Tarrant Texas Caption Fullul— - Form 16A - Post 2005 Act is a legal document that plays a crucial role in the taxation process in Tarrant County, Texas. This detailed description aims to provide an in-depth understanding of what this document entails, its significance, and any variations that may exist. The Full — Form 16— - Post 2005 Act refers to a specific section in the tax law, post-2005, which mandates the provision of detailed information on tax deductions or taxes withheld at source by various institutions. It is primarily used for taxpayers to claim tax credits or refunds. This document serves as a statement of earnings and deductions. It includes key details such as the taxpayer's name, address, Permanent Account Number (PAN), relevant assessment year, tax deduction account number, and details of the eductor (institutions deducting tax at source). The caption in this context refers to the heading or title under which this document is classified. It helps to distinguish it from other tax-related documents and assists both the taxpayer and the tax authorities in identifying the purpose and contents of the document. Variations of the Tarrant Texas Caption Fullul— - Form 16A - Post 2005 Act may differ based on factors such as the type of income, the mode of payment, and the category of the taxpayer. Some examples of these variations include: 1. Type of income: a. Salary Income Variation: Specifically used for salaried individuals and contains details of salary, allowances, deductions, and taxes withheld. b. Non-salary Income Variation: Applicable for individuals who receive income from sources other than salary, like interest, rent, or dividends. It provides related deductions and taxes withheld information. 2. Mode of payment: a. Electronic Variation: Pertaining to payments made electronically and includes details like the mode of payment, transaction number, and bank information. b. Cash Variation: Used when payments are made in cash, containing relevant details to track such transactions. 3. Taxpayer category: a. Individual Variation: Designed for individual taxpayers. b. Business Variation: Primarily used by businesses, providing details of their income and relevant deductions. Overall, the Tarrant Texas Caption Fullul— - Form 16A - Post 2005 Act is a comprehensive document that ensures accurate reporting of income, deductions, and taxes withheld, thereby enabling taxpayers to fulfill their tax obligations efficiently.

