Dallas, Texas, is a vibrant and bustling city located in the northeastern part of the state. Known for its rich history, diverse culture, and thriving economy, Dallas is a major hub for business, entertainment, and tourism. When it comes to the "List of creditors holding 20 largest secured claims" in Dallas, Texas, several variations of this information can be found, depending on the context and timeframe. Some different types of relevant lists and documents include: 1. Dallas, Texas, List of Creditors: This is a comprehensive list of creditors in Dallas, Texas, indicating the entities or individuals to whom debt is owed. It includes both secured and unsecured claims. 2. The Largest Secured Claims: This refers to the top 20 secured claims found in the list of Dallas, Texas, creditors, with the highest value of outstanding debt. Secured claims are typically backed by collateral, such as real estate or assets, to provide assurance to the creditor. 3. Chapter 7 or 13: Chapter 7 and Chapter 13 are different types of bankruptcy filings. In the context of the list of creditors, mentioning that this information is not needed for these specific chapters indicates that the list is relevant for other bankruptcy chapters or purposes. 4. Form 4: Form 4 is a standardized document used in bankruptcy proceedings. In the context of the list of creditors, it likely refers to the format or template in which the information is presented. 5. Post 2005: This indicates that the list of creditors and secured claims is limited to debts or claims that have arisen after 2005. This time frame could be significant for legal or financial reasons related to bankruptcy or debt proceedings. Overall, the "List of creditors holding 20 largest secured claims" for Dallas, Texas, serves as a valuable resource for individuals, businesses, and financial institutions. It provides insights into the financial health of entities in the city and can help inform decisions related to debt management, negotiation, or bankruptcy proceedings.

Dallas Texas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

How to fill out Dallas Texas List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Dallas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Dallas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Dallas List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005:

