Philadelphia, Pennsylvania is a historic and vibrant city located in the northeastern part of the United States. Known for its rich history, diverse culture, and iconic landmarks, Philadelphia is often referred to as the birthplace of America. Philadelphia is the largest city in the state of Pennsylvania and the sixth-largest city in the United States. It is both a cultural and economic hub, offering a wide range of attractions, activities, and opportunities for residents and visitors alike. The city is home to numerous historical sites, including the Liberty Bell, Independence Hall, and the Philadelphia Museum of Art, famous for the iconic "Rocky Steps." Art enthusiasts can explore the various art galleries and museums scattered throughout the city, such as the Barnes Foundation and the Philadelphia Museum of Art. Philadelphia is also known for its vibrant sports culture, with passionate fans supporting teams such as the Philadelphia Eagles (NFL), Philadelphia Phillies (MLB), Philadelphia 76ers (NBA), and Philadelphia Flyers (NHL). The city comes alive during game days, creating an electrifying atmosphere. In addition to its cultural attractions, Philadelphia boasts a thriving food scene, offering a diverse range of culinary experiences. From iconic Philly cheese steaks to world-class restaurants and food festivals, there is something to satisfy every palate. The city's economy is robust and diverse, with sectors such as healthcare, education, technology, finance, and manufacturing driving its growth. Philadelphia is home to prestigious universities and research institutions, including the University of Pennsylvania and Temple University, making it a knowledge hub. When it comes to the list of creditors holding 20 largest secured claims in Philadelphia, Pennsylvania, not needed for Chapter 7 or 13, Form 4, post-2005, there may be various types of creditors involved. These creditors could include financial institutions, mortgage companies, auto loan providers, commercial lenders, and other entities that hold secured debts. The specific names of these creditors may vary depending on the individual cases and circumstances involved. Overall, Philadelphia, Pennsylvania, is a dynamic city with a rich history, cultural offerings, and economic opportunities, making it an exciting place to live or visit.

Philadelphia Pennsylvania List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

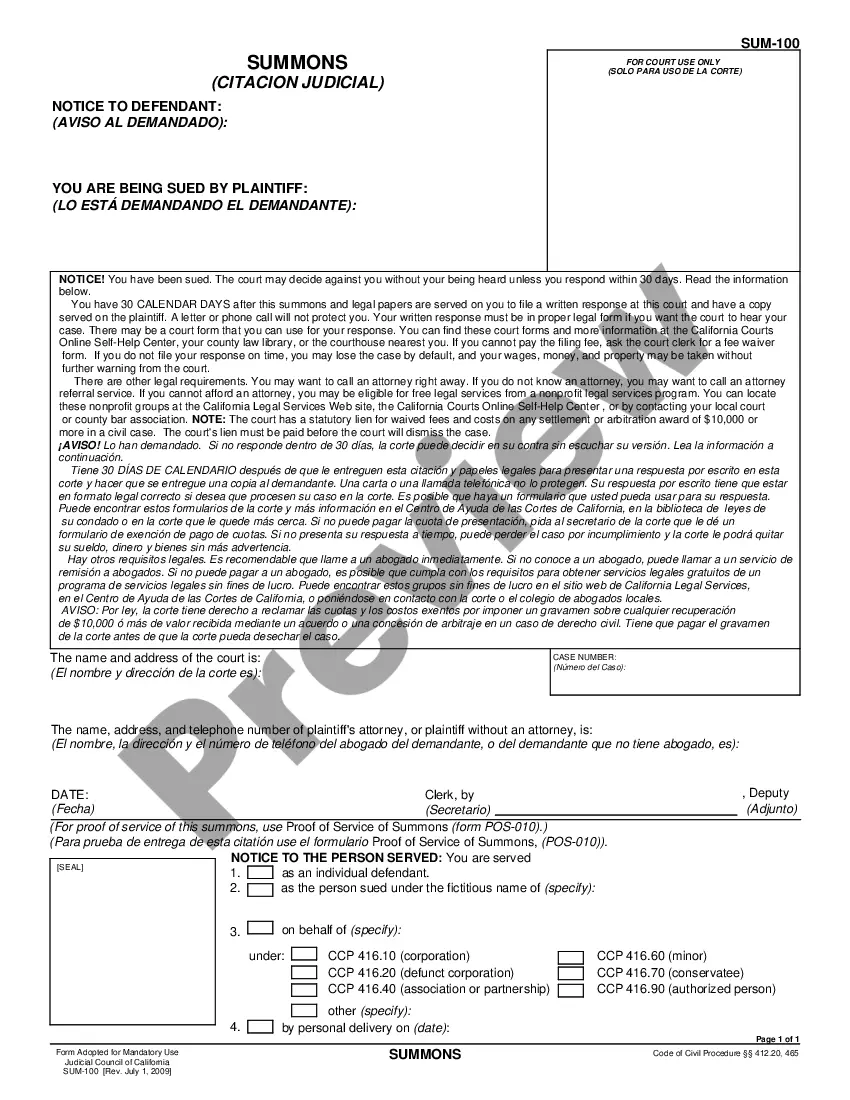

How to fill out Philadelphia Pennsylvania List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Philadelphia List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Philadelphia List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Philadelphia List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Philadelphia List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

What Happens to Secured Debt in a Chapter 7 Bankruptcy? The Chapter 7 discharge eliminates your obligation to pay back the secured loan. But, if you want to keep the property that the bank has a security interest in, you'll need to plan to stay current with your monthly payments.

There are only two ways to get a bankruptcy removed from your credit report: file a dispute with the credit bureaus or wait for the bankruptcy to leave the report after seven to 10 years....How to rebuild your credit after bankruptcy Use a secured credit card.Get a credit builder loan.Become an authorized user.

Your creditors need to know whether your debts to them can be repaid, at least in part. Failing to list assets in a Chapter 7 could spell trouble because: The trustee may have to reopen your case to sell the assets that you failed to disclose. The court could revoke your discharge if you have already received it.

A creditor or the trustee can object to the discharge of one or all of your debts in bankruptcy. The purpose of filing for bankruptcy is often to wipe out (discharge) qualifying debt, such as credit card balances, medical bills, and personal loans.

Chapter 7 Bankruptcy Discharge Wipes Out Most Debts Forever medical bills. personal loans and other unsecured debt. unpaid utilities. phone bills.

Non-exempt Assets First, if you have nonexempt assets and your creditors will receive a distribution in your Chapter 7 bankruptcy, any unlisted debt will typically not be discharged. In this instance, the creditor would be harmed by the fact that it was not listed.

All creditors have the right to be heard with regard to liquidation of the debtor's nonexempt assets in Chapter 7 and with regard to the debtor's repayment plan under Chapter 13. All creditors are also entitled to challenge the debtor's right to a discharge. Not all creditors are treated equally in a bankruptcy case.

Asset and No-Asset Cases in Chapter 7 When money is available, it's considered an asset case. Any debt you fail to list in an asset case won't be discharged. If, however, yours is a no-asset Chapter 7 bankruptcy (there's no money to repay creditors), the debt still might be discharged.

A creditor might not file a proof of claim in your bankruptcy if: you have a no-asset Chapter 7 bankruptcy (meaning you don't have any property the bankruptcy trustee can distribute to your creditors, so they won't get paid) you owe the creditor a very small sum, or.

If a secured creditor fails to file proof of claim, then you will not make any payments toward what you owe on your house or car during your repayment plan. At the end of the bankruptcy process, to keep the collateral, you will still owe the full amount of these secured debts. Plus, you may owe interest and other fees.