Description

How to fill out Cuyahoga Ohio Bankruptcy Proof Of Claim - Form 410?

Draftwing documents, like Cuyahoga Bankruptcy Proof of Claim - Form 410, to take care of your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for a variety of scenarios and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Cuyahoga Bankruptcy Proof of Claim - Form 410 form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Cuyahoga Bankruptcy Proof of Claim - Form 410:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Cuyahoga Bankruptcy Proof of Claim - Form 410 isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

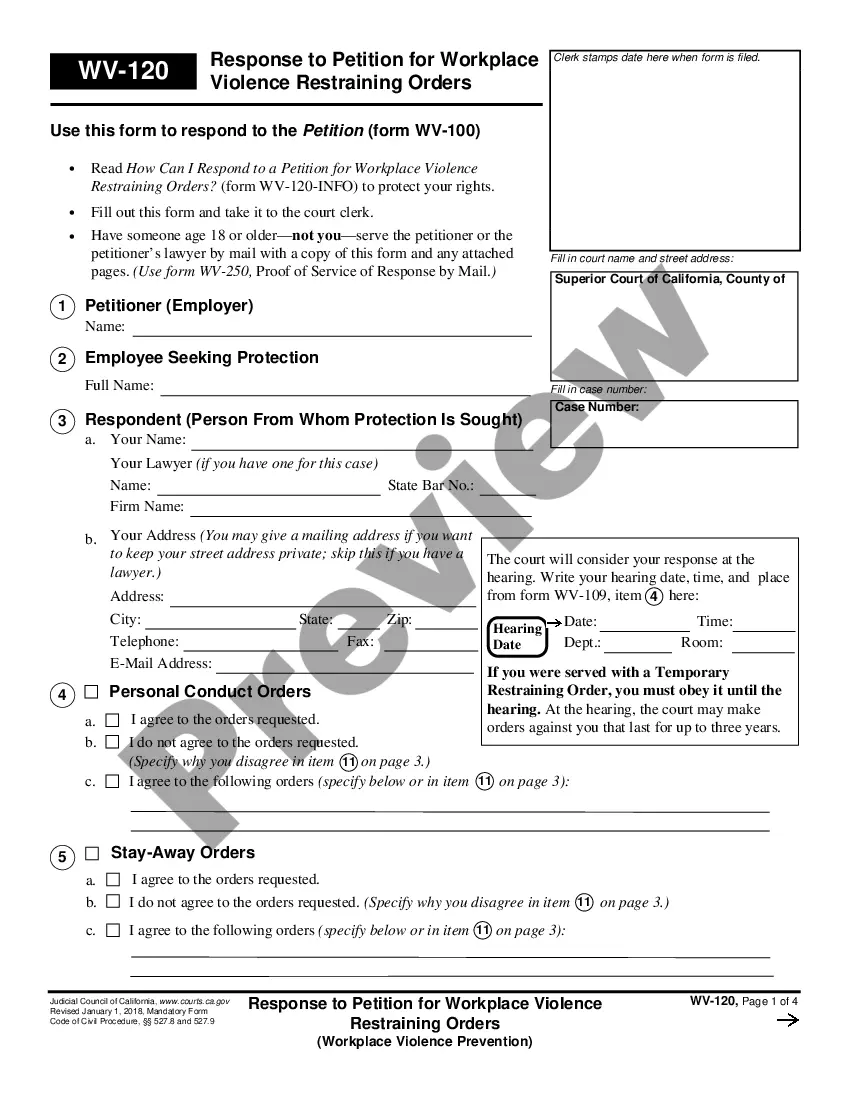

An official form submitted by a creditor setting out the basis and amount of its claim against a debtor in a bankruptcy case. The proof of claim form is Official Bankruptcy Form B 410. The purpose of a proof of claim is to give notice of the claim to the court, the debtor, the trustee and other creditors.

A Proof of Claim is a legal document that a creditor must file with the Bankruptcy Court in order to receive payment under a Chapter 13 plan. Even if the Chapter 13 plan specifically provides for payments to a creditor, a Proof of Claim is required before the Chapter 13 Trustee will disburse funds to that creditor.

What Is a Proof of Claim? A proof of claim is an essential element in the bankruptcy process. It documents your right as a creditor to repayment from the debtor. A debtor's chapter 11 bankruptcy filing may significantly impact a creditor and can jeopardize its ability to handle its own financial responsibilities.

Formal Proof of Claim the debtor's name and the bankruptcy case number. the creditor's information, including a mailing address. the amount owed as of the petition date. the basis for the claim (such as goods or services purchased, a loan or credit card balance, a personal injury or wrongful death award), and.

A claim may be secured or unsecured. Proof of Claim. A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

In bankruptcy law, a proof of claim ("POC") is a form completed by creditors and filed with the bankruptcy court. See sample POC form here. In bankruptcy law, a "claim" is a creditor's right to receive payment for a debt owed by the debtor on the date that a bankruptcy petition is filed.

Official Form 410. Proof of Claim. 12/15. Read the instructions before filling out this form. This form is for making a claim for payment in a bankruptcy case.

Filing a Proof of Claim Online Through ePOC Creditors can easily create, file, amend or withdraw a Proof of Claim (Official Form 410) online using the Court's Electronic Proof of Claim (ePOC) system. Attorneys registered to use CM/ECF may electronically file Proofs of Claims through CM/ECF.

The federal bankruptcy court has exclusive jurisdiction over bankruptcy cases involving personal or business debt.

A claim may be secured or unsecured. Proof of Claim. A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.