When filing for Chapter 7 bankruptcy in Riverside, California, it is important to understand the Statement of Current Monthly Income and Means Test Calculation, especially post-2005 when new bankruptcy laws were implemented. This detailed description will explain what the Statement of Current Monthly Income and Means Test Calculation entail, their importance in Chapter 7 bankruptcy, and any variations that may exist. The Statement of Current Monthly Income is a crucial document required in Chapter 7 bankruptcy filings. It provides an overview of an individual's average monthly income over the previous six months leading up to the bankruptcy filing. This statement helps determine if the individual's income falls below the state median and qualifies them for Chapter 7 bankruptcy without the need for a Means Test Calculation. On the other hand, the Means Test Calculation is used to assess whether an individual's income allows them to repay a portion of their debts under Chapter 13 bankruptcy, or if they are eligible for complete debt discharge through Chapter 7 bankruptcy. The Means Test takes into account various factors such as income, expenses, family size, and allowed deductions to determine the individual's disposable income, which impacts their bankruptcy eligibility. For Riverside, California, the Means Test Calculation follows specific guidelines set by the state, taking into consideration the applicable income standards and expenses prevalent in the area. These guidelines ensure accurate assessments and determinations based on the local cost of living. Additionally, different variations of the Riverside California Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 may exist. These may include variations based on changes in state median income, modifications to allowable deductions or living expenses, or adjustments due to updated bankruptcy laws or local regulations. It is crucial to stay up-to-date with any changes and consult with an experienced bankruptcy attorney to ensure compliance with the most recent versions of these documents. In conclusion, the Riverside California Statement of Current Monthly Income and Means Test Calculation are essential components of Chapter 7 bankruptcy filings post-2005. They help assess an individual's income, expenses, and disposable income to determine eligibility for bankruptcy relief. Being familiar with the specific Riverside guidelines and any variations that may arise is crucial for accurate and successful bankruptcy filings in the area.

Riverside California Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005

Description

How to fill out Riverside California Statement Of Current Monthly Income And Means Test Calculation For Use In Chapter 7 - Post 2005?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Riverside Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Riverside Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Riverside Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005:

- Check the content of the page you’re on.

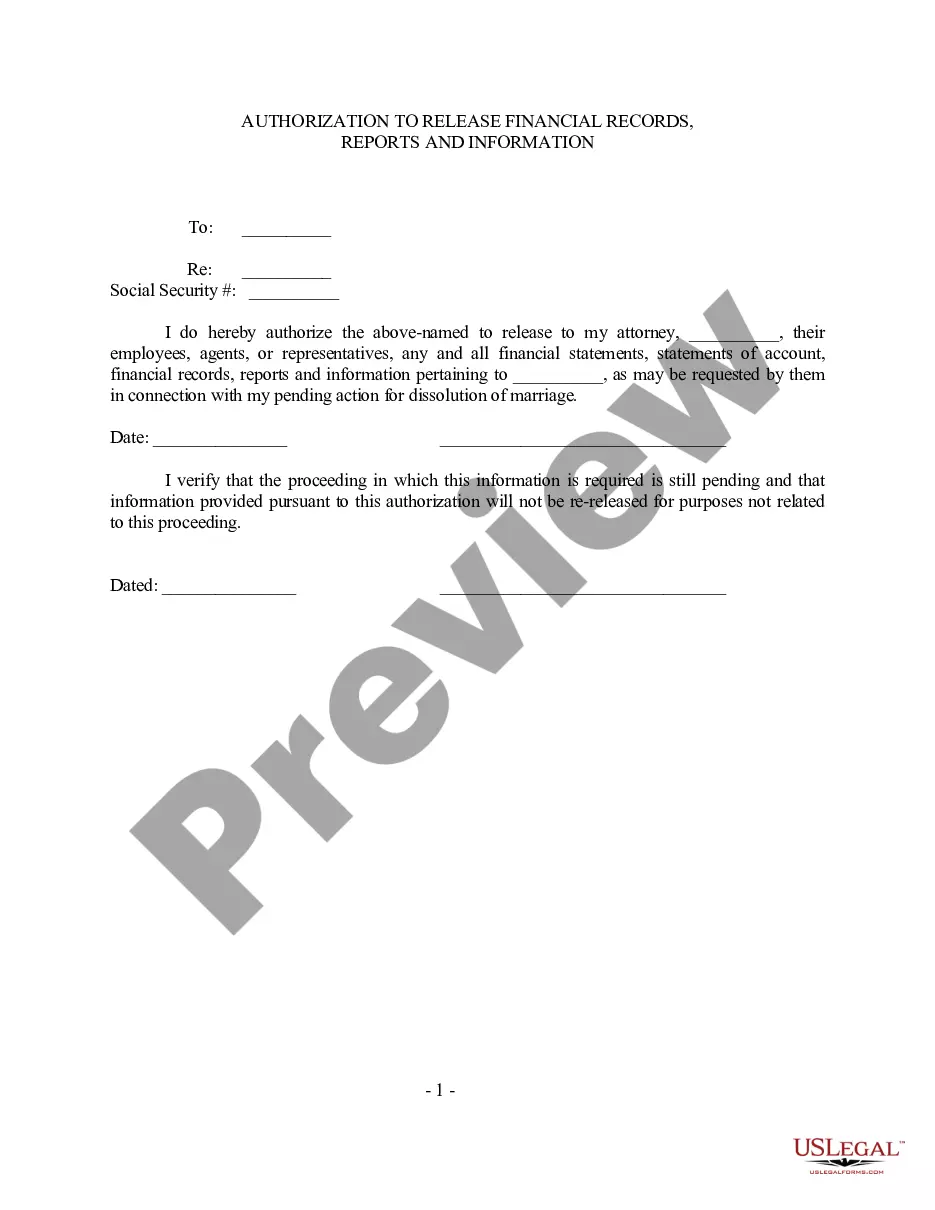

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!