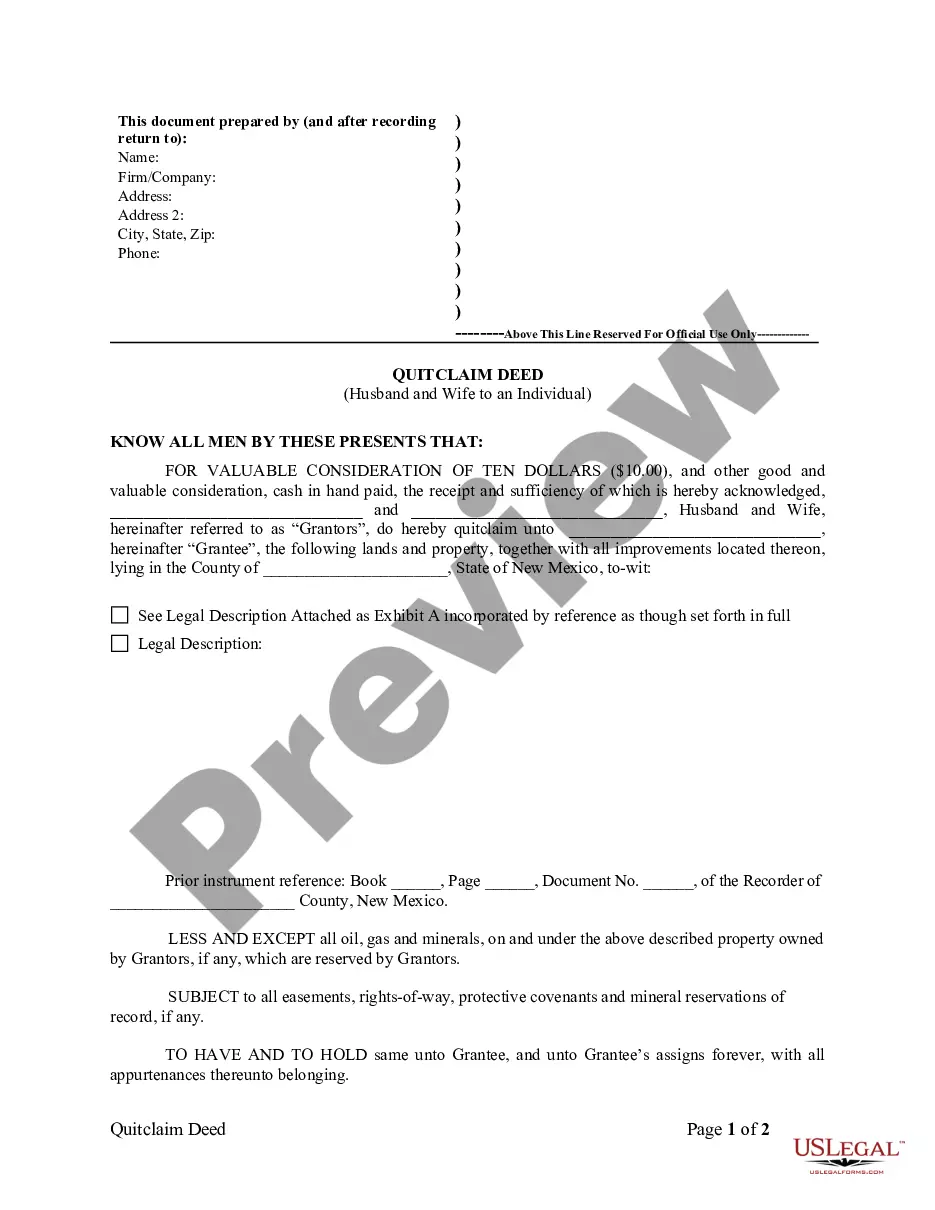

Collin Texas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 In the bankruptcy process, the Statement of Current Monthly Income (Form 122A-1) and the Disposable Income Calculation (Form 122A-2) are crucial documents for debtors filing for Chapter 13 bankruptcy in Collin County, Texas. These forms are part of the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) enacted in 2005, which introduced several changes to bankruptcy laws. The Statement of Current Monthly Income (Form 122A-1) requires debtors to disclose their average monthly income from various sources, including wages, business profits, rental income, and any other applicable sources. The form is designed to assess the debtor's financial situation accurately and determine their eligibility for Chapter 13 bankruptcy. It includes information such as income from employment, overtime, bonuses, and non-employment sources like child support or alimony payments. It's important to note that the Collin Texas Statement of Current Monthly Income complies with the BAP CPA guidelines and is specific to debtors residing in Collin County. This statement must detail all financial inflows from the six-month period before filing for bankruptcy. The Disposable Income Calculation (Form 122A-2) works in conjunction with the Statement of Current Monthly Income. Its purpose is to determine the debtor's monthly disposable income, which is a crucial factor in the debt repayment plan proposed in Chapter 13 bankruptcy. The calculation involves