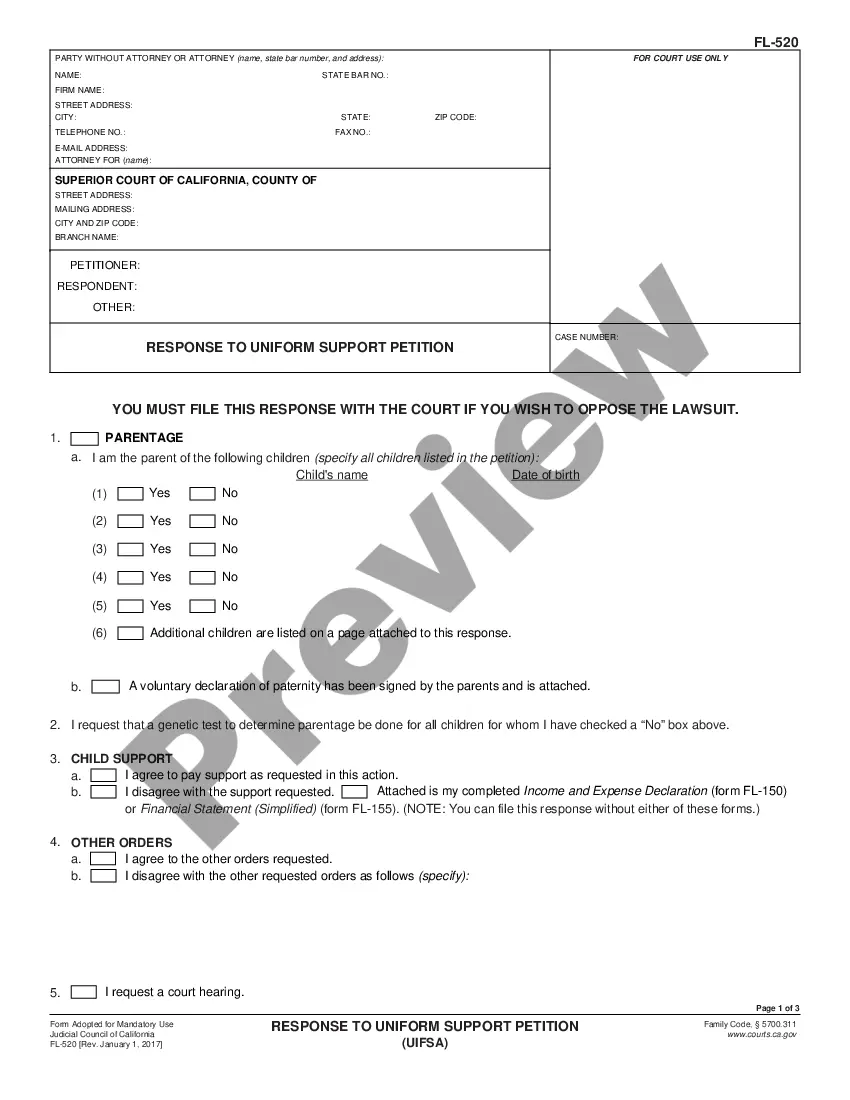

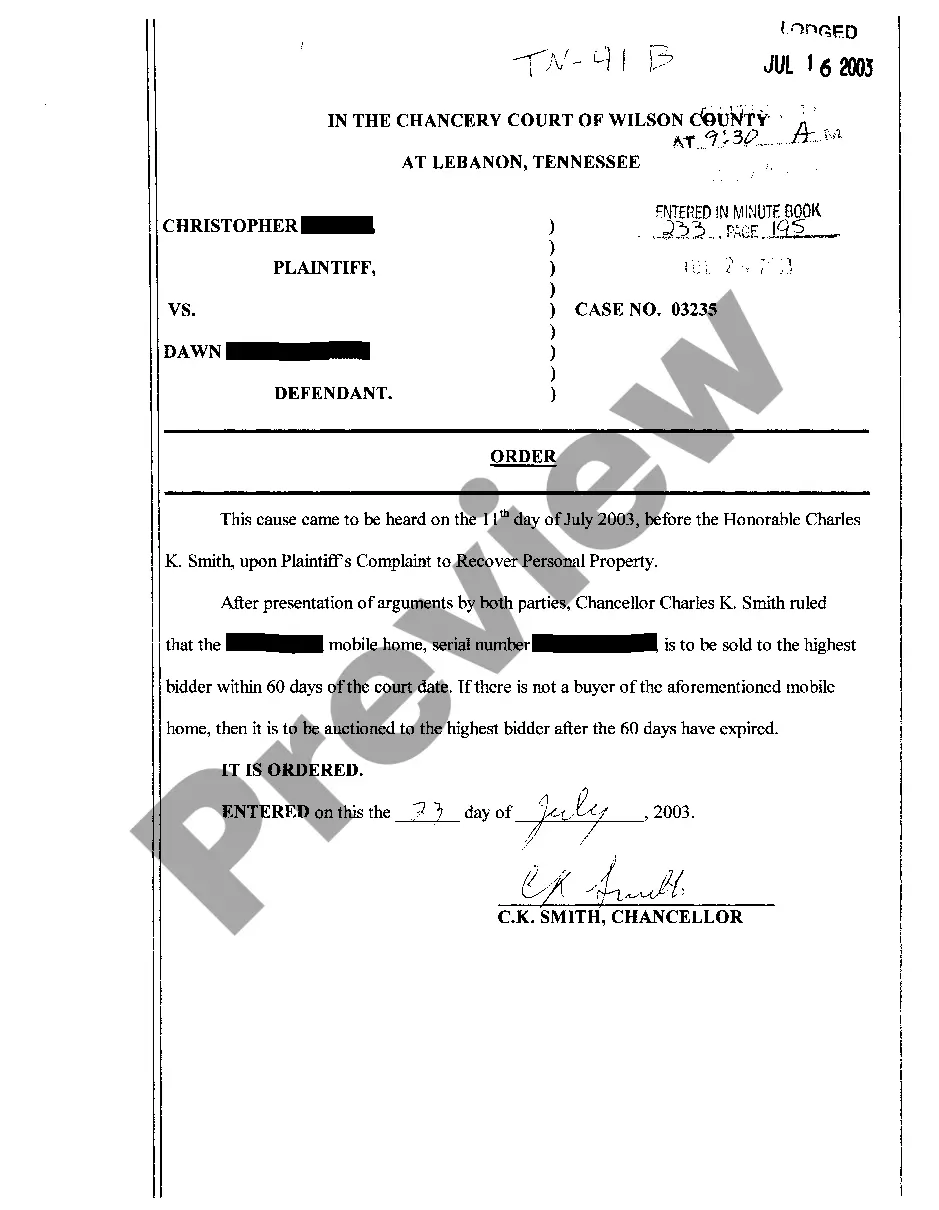

Dallas Texas Declaration under penalty of perjury on behalf of a corporation or partnership — Form 2 is a legal document that is used to make a sworn statement on behalf of a corporation or partnership in the State of Texas. This declaration is made under penalty of perjury, indicating that the information provided is true and accurate to the best of the declaring's knowledge. In the pre-2005 version of the Dallas Texas Declaration under penalty of perjury, certain specific requirements and guidelines were followed. It was essential for the declaration to be notarized in the presence of a notary public. The declaring, representing either a corporation or partnership, would specifically state their role within the entity and provide relevant identifying information. The declaration would then verify that the provided information is true and correct, and that the declaring had the authority to make such a statement on behalf of the organization. Post-2005, there might be certain modifications or updates to the Dallas Texas Declaration under penalty of perjury on behalf of a corporation or partnership — Form 2, however, detailed information regarding any notable changes is unavailable. Keywords: Dallas Texas, Declaration under penalty of perjury, corporation, partnership, Form 2, pre-2005, post-2005.

Dallas Texas Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

How to fill out Dallas Texas Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Dallas Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Dallas Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Dallas Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Dallas Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

If executed within the United States, its territories, possessions, or commonwealths: I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct.

