King Washington Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out King Washington Real Property - Schedule A - Form 6A - Post 2005?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like King Real Property - Schedule A - Form 6A - Post 2005 is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the King Real Property - Schedule A - Form 6A - Post 2005. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law requirements.

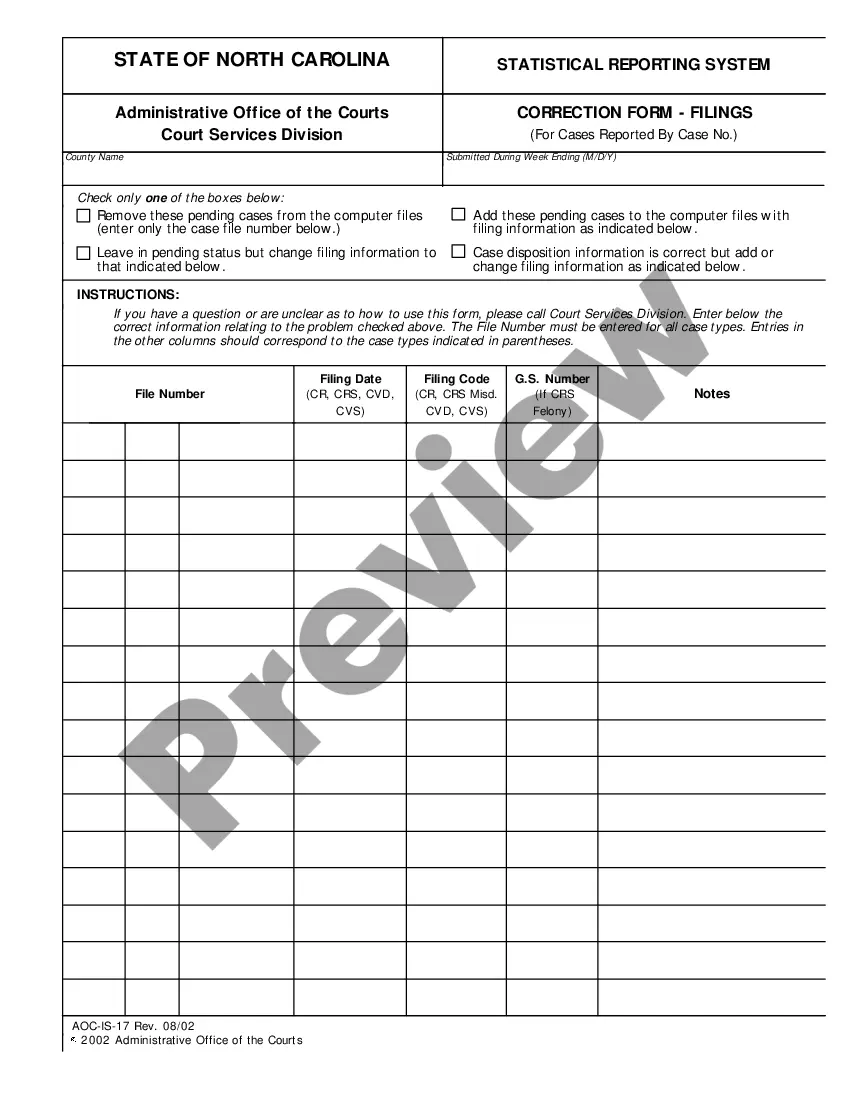

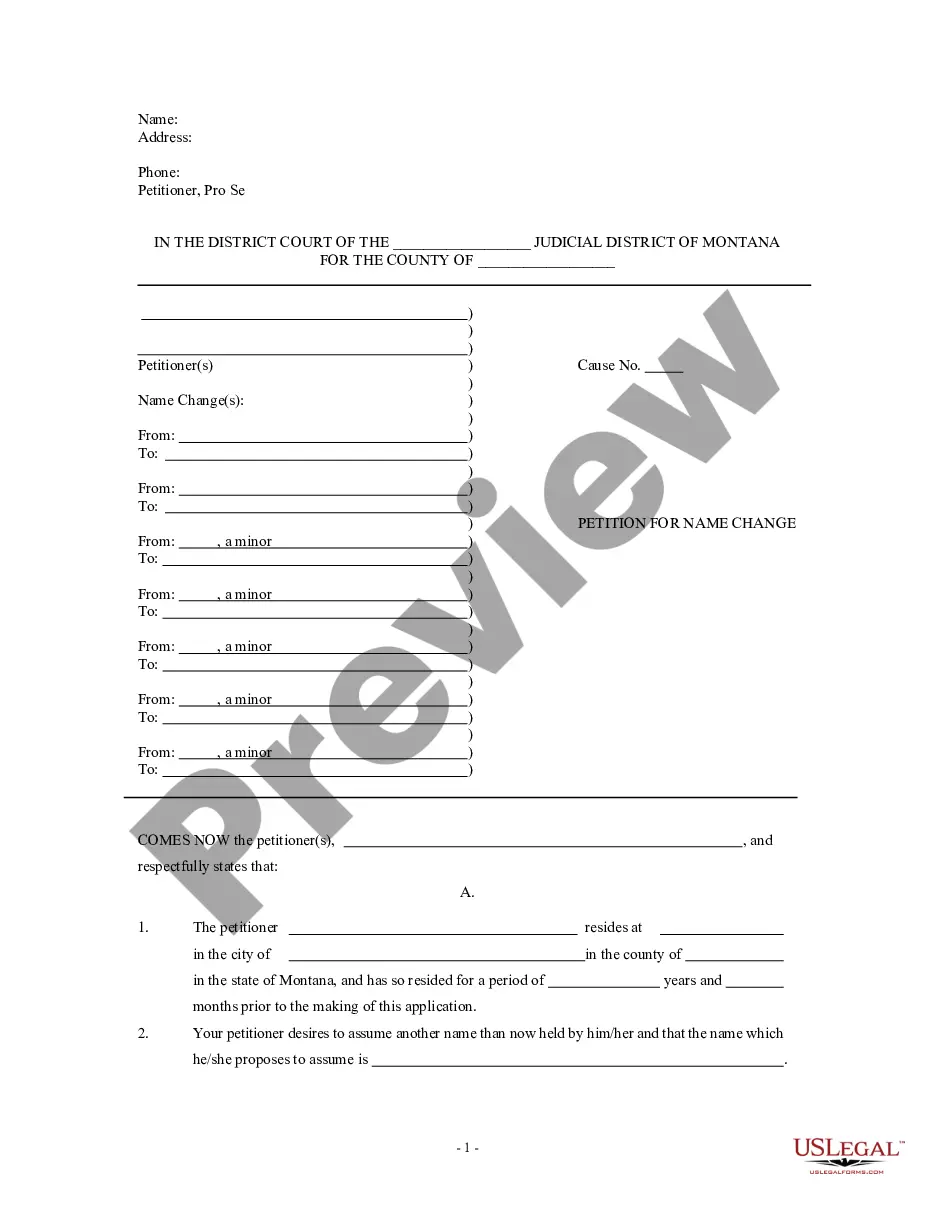

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the King Real Property - Schedule A - Form 6A - Post 2005 in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

If during the current tax year you transferred property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. Also file Form 8824 for the 2 years following the year of a related party exchange.

Line 1: List the address or legal description and type of property relinquished (sold). Line 2: List the address or legal description and type of property received. Line 3: List the month, day, year relinquished property was originally acquired. Line 4: List the date relinquished property was transferred to the buyer.

If during the current tax year you transferred property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. Also file Form 8824 for the 2 years following the year of a related party exchange.

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets. The disposition of capital assets not reported on Schedule D.

Form 8824 is used to report an exchange of real property for real property of a like kind, and to calculate how much of the gain is being deferred, the basis in the acquired property, and the taxable gain to be reported in the current year.

If during the current tax year you transferred property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. Also file Form 8824 for the 2 years following the year of a related party exchange.

