Riverside California Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 In Riverside California, individuals considering Chapter 13 bankruptcy proceedings must complete a Statement of Current Monthly Income and Disposable Income Calculation. This document is crucial for determining the debtor's ability to repay their debts within a specified time frame. The Post-2005 version refers to the changes made to bankruptcy laws in that year. The Statement of Current Monthly Income requires individuals to provide comprehensive details about their income sources. This includes wages, salaries, self-employment income, rental properties, pension, retirement benefits, and any other regular earnings. Additionally, individuals must disclose any contributions received from family members or social security benefits. Furthermore, the Statement of Current Monthly Income takes into account any potential changes to income during the repayment period. This may include anticipated job changes, pay raises, and other variations that may impact an individual's monthly earnings. After determining the current monthly income, the Disposable Income Calculation comes into play. This calculation serves to assess how much disposable income a debtor has left after deducting certain allowed expenses. These expenses include reasonable monthly living costs, such as housing, utilities, transportation, food, and medical expenses. It is crucial to note that these allowances may vary based on Riverside California standards. Different versions of the Riverside California Statement of Current Monthly Income and Disposable Income Calculation may exist, primarily due to updates or amendments made to bankruptcy laws. These updates ensure compliance with evolving economic conditions, income thresholds, and other relevant factors affecting bankruptcy proceedings. The accuracy and completeness of the Statement of Current Monthly Income and Disposable Income Calculation are of utmost importance. Providing incorrect information or omitting certain income sources may result in legal consequences, dismissal of the bankruptcy case, or even potential charges of bankruptcy fraud. Therefore, individuals in Riverside California considering Chapter 13 bankruptcy must consult with an experienced bankruptcy attorney to ensure their Statement of Current Monthly Income and Disposable Income Calculation accurately reflects their financial situation. This will help them navigate the complexities of the Chapter 13 process and increase their chances of successfully restructuring their debts. Keywords: Riverside California, Chapter 13, bankruptcy, Statement of Current Monthly Income, Disposable Income Calculation, Post-2005, repayment period, income sources, allowed expenses, bankruptcy laws, bankruptcy attorney, financial situation.

Riverside California Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Riverside California Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

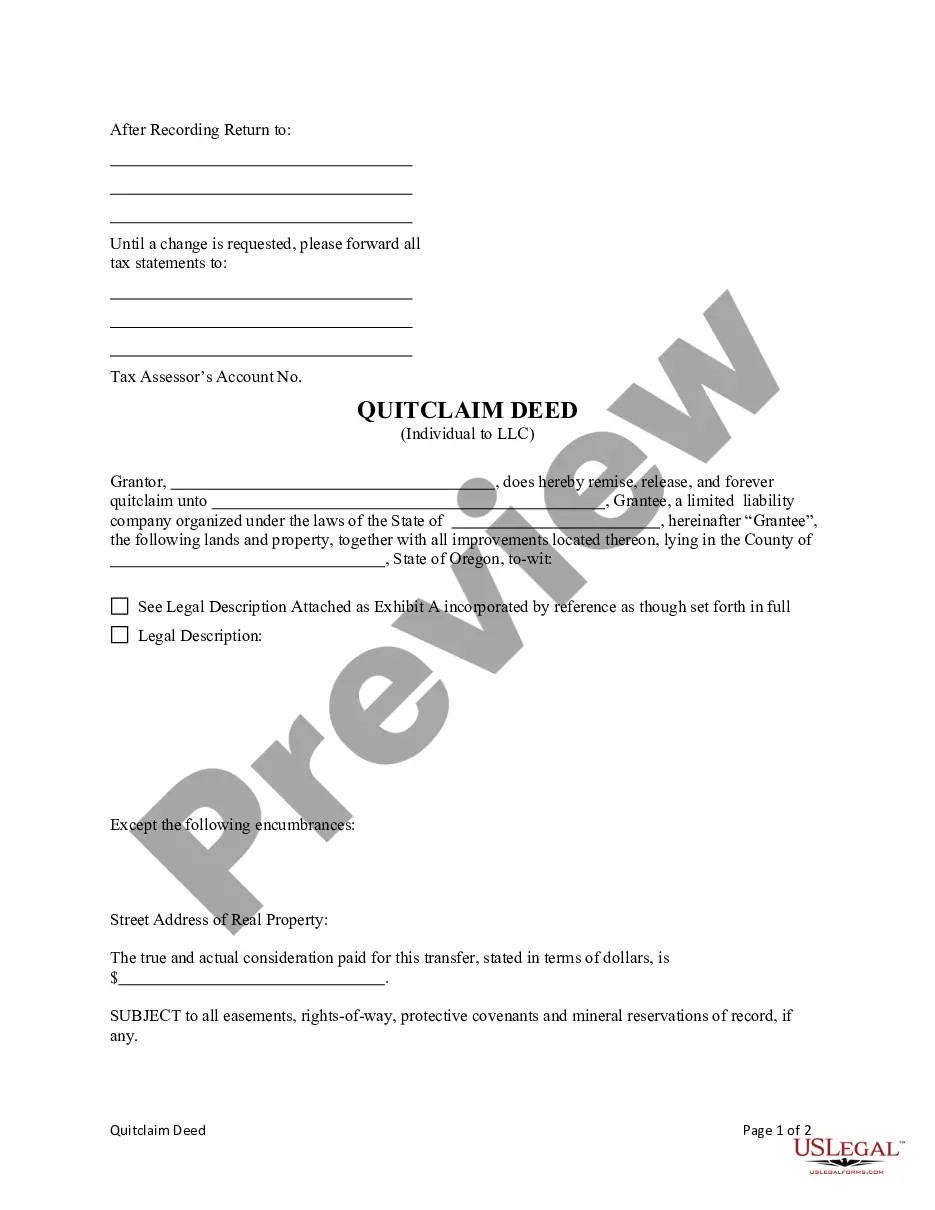

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Riverside Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any activities related to paperwork execution simple.

Here's how you can purchase and download Riverside Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar document templates or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Riverside Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Riverside Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to deal with an exceptionally complicated situation, we advise using the services of an attorney to review your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!