Nassau County in New York offers residents the opportunity to claim property as exempt through the Schedule C — Form 6C, following changes made in 2005. This form allows individuals to protect certain assets from being used to satisfy outstanding debts or judgments. There are several types of Nassau New York Property that can be claimed as exempt on Schedule C — Form 6— - Post 2005. Some of these include: 1. Homestead Exemption: Homeowners in Nassau County can claim their primary residence as exempt up to a certain value. This exemption is designed to protect the equity in the home, providing a safeguard for individuals facing financial difficulties. 2. Motor Vehicle Exemption: Individuals can also claim their motor vehicles as exempt, provided the fair market value does not exceed a specific limit. This exemption aims to ensure that residents can maintain necessary transportation. 3. Tools of Trade Exemption: Nassau County residents who rely on certain tools or equipment for their work can claim them as exempt. This exemption protects essential tools such as machinery, instruments, or vehicles needed to earn a living. 4. Household Goods and Furnishings Exemption: Individuals can exempt essential household items such as furniture, appliances, and clothing from being used to satisfy debts or judgments. This exemption ensures that residents can maintain a reasonable standard of living. 5. Personal Property Exemption: Certain personal property, such as jewelry, artwork, and electronics, may also be claimed as exempt on Schedule C — Form 6— - Post 2005. However, there are limits imposed on the total value that can be claimed for each category. It is important to note that each exemption has its own limitations and requirements, which should be carefully reviewed before submitting the form. Additionally, some exemptions may not be available to individuals with substantial assets or those who have recently transferred property. It is advisable to consult with a legal professional or tax advisor to ensure eligibility and full compliance with the exemption process. By utilizing the Schedule C — Form 6— - Post 2005, residents of Nassau County can protect their valuable assets from being seized to satisfy outstanding debts or judgments. Understanding the various types of exempt property and their corresponding limitations allows individuals to make informed decisions and safeguard their personal belongings.

Nassau New York Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

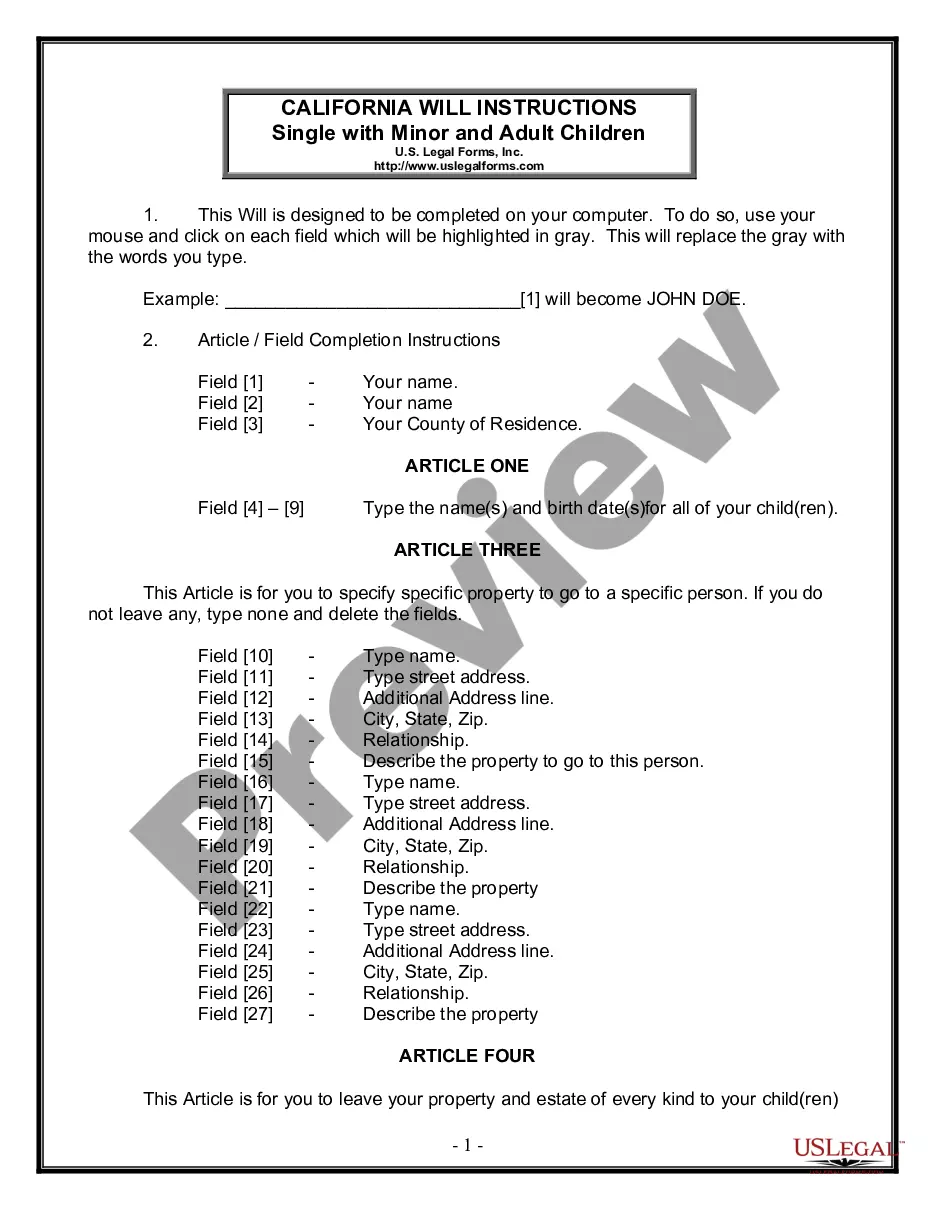

How to fill out Nassau New York Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Nassau Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how to locate and download Nassau Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Nassau Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to cope with an extremely complicated case, we recommend using the services of a lawyer to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and get your state-compliant documents with ease!