Tarrant Texas Caption - Full - Form 16A - Post 2005 Act

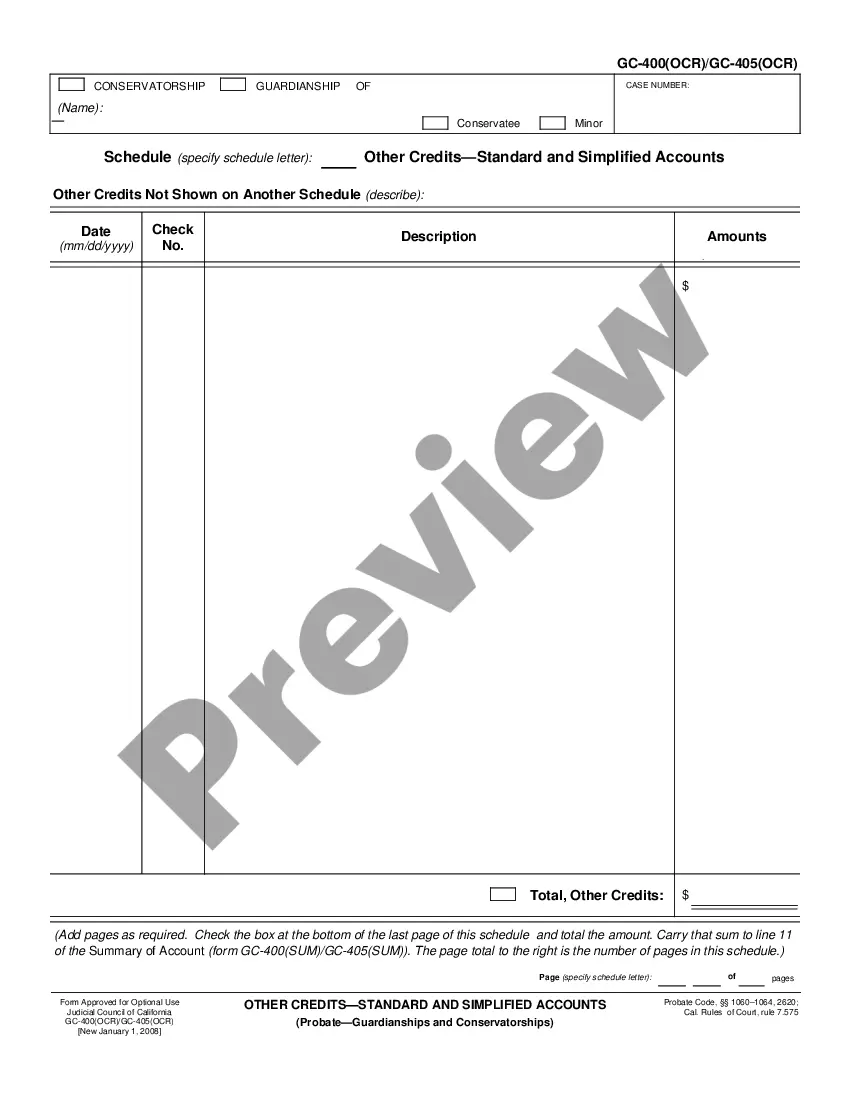

Description

How to fill out Tarrant Texas Caption - Full - Form 16A - Post 2005 Act?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Tarrant Caption - Full - Form 16A - Post 2005 Act.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Tarrant Caption - Full - Form 16A - Post 2005 Act will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Tarrant Caption - Full - Form 16A - Post 2005 Act:

- Ensure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Tarrant Caption - Full - Form 16A - Post 2005 Act on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Form 16, Form 16A and Form 16B are all certificates of tax deducted at source on your income from different sources. All three of them vary in terms of purpose, eligibility, and where they are applicable.

Form 27D is a certificate for Tax Collected at Source (TCS) u/s 206 of Income Tax Act, 1961. It is the certificate for the return filed in Form 27EQ. The filing of Form 27D requires details of both PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number).

Part A has information of the employer & employee, like name & address, PAN and TAN details, the period of employment, details of TDS deducted & deposited with the government. Part B includes details of salary paid, other incomes, deductions allowed, tax payable etc.

1. Brief Steps for Downloading Form 27D. Step 1: Login to TRACES website by entering the User ID, Password ,TAN of the Deductor and the Verification Code. Step 2: Landing page will be displayed.Step 3: Click on Form 27D available under Download's

Form 27D is the certificate of collection of tax at source under sub-section (5) of section 206C to be furnished by the collector.

Form 16 is a TDS certificate issued by the employer to the employee stating the tax deducted at source along with the salary income. Form 16A is a TDS certificate that reflects the tax deducted at the source on the non-salary income.

Form 16 is a TDS certificate issued by the employer to the employee stating the tax deducted at source along with the salary income. Form 16A is a TDS certificate that reflects the tax deducted at the source on the non-salary income.

FREE. When an employer deducts tax from an employee's salary, he issues a Form 16 certificate to the employee. In layman's terms, it's an acknowledgment that the deducted tax has been deposited with the Income Tax Department.

Yes. Form 16 is just a TDS Certificate showing TDS details on Salary. It is not your final liability. Therefore, while comparing Form 16 vs ITR, one should remember that Form 16 is not a substitute for the Income Tax Return.

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Tax Payers.

Interesting Questions

More info

The City of Plano passed a law authorizing the City Council to issue emergency tax increment financing (TIF) bonds in anticipation of new development projects. It will be interesting to see if the City Council follows suit later in the year. But perhaps it is more helpful to look at the Commission decision itself. One of the Commissioners opined that “the Legislature may not want TIF. … It is a piecemeal response to a problem that was never anticipated.” That is a point to note, however, which raises the question, do we really need TIF in the first place? The issue of whether we need TIF came up during the debate over the TIF law passed last year. According to the Commission, there were about 2,000 housing projects in operation in Tarrant County and some in the Plano District. If these projects were funded through TIF, developers could obtain about 40 percent of their development fees from the County taxpayer.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.