Nassau is a vibrant town located in Nassau County, New York. Situated on Long Island, Nassau offers a unique blend of residential and commercial areas, making it an ideal place to live, work, and visit. This description aims to delve deeper into the Nassau New York List of creditors holding 20 largest secured claims — Not needed for Chapter 7 or 1— - Form 4 — Post 2005 by highlighting its relevance and potential variations. The Nassau New York List of creditors holding 20 largest secured claims is a legal document that outlines the individuals or institutions holding substantial secured claims against debtors in Nassau County, New York. This report is specifically related to debts that do not fall under Chapter 7 or 13 bankruptcy filings and follows the guidelines set forth in Form 4 after the year 2005. It is important to note that this list may have various categories or types, depending on specific factors. Some potential variations of the Nassau New York List of creditors holding 20 largest secured claims include: 1. Residential Property Claims: These could involve mortgages or loans held by banks, lending institutions, or private individuals against residential properties located in Nassau County. The list may detail the outstanding balances, interest rates, and the names of the lenders. 2. Commercial Property Claims: Similar to residential property claims, this category of secured claims pertains to loans or mortgages held against commercial properties, such as office buildings, retail spaces, or industrial facilities within Nassau County. 3. Vehicle Loans: This category includes secured claims related to automobile loans in Nassau County. Lenders may include banks, credit unions, or finance companies, all of whom have legal rights to the vehicles until the debt is repaid. 4. Business Loans: Secured claims against business entities or individuals related to commercial loans or lines of credit fall into this category. It may encompass loans, equipment financing, or inventory financing provided by banks, financial institutions, or private lenders. 5. Personal Loans: This category encompasses secured claims related to personal loans, including loans for education, medical expenses, or debt consolidation. These loans typically involve collateral such as real estate or valuable assets. 6. Other Secured Claims: This category may encompass various other types of secured claims not falling into the aforementioned categories. It could include loans secured against specific assets like boats, artwork, or valuable collections. The Nassau New York List of creditors holding 20 largest secured claims — Not needed for Chapter 7 or 1— - Form 4 — Post 2005 serves as a crucial resource for debtors, attorneys, and interested parties involved in financial matters in Nassau County, New York. By providing detailed information about the largest secured claims within the county, this list facilitates transparency, accountability, and informed decision-making in relation to debt repayment and financial negotiations.

Nassau New York List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

How to fill out Nassau New York List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Nassau List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Nassau List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from the My Forms tab.

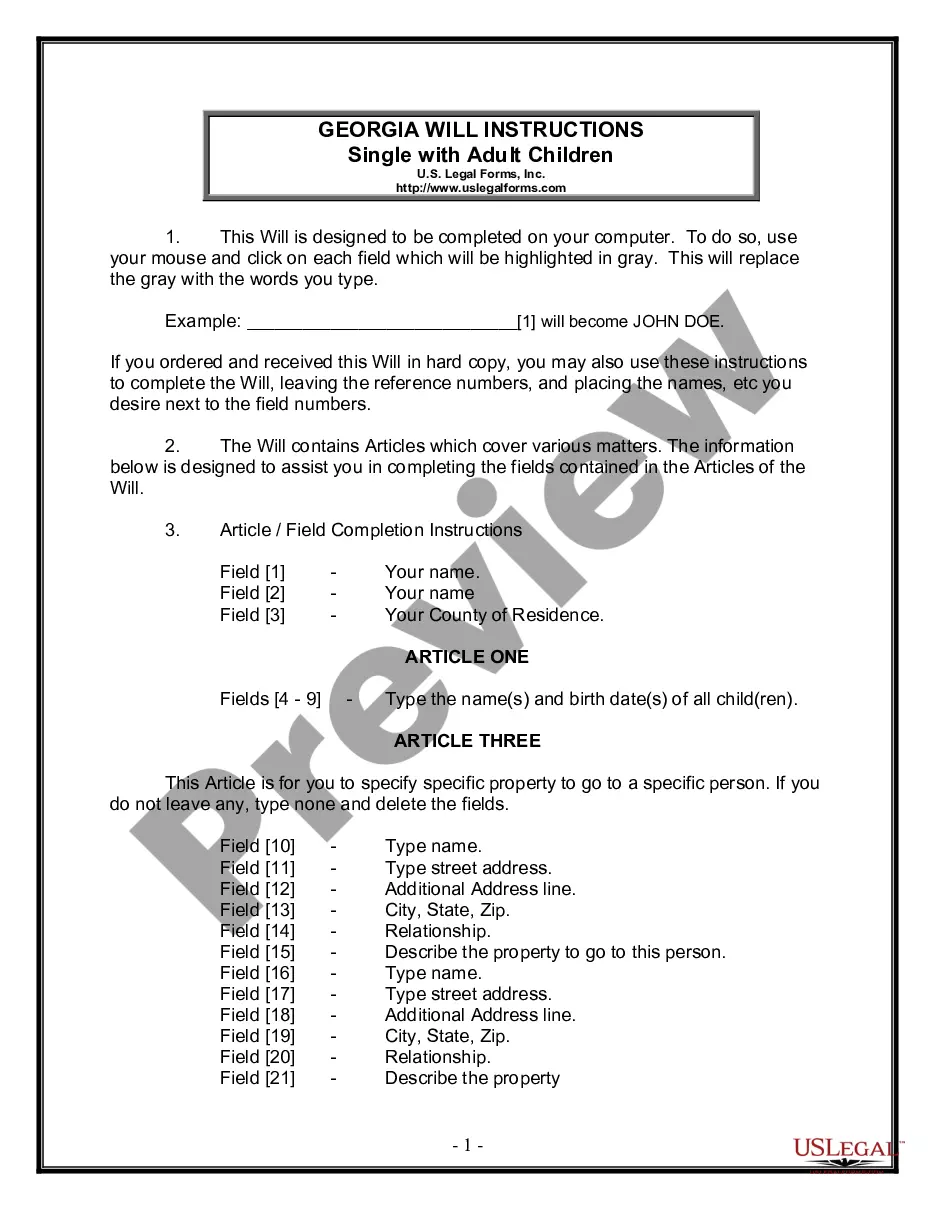

For new users, it's necessary to make some more steps to obtain the Nassau List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005:

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!