Contra Costa California Personal Property — Schedule — - Form 6B - Post 2005 is a document used for reporting personal property assets in Contra Costa County, California. This form is typically required to be filed by individuals or businesses who own qualifying personal property within the county. The purpose of Contra Costa California Personal Property — Schedule — - Form 6B - Post 2005 is to provide county officials with detailed information about the taxable property assets owned by individuals or businesses, enabling accurate assessment of property taxes. It is an essential document that helps determine the fair market value of personal property. Some relevant keywords related to this form include Contra Costa County, California, personal property, Schedule B, Form 6B, Post 2005, taxable assets, assessment, property taxes, fair market value, and reporting. There may be different types of Contra Costa California Personal Property — Schedule — - Form 6B - Post 2005, depending on the classification of personal property. These forms may vary based on factors such as the nature of the assets, their value, and any applicable exemptions or special categories. It is essential to consult the official Contra Costa County Tax Assessor's office or website to access the most up-to-date versions and variations of Contra Costa California Personal Property — Schedule — - Form 6B - Post 2005. They will provide detailed instructions and guidelines specific to different types of personal property, ensuring accurate reporting and compliance with county regulations. In conclusion, Contra Costa California Personal Property — Schedule — - Form 6B - Post 2005 is a crucial document used for reporting personal property assets held within Contra Costa County. By accurately reporting these assets, individuals and businesses contribute to the fair assessment of property taxes and support the county's revenue generation efforts.

Contra Costa California Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Contra Costa California Personal Property - Schedule B - Form 6B - Post 2005?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Contra Costa Personal Property - Schedule B - Form 6B - Post 2005.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Contra Costa Personal Property - Schedule B - Form 6B - Post 2005 will be accessible for further use in the My Forms tab of your profile.

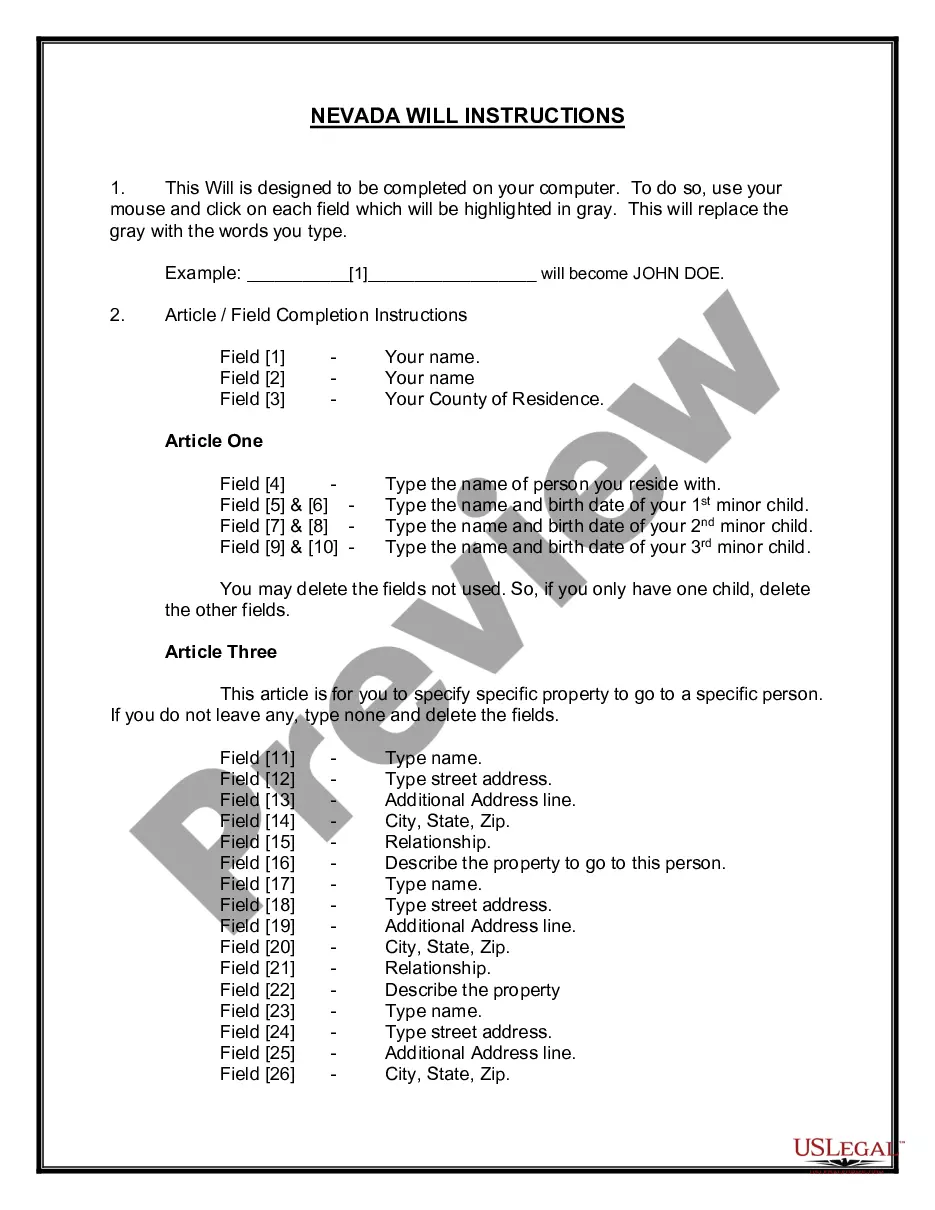

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Contra Costa Personal Property - Schedule B - Form 6B - Post 2005:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Contra Costa Personal Property - Schedule B - Form 6B - Post 2005 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!