Cook Illinois Personal Property — Schedule — - Form 6B - Post 2005 is a legal document used in the state of Illinois to assess and report personal property for tax purposes. This form is required to be filed by individuals, businesses, and organizations owning tangible personal property within Cook County. The purpose of Cook Illinois Personal Property — Schedule — - Form 6B - Post 2005 is to provide an inventory of personal property for accurate assessment and taxation. It is important to complete this form thoroughly and accurately to avoid penalties or tax discrepancies. Keywords associated with Cook Illinois Personal Property — Schedule — - Form 6B - Post 2005: 1. Cook Illinois: Refers to Cook County, which is one of the largest counties in the United States, located in the state of Illinois. 2. Personal Property: This refers to tangible assets owned by individuals, businesses, or organizations. It includes assets such as machinery, equipment, furniture, tools, inventory, vehicles, and more. 3. Schedule B: This indicates that the form is a part of a larger document where various aspects of personal property are reported, assessed, and monitored. 4. Form 6B: Cook Illinois Personal Property — Schedule — - Form 6B is a specific form within the larger filing process. It is used to disclose personal property details and values. 5. Post 2005: This term signifies that the form is applicable for personal property acquired or owned after the year 2005. There may be different forms for property acquired or owned before this period. Different types of Cook Illinois Personal Property — Schedule — - Form 6B - Post 2005: 1. Individual Filing: This form may be used by individual taxpayers to report their personal property holdings within Cook County. 2. Business Filing: Businesses, including partnerships, corporations, and sole proprietorship, must use this form to declare their tangible personal property for taxation purposes. 3. Organization Filing: Non-profit organizations, educational institutions, and other organizations must complete this form to report their personal property holdings. 4. Additional Schedules: Depending on the complexity and nature of personal property, additional schedules may be required to disclose specific asset categories and values. It is essential to consult the official Cook County website or seek professional guidance to ensure accurate completion and filing of Cook Illinois Personal Property — Schedule — - Form 6B - Post 2005. Complying with tax regulations is crucial to avoid penalties and maintain legal compliance.

Cook Illinois Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Cook Illinois Personal Property - Schedule B - Form 6B - Post 2005?

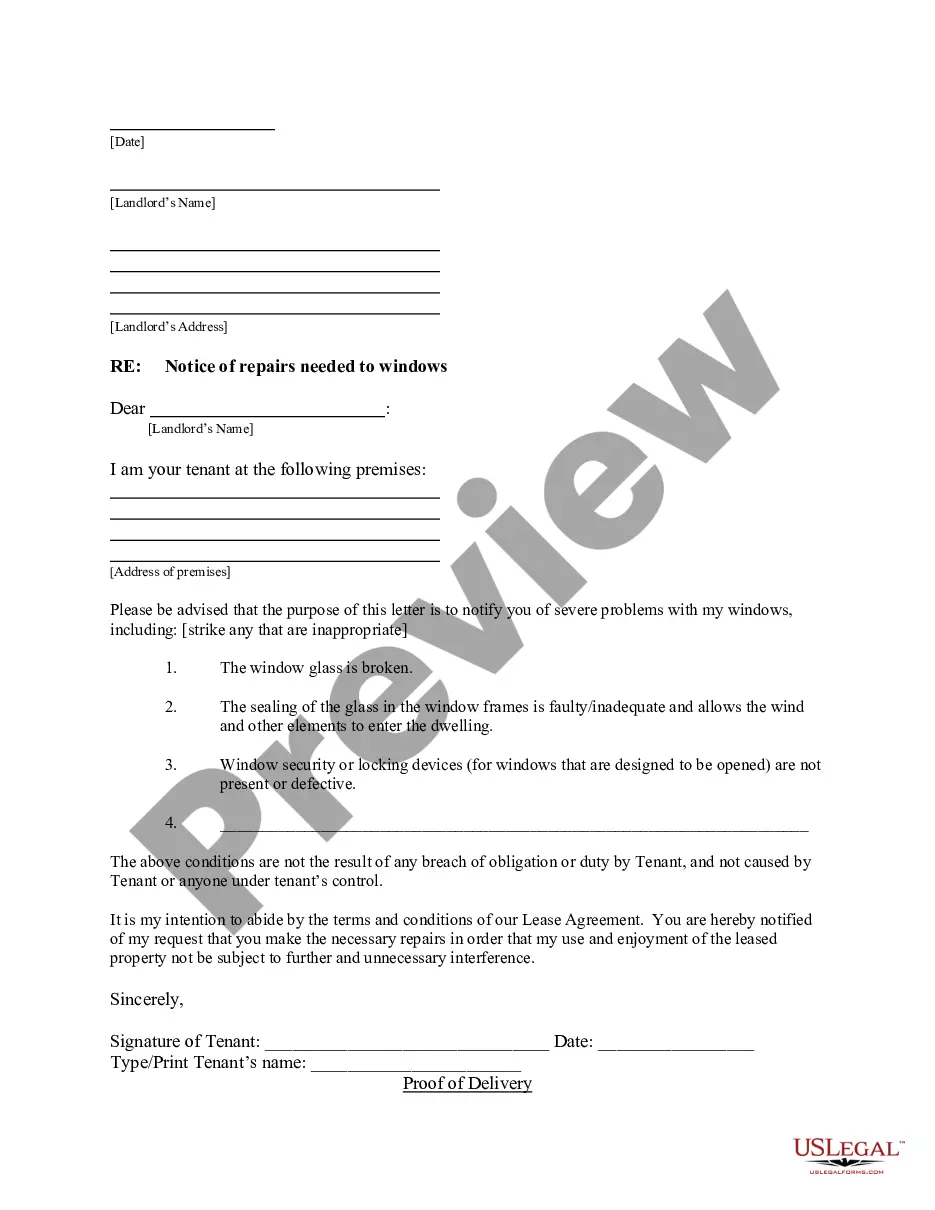

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Cook Personal Property - Schedule B - Form 6B - Post 2005, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities associated with document completion straightforward.

Here's how to find and download Cook Personal Property - Schedule B - Form 6B - Post 2005.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Check the similar document templates or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Cook Personal Property - Schedule B - Form 6B - Post 2005.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Cook Personal Property - Schedule B - Form 6B - Post 2005, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to deal with an exceptionally difficult situation, we advise getting a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific documents with ease!