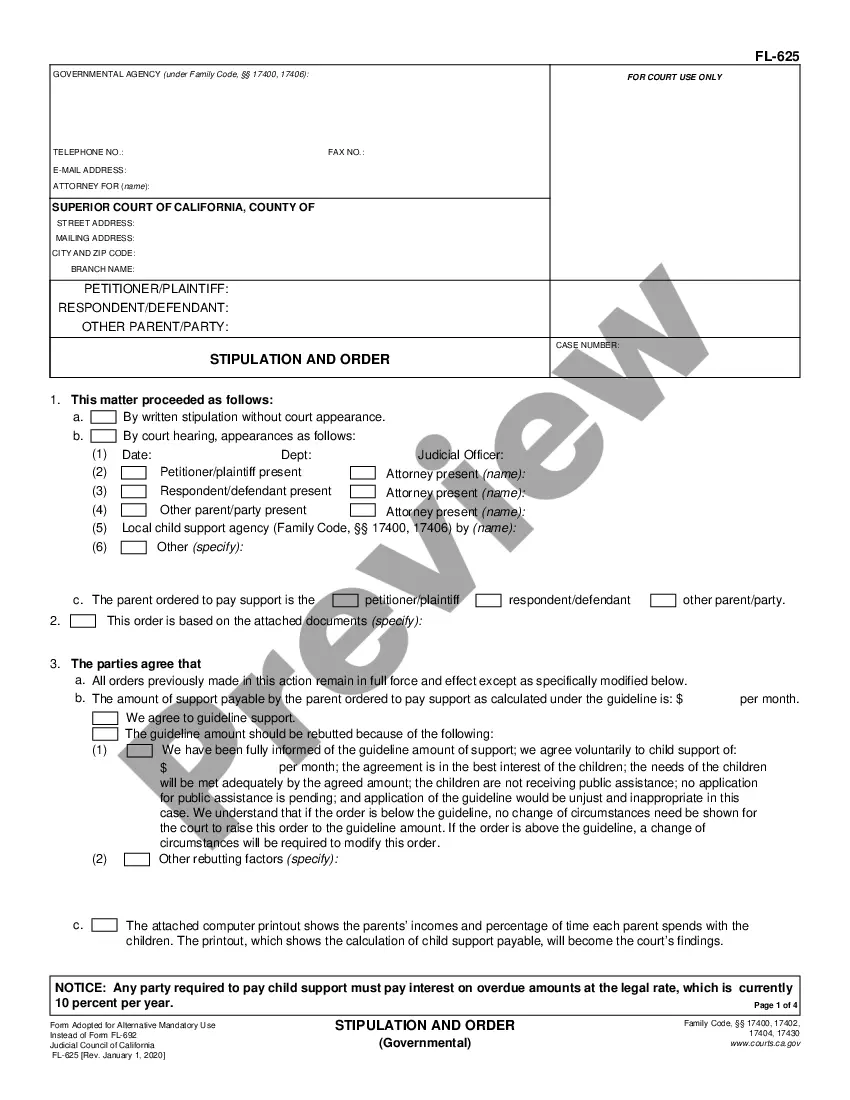

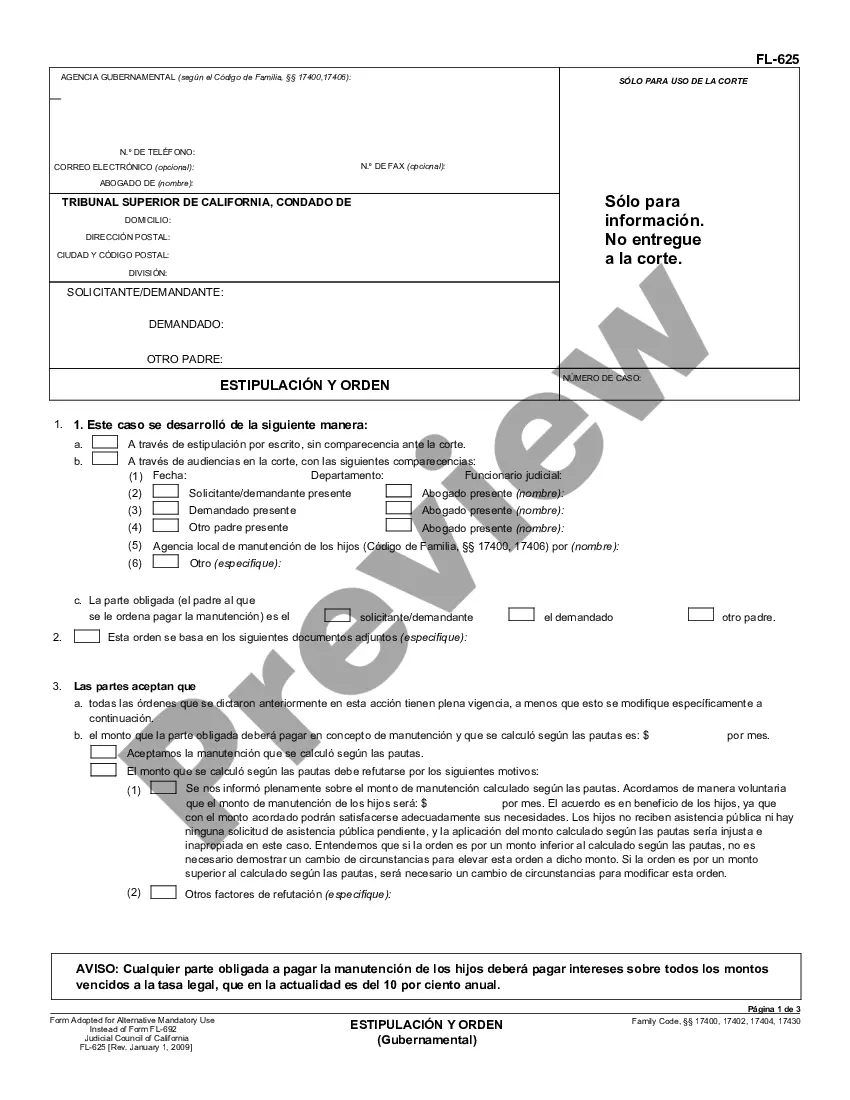

Dallas, Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is a crucial document required for individuals or businesses filing for bankruptcy under Chapter 11 in the United States. This statement aids in determining the debtor's ability to repay their debts and assists in formulating an effective repayment plan. The Statement of Current Monthly Income is a comprehensive financial snapshot that outlines the debtor's income, expenses, and monthly expenditures. It helps the bankruptcy court assess the debtor's financial situation accurately, ensuring a fair and sustainable repayment plan is developed. It is important to note that this form is specific to Dallas, Texas, and may have some variations compared to other locations. Keywords: Dallas Texas, Statement of Current Monthly Income, Chapter 11, bankruptcy, financial snapshot, repayment plan, income, expenses, monthly expenditures, financial situation. As for the different types of Dallas Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005, there may not be distinct variations in the form itself; however, the content of the form will differ depending on whether the debtor is an individual or a business entity. Both types require detailed financial information, separation of personal and business expenses (if applicable), as well as documentation to support the income and expenses stated in the report. For individuals, the form may include sections dedicated to personal income sources such as employment, self-employment, investments, retirement benefits, and any additional sources of income. On the other hand, the form for business entities will encompass details of the company's revenue streams, profits, ownership, and any other financial aspects relevant to the bankruptcy process. Regardless of the type, it is crucial for debtors to provide accurate and truthful financial information when completing the Statement of Current Monthly Income. Failure to do so may result in legal consequences, including the denial of bankruptcy relief or potential criminal charges. In conclusion, the Dallas, Texas Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is a key document in the bankruptcy process. It provides a comprehensive overview of the debtor's financial situation and helps in creating an effective repayment plan. Debtors must ensure they accurately complete the form, including all relevant income and expenses, to ensure a fair evaluation by the bankruptcy court.

Dallas Texas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out Dallas Texas Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

Preparing documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Dallas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Dallas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Dallas Statement of Current Monthly Income for Use in Chapter 11 - Post 2005:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!