The Fulton Georgia Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 is a legal document used in the bankruptcy process. This document is essential for individuals residing in Fulton County, Georgia, who wish to file for Chapter 13 bankruptcy under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. The main purpose of this statement is to provide a detailed overview of an individual's current monthly income and calculate their disposable income. This information is crucial as it helps determine the feasibility of a Chapter 13 bankruptcy repayment plan, which is based on the debtor's ability to repay their debts within a specified period (typically three to five years). The information required in this statement includes various sources of income, such as wages, self-employment income, rental income, and any other regular sources of funds. It also considers recurring expenses, such as mortgage or rent payments, utility bills, healthcare costs, education expenses, and necessary transportation expenses. The calculations in the Fulton Georgia Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 follow specific guidelines mandated by bankruptcy laws. These guidelines take into account the debtor's income, household size, and allowable expenses, as determined by the Internal Revenue Service (IRS) and the U.S. Trustee Program. It is important to note that there are no different types of the Fulton Georgia Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005. However, there might be slight variations in the format or specific instructions from one jurisdiction to another. It is crucial for individuals in Fulton County, Georgia, to use the specific form provided by the local bankruptcy court or seek guidance from an experienced bankruptcy attorney to ensure accuracy and compliance with the applicable rules. In summary, the Fulton Georgia Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 is a vital document in the bankruptcy process. It helps determine a debtor's ability to repay their debts through a Chapter 13 repayment plan by analyzing their current monthly income and calculating their disposable income. Proper completion of this statement is essential for a successful bankruptcy case in Fulton County, Georgia.

Fulton Georgia Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Fulton Georgia Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

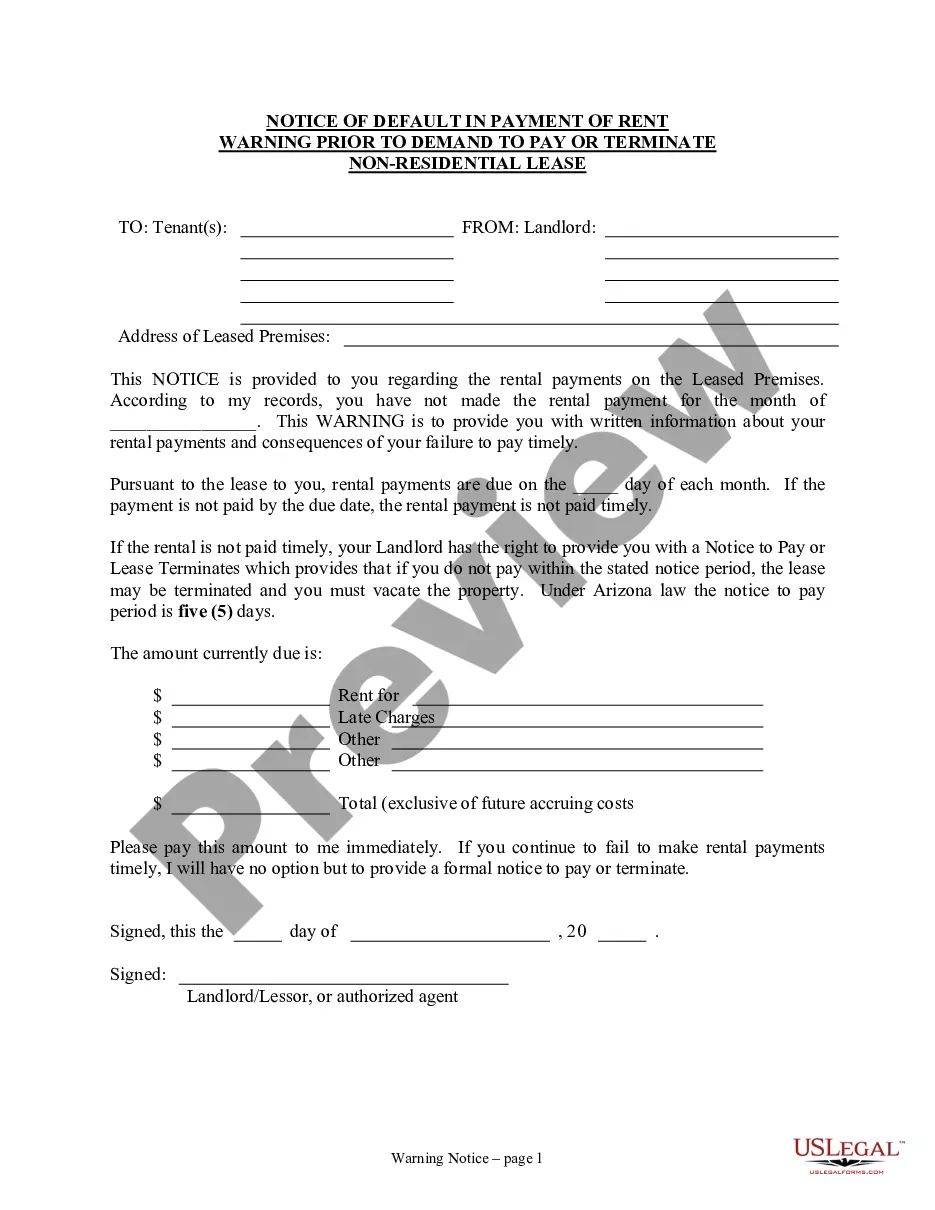

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Fulton Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the recent version of the Fulton Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fulton Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Fulton Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

The mean formula is given as the average of all the observations. It is expressed as Mean = {Sum of Observation} ÷ {Total numbers of Observations}.

Certain family and household expenses might help you pass the means test for Chapter 7 bankruptcy. If your income is higher than your state's median income for a similar size household, you must complete the entire bankruptcy means test form to determine whether you qualify for Chapter 7 bankruptcy.

Either way, once you get your discharge in a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, you will get credit again and be able to increase your score. Lenders will look at your credit histories such as on-time payments and debt to income ratio to determine if they should extend credit to you.

When you file for Chapter 13 bankruptcy, there is no "means test" to determine whether your income is too high. In fact, opposite forces are at work in Chapter 13 -- if your income is so low that you cannot fund a repayment plan, you won't be eligible for Chapter 13.

Requirements to File for Chapter 13 Bankruptcy When you file for Chapter 13 bankruptcy, there is no "means test" to determine whether your income is too high. In fact, opposite forces are at work in Chapter 13 -- if your income is so low that you cannot fund a repayment plan, you won't be eligible for Chapter 13.

How Does the Chapter 7 Means Test Work? The means test limits the use of Chapter 7 bankruptcy to those who can't pay their debts by testing whether you have enough income to repay creditors. If you don't, you'll pass.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

To find the mean, add all of the data points together and divide by n. Example: 10 + 11 + 11 + 12 + 13 + 14 + 25 / 7 = 13.7. The mean for our data set is 14, since calculating an average number of employees makes more sense to round to the nearest whole number.

To determine your current monthly income in Chapter 13 bankruptcy, you take your average monthly income for the six-month period prior to filing for bankruptcy.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.