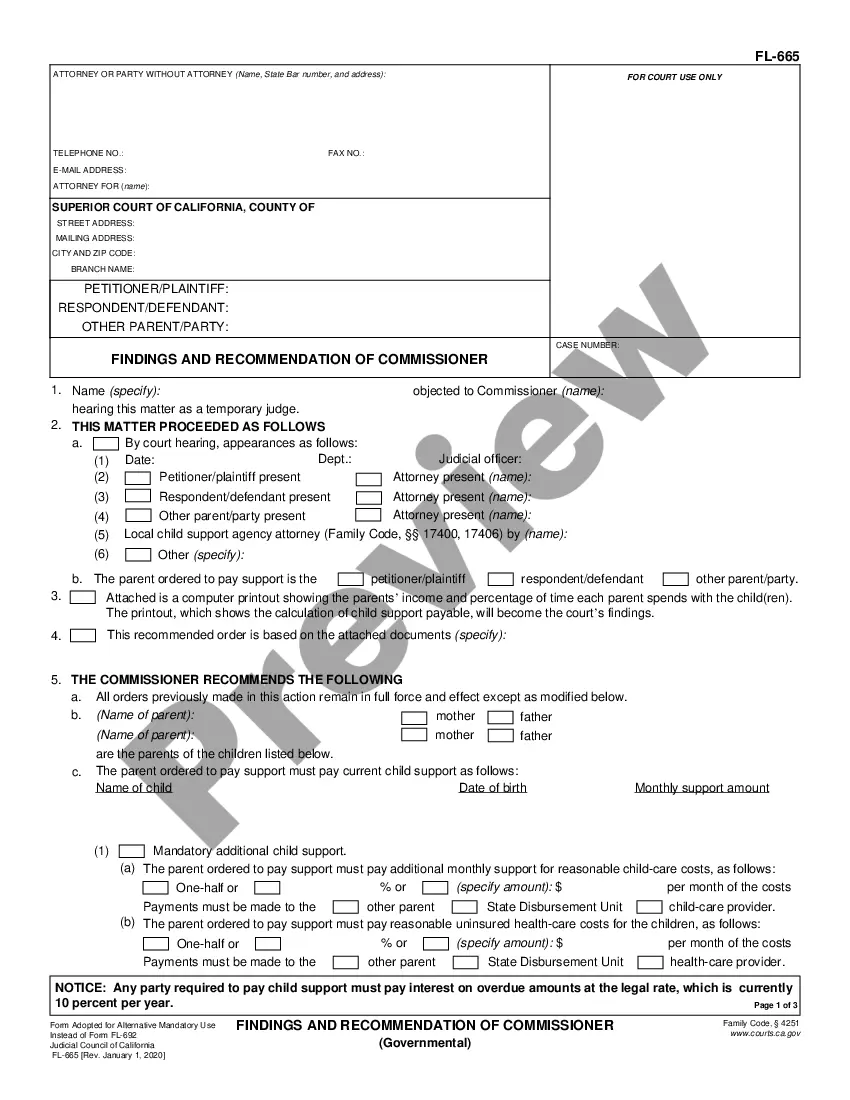

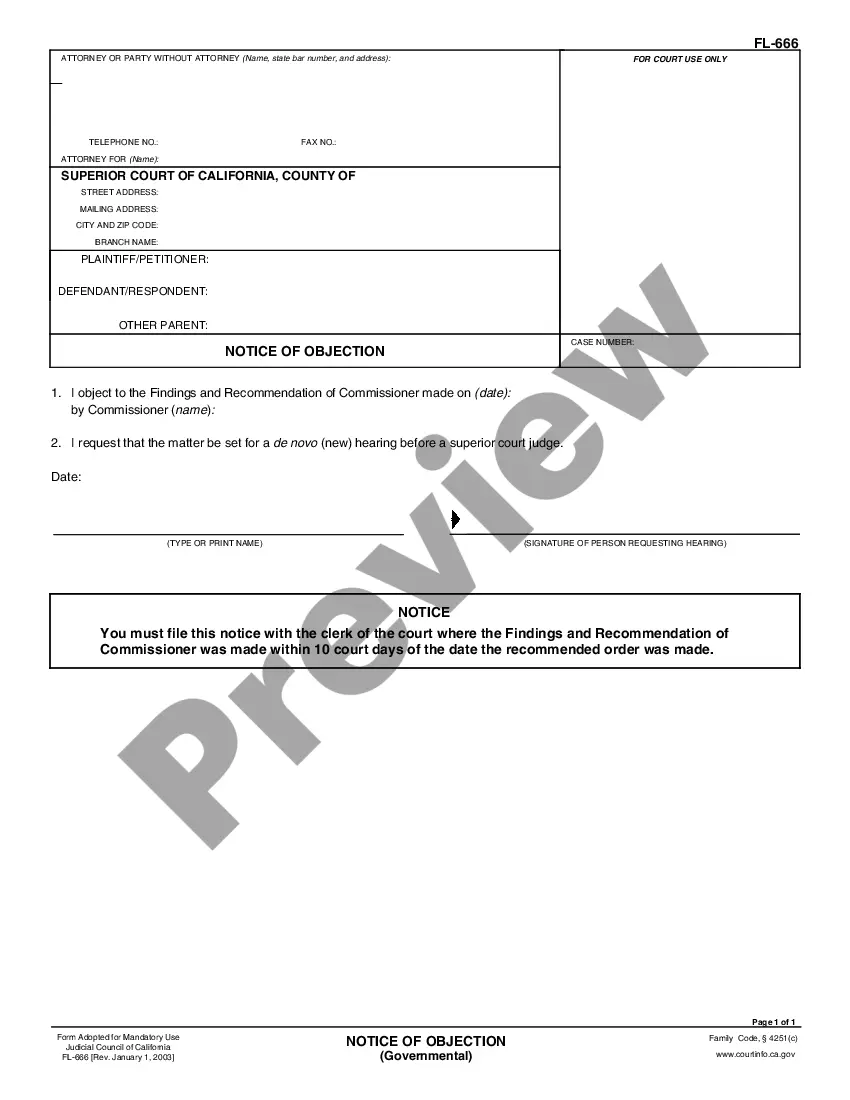