subtracting certain allowed expenses, determined by IRS standards and local Collin County guidelines, from the debtor's monthly income. By calculating disposable income, debtors can determine the amount they can afford to pay to creditors each month, leading to the formation of a feasible and manageable repayment plan under Chapter 13. This plan allows debtors to keep their assets while paying off a portion of their debts over a three to five-year period. Though there may not be different types of Collin Texas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005, variations may occur depending on individual circumstances and specific district requirements. It is crucial for the debtor to consult with a qualified bankruptcy attorney or seek professional guidance to ensure the accurate completion of these forms. In conclusion, the Collin Texas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 play a crucial role in determining a debtor's eligibility and repayment plan in Collin County, Texas. These forms help ensure a fair and equitable resolution for both debtors and creditors in Chapter 13 bankruptcy cases.

Collin Texas Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Collin Texas Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

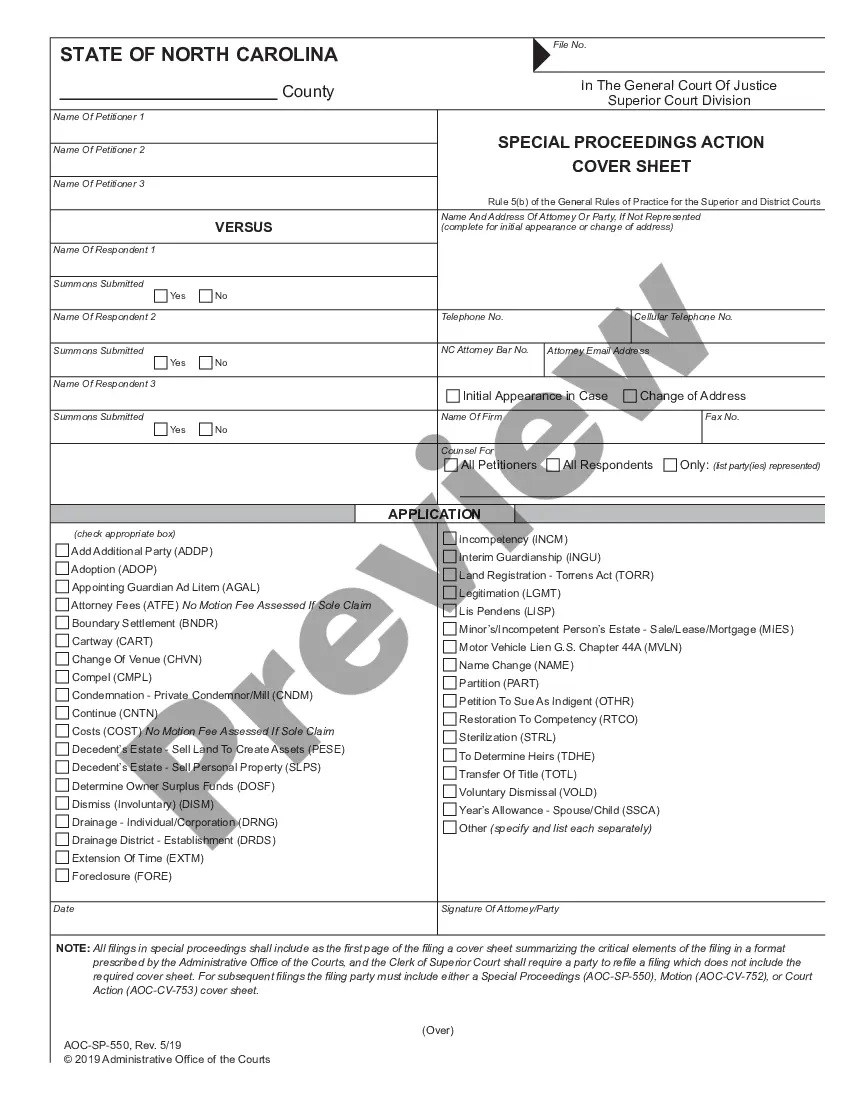

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Collin Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Collin Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 will be accessible for further use in the My Forms tab of your profile.

