Collin Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is an essential legal document required for individuals or businesses filing for bankruptcy under Chapter 11 in the Collin County area of Texas. This statement provides a detailed breakdown of the filer's monthly income and expenses, offering a comprehensive overview of their financial situation. In Chapter 11 bankruptcy cases filed after 2005, this statement plays a crucial role in determining the filer's eligibility and crafting a viable reorganization plan. It assists the bankruptcy court in evaluating whether the debtor's income is sufficient to cover ongoing expenses and make payments towards their debts. The main purpose of the Collin Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is to assess the debtor's ability to meet the criteria outlined in the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA), which introduced several financial requirements for bankruptcy eligibility. Some key components covered in this statement include: 1. Gross Income: The statement aims to capture the filer's total income from all sources, including wages, self-employment earnings, rental income, retirement benefits, and any other form of regular income. 2. Deductions: Certain deductions are allowed to calculate the filer's disposable income, such as taxes, insurance premiums, payroll deductions, and reasonable expenses necessary for the production of income. 3. Average Monthly Income: This section determines the filer's average monthly income by taking the total gross income for the past six months and dividing it by six. The resulting figure reflects the debtor's current financial situation. 4. Median Family Income: The Collin Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 also requires the filer to compare their average monthly income with the median family income in the area. If the filer's income falls below the median, they may qualify for Chapter 11. 5. Expenses: Alongside income, the statement outlines the filer's essential monthly expenses, including mortgage or rent payments, utilities, transportation costs, groceries, healthcare, and childcare expenses. This section serves to evaluate whether the debtor can sustain ongoing payments while meeting necessary living expenses. It is important to note that if the Collin Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 shows that the filer has disposable income, they may be required to propose a repayment plan under Chapter 11 bankruptcy. This plan would outline how the debtor intends to repay their creditors over an extended period, often up to five years. In summary, the Collin Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 plays a critical role in assessing the financial status of individuals or businesses seeking bankruptcy protection. By providing a comprehensive overview of income, expenses, and obligations, this statement helps the bankruptcy court determine the filer's eligibility and evaluate the feasibility of their reorganization plan.

Collin Texas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out Collin Texas Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Collin Statement of Current Monthly Income for Use in Chapter 11 - Post 2005, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Collin Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Collin Statement of Current Monthly Income for Use in Chapter 11 - Post 2005:

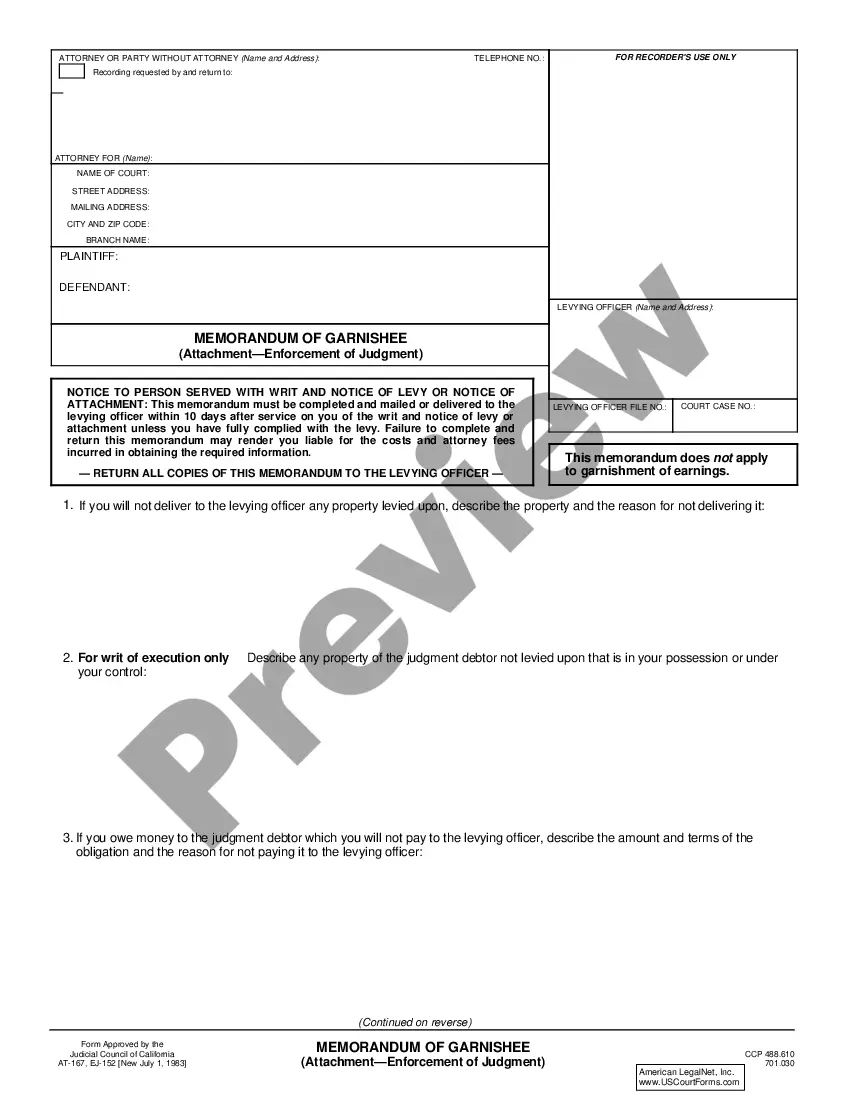

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!