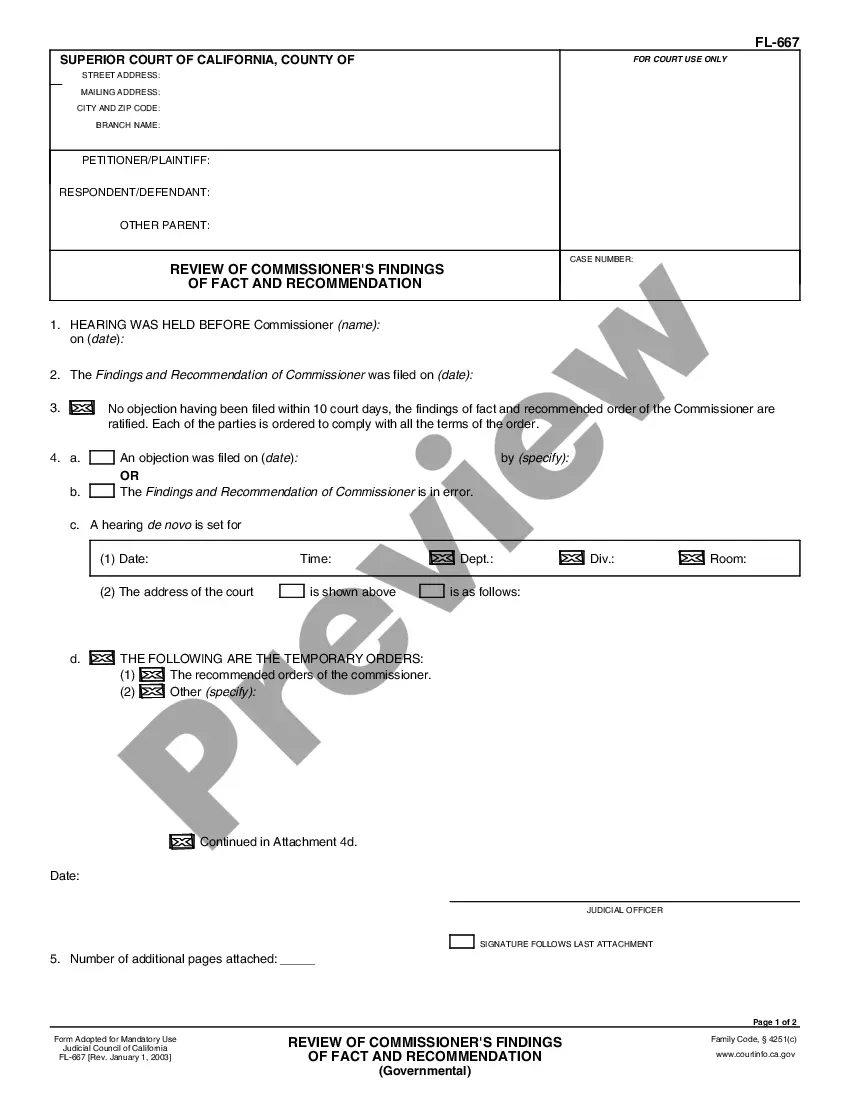

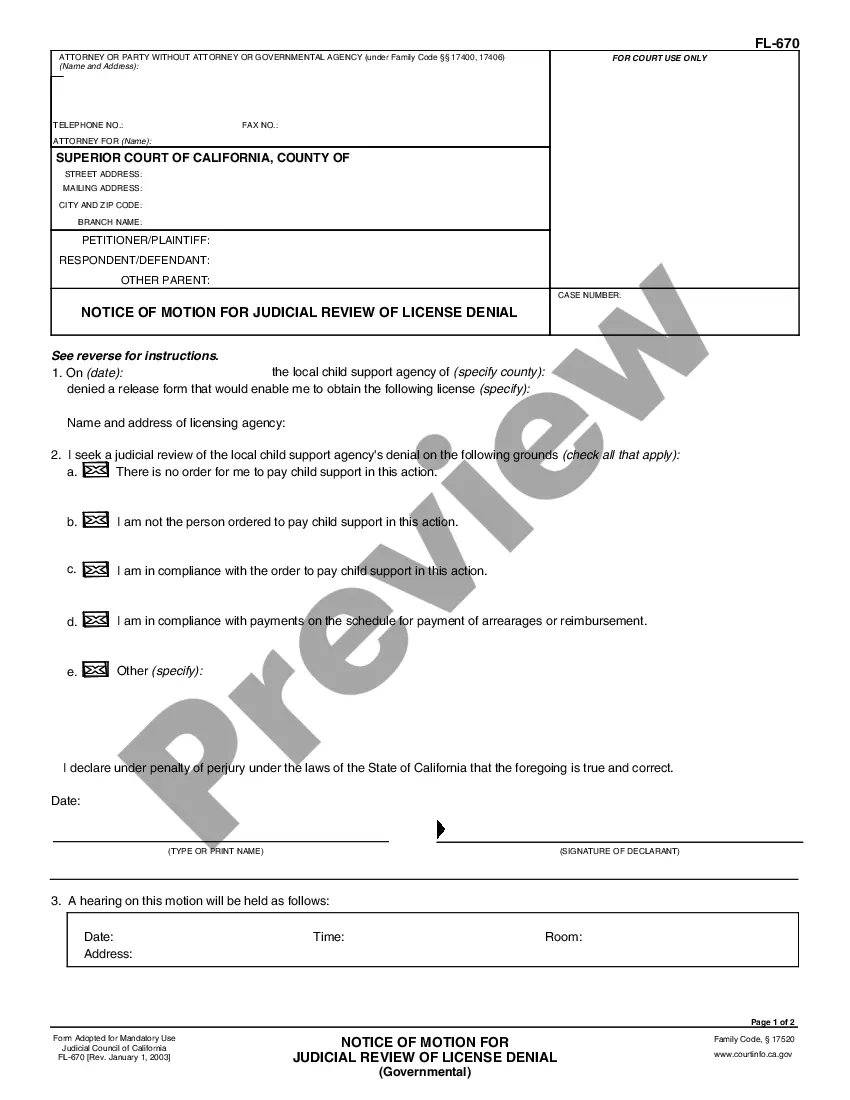

