San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its technological innovation, diverse population, and stunning natural landscapes, it is a hub of opportunities for residents and businesses alike. As one of the largest cities in California, San Jose boasts a rich cultural heritage, a thriving arts scene, and numerous attractions that draw visitors from around the world. In the context of the U.S. Bankruptcy Code, specifically Chapter 11 after 2005, individuals or businesses in San Jose may be required to file a Statement of Current Monthly Income. This document plays a crucial role in determining the eligibility of debtors for a Chapter 11 bankruptcy filing. It provides an overview of an individual's or business's income, expenses, and financial obligations. The San Jose, California Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 includes various sections that need to be accurately filled out. These sections might consist of the following: 1. Personal Information: This section requires the debtor to provide their name, address, contact details, and the date of filing the statement. 2. Household Size and Dependents: The debtor must disclose the number of people living in their household and any dependents they have. This information helps determine the applicable median income levels for the means test calculation. 3. Income Sources: Here, the debtor must list all sources of income, including wages, salaries, self-employment income, rental income, and any other forms of monetary gain. Details such as the frequency of income, employer information, and average monthly income are typically required. 4. Deductions and Expenses: This section requires an itemized breakdown of monthly expenses essential for sustaining the debtor and their household. These may include rent/mortgage payments, utilities, transportation costs, healthcare expenses, insurance premiums, and other necessary living expenditures. 5. Monthly Payment to Unsecured Creditors: If the debtor is proposing a repayment plan, they must specify the amount they plan to allocate each month towards their unsecured debts. The San Jose California Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is a critical document in the bankruptcy process. It helps the bankruptcy court assess a debtor's financial condition and decide if Chapter 11 bankruptcy is a suitable option for them. By accurately disclosing all relevant income and expenses, debtors can ensure a smooth and transparent bankruptcy process that aligns with the legal requirements set forth by the U.S. Bankruptcy Code.

San Jose California Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out San Jose California Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

Drafting paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create San Jose Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 without expert assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Jose Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the San Jose Statement of Current Monthly Income for Use in Chapter 11 - Post 2005:

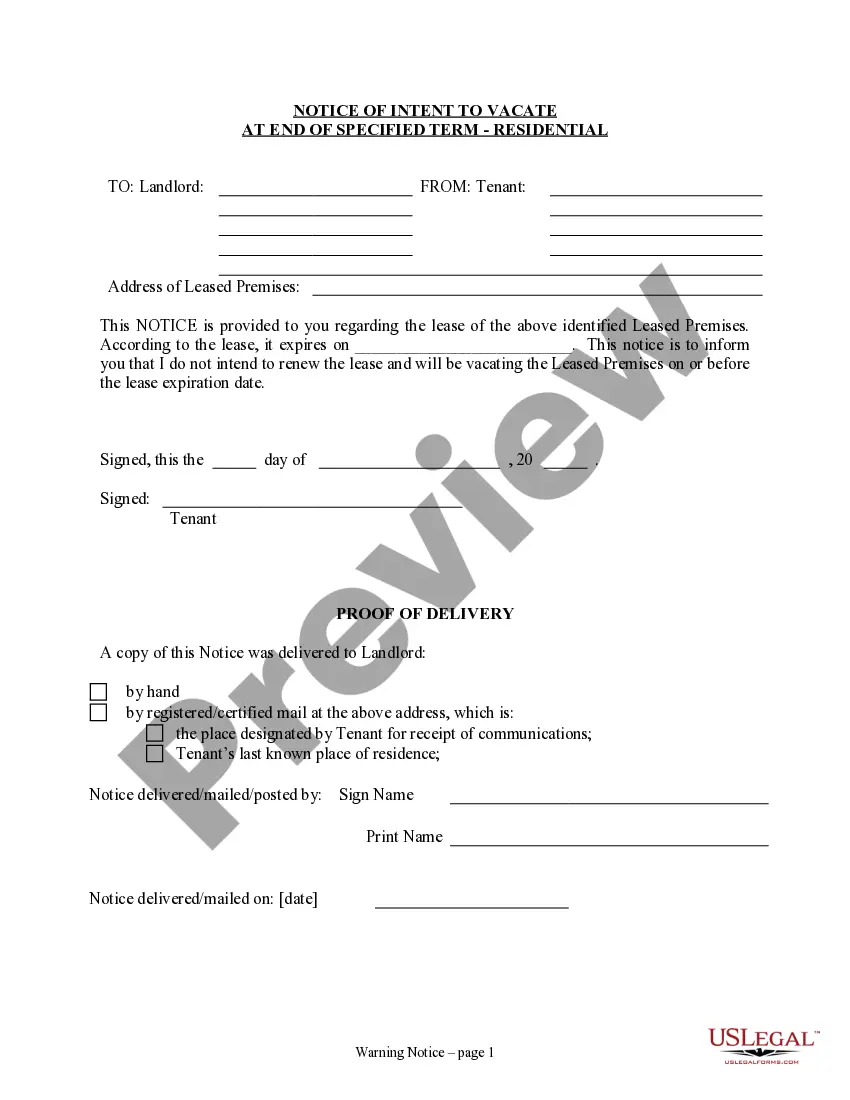

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!