Fairfax, Virginia Order Confirming Plan — Form 1— - Pre and Post 2005 Act In Fairfax, Virginia, an Order Confirming Plan — Form 1— - Pre and Post 2005 Act is a legal document used in bankruptcy cases. It plays a crucial role in both PRE- and post-2005 bankruptcy proceedings, ensuring the fair distribution of assets and providing clarity on the approved repayment plan. Pre-2005 Act Order Confirming Plan: Before the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, bankruptcy laws were slightly different. The Pre-2005 Act Order Confirming Plan was used in bankruptcy cases before this significant amendment. This form outlines the debtor's proposed repayment plan, detailing how they intend to repay their debts. It includes a schedule of payments, repayment duration, interest rates, and any applicable fees or penalties. The pre-2005 Act Order Confirming Plan had specific requirements that debtors needed to meet for approval. Post-2005 Act Order Confirming Plan: After the implementation of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, bankruptcy laws underwent significant changes. The Post-2005 Act Order Confirming Plan was introduced to align with the new provisions. The Post-2005 Act Order Confirming Plan follows an updated set of rules and regulations. It focuses on ensuring that debtors meet the requirements of the means test, which assesses their ability to repay debts based on their income and expenses. Additionally, it may include provisions related to credit counseling and financial management courses, which are now mandatory components of the bankruptcy process. Both types of Order Confirming Plans serve to establish an organized financial plan for the debtor and provide confirmation from the court that their proposed repayment strategy is acceptable. Key Considerations for Fairfax Virginia Order Confirming Plan — Form 15: 1. Bankruptcy Code Compliance: The Order Confirming Plan must adhere to the specific provisions outlined in the United States Bankruptcy Code to ensure its legality and enforceability. 2. Repayment Plan Details: The Plan should clearly articulate the debtor's repayment intentions, including the proposed amount, duration, interest rates, and any special conditions that may affect the repayment schedule. 3. Documentation Requirements: Debtors need to supplement their Order Confirming Plan with supporting documents, such as income statements, expense records, and any relevant financial information, to justify the proposed repayment plan. 4. Court Approval: The Order Confirming Plan must undergo review and approval by the bankruptcy court, ensuring it meets the legal requirements and is fair to both creditors and the debtor. 5. Compliance with Local Rules: Certain jurisdictions, like Fairfax, Virginia, may have specific local rules and procedures for Order Confirming Plans. Debtors must ensure their submission complies with these unique regulations. 6. Attorney Involvement: Legal counsel is essential throughout the bankruptcy process, including the creation and submission of the Order Confirming Plan. An experienced bankruptcy attorney can provide guidance, help prepare the necessary documentation, and represent the debtor's interests in court. In conclusion, a Fairfax Virginia Order Confirming Plan — Form 1— - Pre and Post-2005 Act is a vital document in bankruptcy cases. It outlines the debtor's repayment plan and plays a significant role in determining the feasibility of debt repayment based on different bankruptcy laws. Whether PRE- or post-2005, the Order Confirming Plan ensures a fair and structured approach towards resolving the debtor's financial obligations while complying with applicable laws and regulations.

Fairfax Virginia Order Confirming Plan - Form 15 - Pre and Post 2005 Act

Description

How to fill out Fairfax Virginia Order Confirming Plan - Form 15 - Pre And Post 2005 Act?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Fairfax Order Confirming Plan - Form 15 - Pre and Post 2005 Act, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Fairfax Order Confirming Plan - Form 15 - Pre and Post 2005 Act, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Order Confirming Plan - Form 15 - Pre and Post 2005 Act:

- Glance through the page and verify there is a sample for your area.

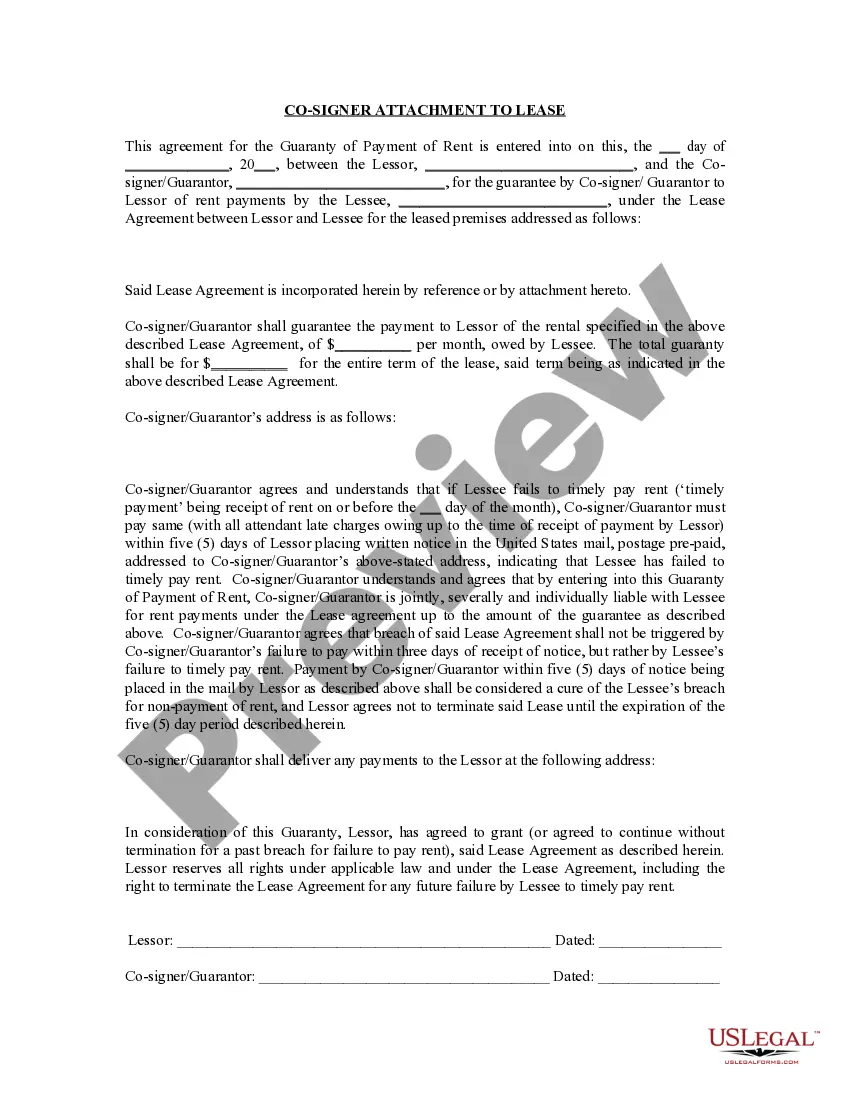

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fairfax Order Confirming Plan - Form 15 - Pre and Post 2005 Act and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!