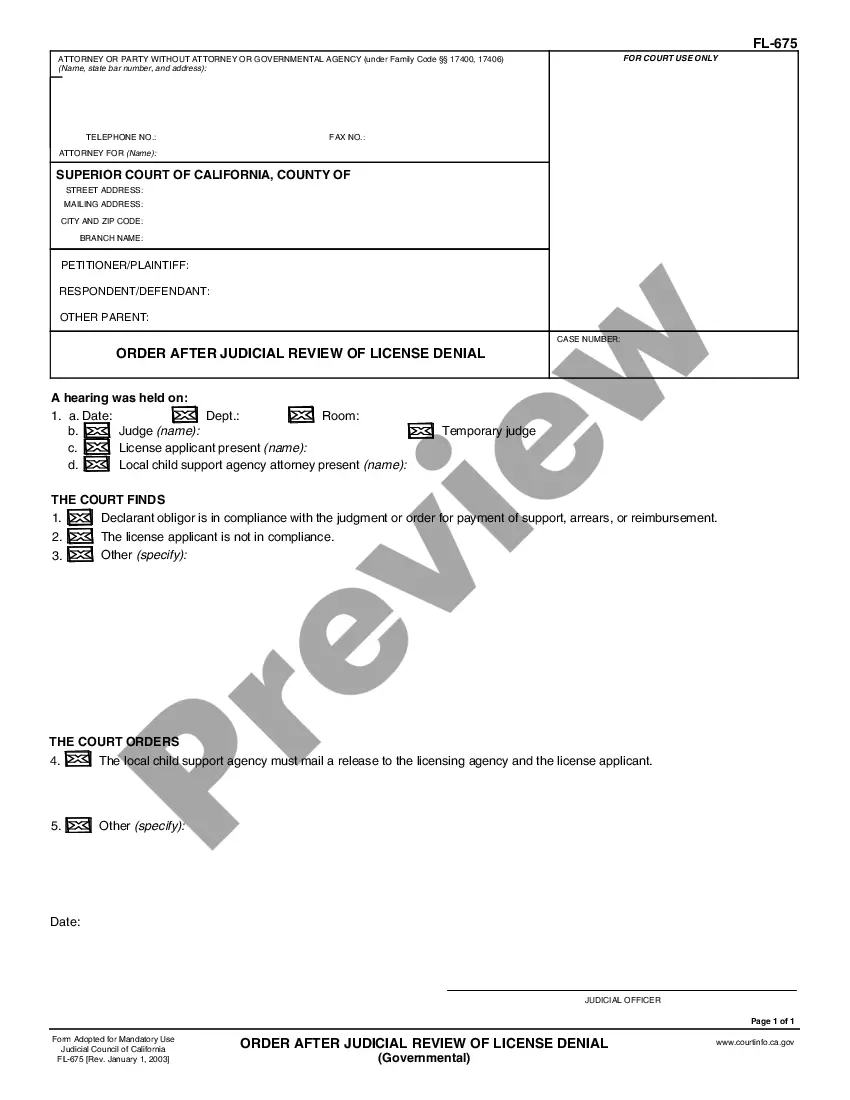

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!