Steps to Successfully Complete a 1031 Exchange Identify Your 1031 Exchange Objectives & Property Search.Find a Qualified Intermediary.Add a Cooperation Clause in Your Sales Contract.Provide a Copy of the Contract to the Intermediary.Funds for the Exchange are Wired to the Exchange Account.

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

YES, it is possible to improve property ALREADY OWNED by a 1031 Exchange! An improvement exchange just means we are going to buy something and build on it2026 Hear it all from the best 1031 Exchange facilitator in the business, David Moore.

Line 1: List the address or legal description and type of property relinquished (sold). Line 2: List the address or legal description and type of property received. Line 3: List the month, day, year relinquished property was originally acquired. Line 4: List the date relinquished property was transferred to the buyer.

Interesting Questions

More info

A comprehensive report on the health and environmental impact of seafood in Florida. It is available online at This new year, celebrate the many ways that Gulf Coast cities continue to lead their communities with innovative and creative ideas, inspiring and connecting people in meaningful, sustainable ways to bring about real results. Gullet. It has grown up to be the new king of the bay. A large clam with a long neck. The most popular and abundant clam in Florida — with an abundance of edible and non-edible species There are approximately 11 or 12 species in the Gullet family, the most famous being the Chesapeake Bay The larger Gulf of Mexico Clams (Gulfs) are found in the Gulf of Mexico from the Texas Coast to the Gulf Coast Gulfs typically grow about 25-30 inches and average 20 pounds and weigh about 100-200 pounds This is considered the primary oyster shell of the Gulf. This oyster shell was used for centuries as an artificial skin used as clothing (socks.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.