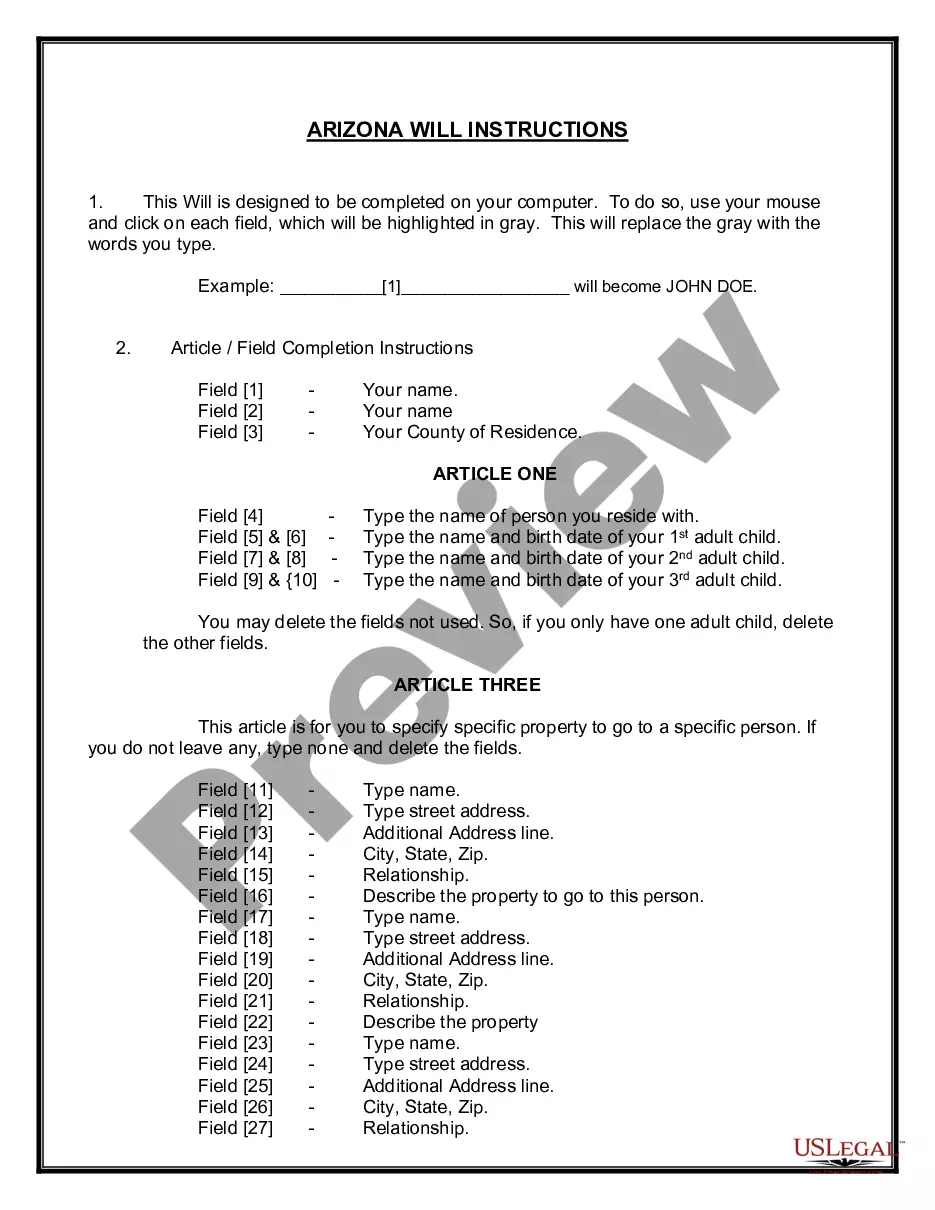

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Collin Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005:

- Make sure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Collin Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!