Houston Texas Property Claimed as Exempt — Schedule — - Form 6C - Post 2005: An Overview In Houston, Texas, property owners may be eligible to claim certain exemptions for their properties utilizing Schedule C, also known as Form 6C, specifically designed for claims filed after 2005. This schedule allows property owners to exclude certain properties from taxation under certain conditions. Here, we will provide a detailed description of what Houston Texas Property Claimed as Exempt — Schedule — - Form 6C - Post 2005 entails. Types of Property Claimed as Exempt — Schedule — - Form 6C - Post 2005: 1. Homestead Exemption: The Homestead Exemption is one of the most common types of property exemptions claimed in Houston, Texas. It offers significant relief to homeowners by excluding a portion of the property's assessed value from taxation. To qualify, the property being claimed must be the homeowner's primary residence. There are various requirements and conditions to meet eligibility criteria, such as residency, property value limits, and applicant qualifications. 2. Over 65 Homestead Exemption: This exemption is specifically available for homeowners who are 65 years or older. It provides additional benefits beyond the standard Homestead Exemption, including higher property value threshold limitations. It aims to assist senior citizens in managing their property taxes more effectively. 3. Disabled Persons Exemption: The Disabled Persons Exemption is designed to support individuals with disabilities and reduce their property tax burden. To qualify, the homeowner must meet specific disability criteria as defined by state regulations and provide appropriate documentation. This exemption aims to provide financial relief to individuals facing physical or mental challenges in their daily lives. 4. Veteran's Exemption: The Veteran's Exemption is available to honorably discharged veterans, their surviving spouses, or their unmarried minor children. This exemption recognizes the sacrifices made by veterans and offers property tax relief. Eligibility criteria may include proof of military service, residency, and other requirements as outlined by the Texas Property Tax Code. 5. Charitable Organization Exemption: Non-profit charitable organizations in Houston, Texas, may qualify for property tax exemption under Schedule C — Form 6C if they meet certain criteria. Organizations must demonstrate their commitment to public benefit and meet specific requirements laid out by state laws governing property tax exemptions for charitable entities. It is essential for property owners in Houston, Texas, to become familiar with the different types of exemptions available under Schedule C — Form 6— - Post 2005. Each exemption has specific eligibility criteria, qualification requirements, and documentation procedures that must be adhered to when claiming exemption on the property. Claiming exemptions can significantly reduce property tax liabilities, providing relief for homeowners, disabled individuals, veterans, and charitable organizations. It is advisable to consult with a qualified tax professional or the Harris County Appraisal District (HAD) to ensure accurate understanding and proper completion of Form 6C when filing for various property exemptions in Houston, Texas.

Houston Texas Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

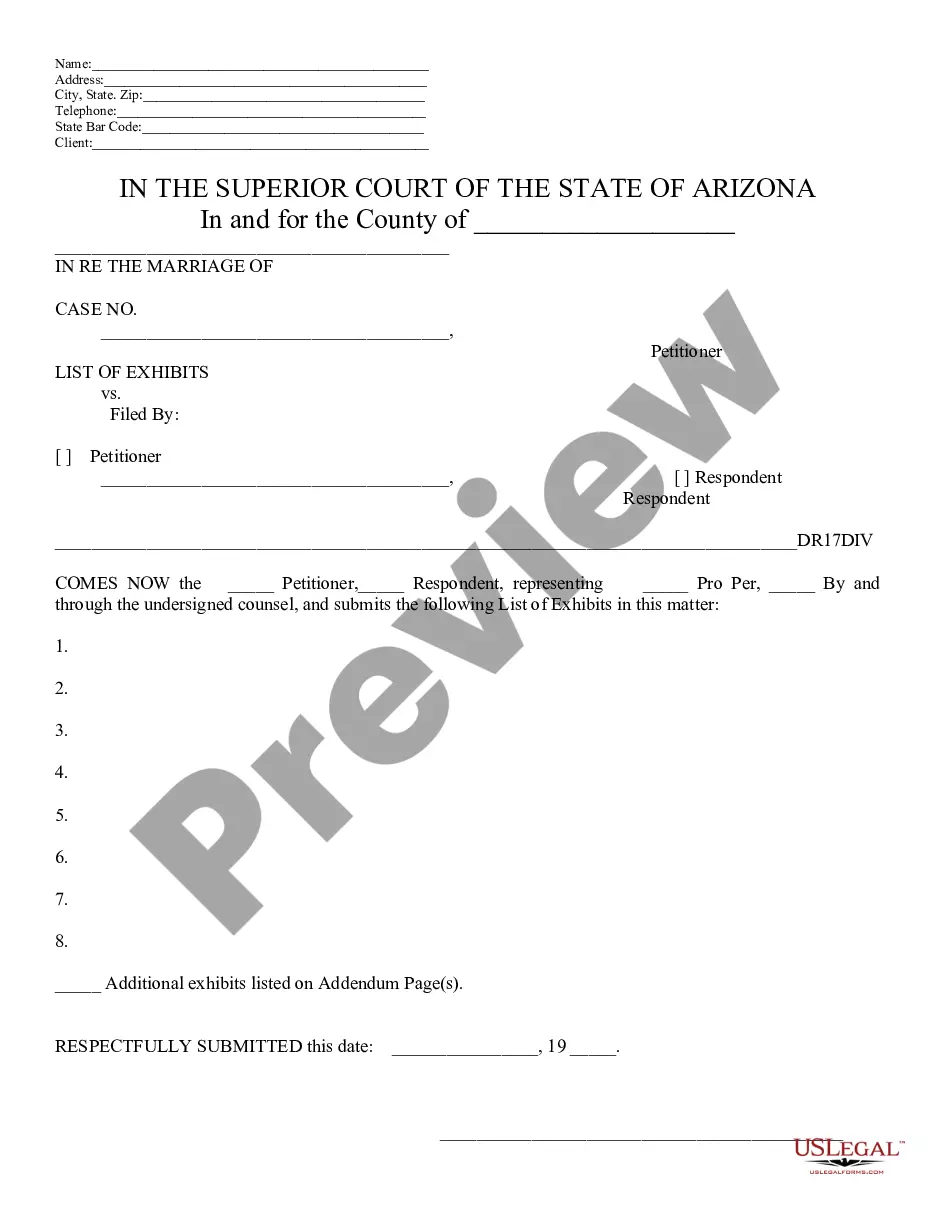

How to fill out Houston Texas Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Houston Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Houston Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Houston Property Claimed as Exempt - Schedule C - Form 6C - Post 2005:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!