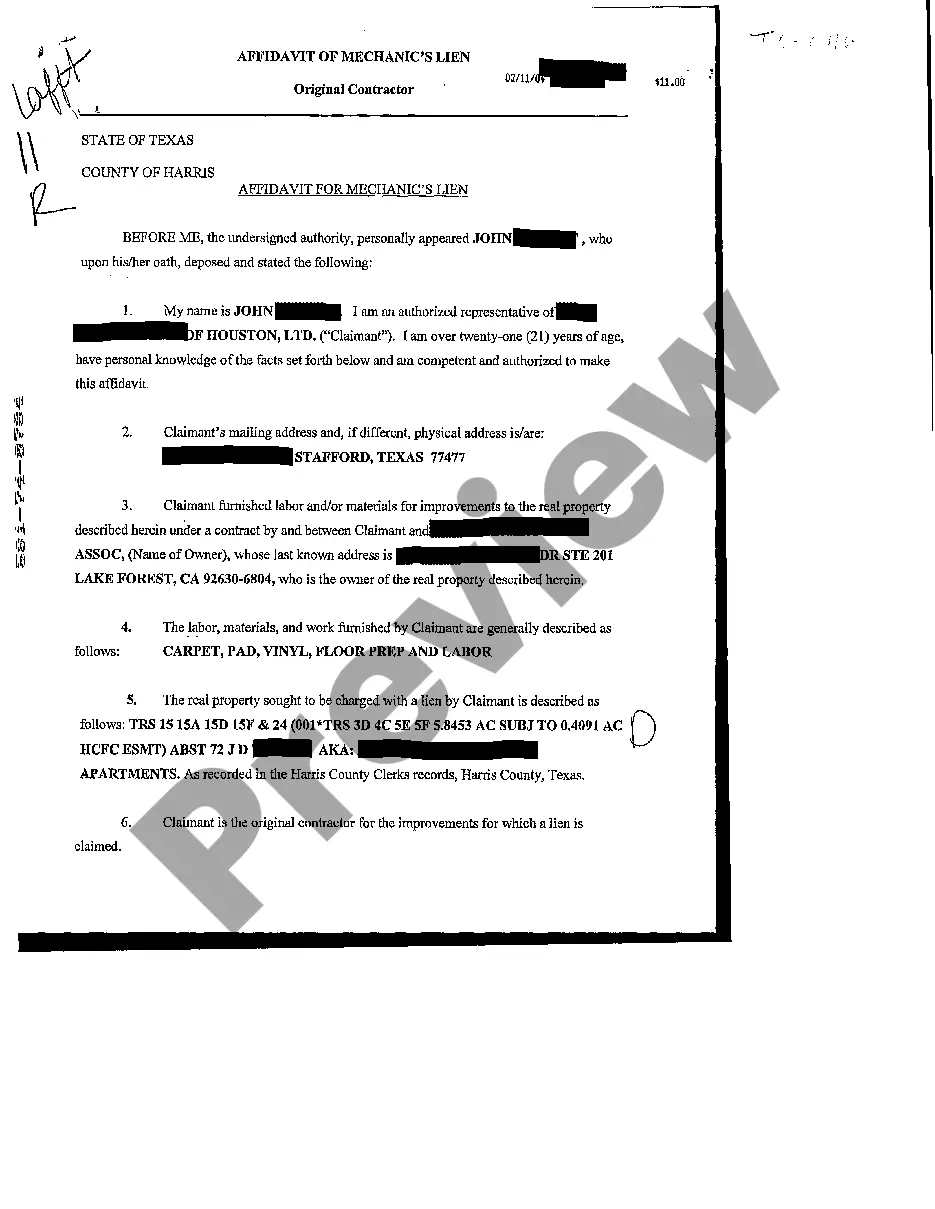

Riverside California Personal Property — Schedule — - Form 6B - Post 2005 is a legal document used to declare personal property owned by individuals or businesses residing in Riverside, California. This form is specifically designed for assets acquired after the year 2005. It is crucial to accurately complete this form to ensure compliance with state regulations and to properly assess property taxes. Schedule B serves as an inventory of personal property within Riverside, California, and requires the owner to provide detailed information about each item. By submitting this form, individuals or businesses inform the local county assessor's office about their personal property, enabling the government to assess appropriate property taxes based on these assets. Common types of personal property that must be reported on Riverside California Personal Property — Schedule — - Form 6B - Post 2005 include but are not limited to: 1. Vehicles: All types of cars, motorcycles, boats, recreational vehicles, and other modes of transportation, along with their corresponding identification numbers, make, model, and year of manufacture. 2. Furniture and Appliances: Household items such as sofas, chairs, tables, beds, refrigerators, washing machines, televisions, and other valuable or costly pieces of furniture or appliances. 3. Electronics and Devices: This includes personal computers, laptops, tablets, smartphones, cameras, gaming consoles, printers, and any other electronic devices owned. 4. Jewelry and Accessories: All valuable gemstones, precious metals, watches, necklaces, rings, bracelets, and other forms of jewelry. 5. Artwork and Collectibles: Paintings, sculptures, antiques, rare books, collector's items, or any other valuable items acquired for artistic, cultural, or investment purposes. 6. Equipment and Machinery: This category encompasses tools, machinery, heavy equipment, agricultural or construction equipment, industrial appliances, and all types of assets used for business or personal purposes. 7. Office Supplies and Furniture: Items such as desks, chairs, computers, printers, copiers, fax machines, office furniture, and stationery owned by businesses. 8. Inventory and Stock: Any goods, products, or supplies held for sale, distribution, or manufacturing purposes, including raw materials, unfinished goods, or finished products. 9. Business-related Assets: This category includes items such as office supplies, software licenses, professional equipment, machinery, vehicles, and any other personal property essential for business operations. It is important to remember that these are only examples, and the Riverside California Personal Property — Schedule — - Form 6B - Post 2005 can cover various other personal property items not listed here. The accuracy and thoroughness of the information provided on this form are crucial, as it plays a significant role in determining property taxes. Failing to submit this form or providing incorrect information may lead to penalties or legal consequences.

Riverside California Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Riverside California Personal Property - Schedule B - Form 6B - Post 2005?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Riverside Personal Property - Schedule B - Form 6B - Post 2005 without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Riverside Personal Property - Schedule B - Form 6B - Post 2005 on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Riverside Personal Property - Schedule B - Form 6B - Post 2005:

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!