An unsworn declaration made under this section must be 1) in writing, 2) signed by the person making the declaration as true under penalty of perjury and 3) in substantially the form used above.

A statement that has been signed by a declarant who will be found guilty of perjury if the facts declared in the statement are shown to be materially false. These statements have the same effect as an affidavit does in federal court.

Declarations are sometimes called sworn statements under the penalty of perjury. They are similar to affidavits in court because both are considered equivalent legally, although most judges prefer affidavits over declarations.

C. Penalty of Perjury: By taking an oath or affirmation with respect to an affidavit or other statement to be used in an official proceeding, a person may be subject to criminal penalties for perjury, should he or she fail to be truthful.

Primary tabs. A statement that has been signed by a declarant who will be found guilty of perjury if the facts declared in the statement are shown to be materially false. These statements have the same effect as an affidavit does in federal court.

(b) Statements "under penalty". --A person commits a misdemeanor of the third degree if he makes a written false statement which he does not believe to be true, on or pursuant to a form bearing notice, authorized by law, to the effect that false statements made therein are punishable.

Form: (1) If executed without the United States: I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct. Executed on (date). (Signature). (2) If executed within the United States, its territories, possessions, or

Form: (1) If executed without the United States: I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct. Executed on (date). (Signature). (2) If executed within the United States, its territories, possessions, or