Clark Nevada Summary of Schedules — Form 6CONTSU— - Post 2005 is a legal document that provides a comprehensive overview of the financial affairs of an individual or entity residing in Clark County, Nevada. This form is typically required in bankruptcy cases and is essential for creditors, bankruptcy trustees, and other interested parties to understand the debtor's financial situation. The Clark Nevada Summary of Schedules — Form 6CONTSU— - Post 2005 contains various sections that cover different aspects of the debtor's financial disclosures. These sections include: 1. Real Property: This section requires the debtor to list all real estate properties they own, their location, estimated value, and any related mortgages or liens. 2. Personal Property: Here, the debtor must declare all personal assets, such as vehicles, jewelry, artwork, furniture, electronics, and other valuable possessions. 3. Bank Accounts: This section demands a detailed account of the debtor's bank accounts, including checking, savings, and investment accounts, along with the respective balances. 4. Investments: Debtors are required to disclose any investments they hold, including stocks, bonds, mutual funds, retirement plans, and other financial instruments. 5. Business Interests: If the debtor owns or has an interest in any businesses, this section requires them to provide information about the nature of the business, ownership percentage, and estimated value. 6. Other Assets: This section allows the debtor to disclose any assets not covered in the previous sections, such as patents, copyrights, royalties, pending lawsuits, tax refunds, or any other valuable claims. 7. Unsecured Creditors: Debtors must list all their unsecured creditors, such as credit card issuers, personal loans, medical bills, or other debts that are not backed by collateral. 8. Secured Creditors: In this section, the debtor provides information about secured creditors, including mortgages, loans secured by collateral, car loans, or other debts tied to specific assets. 9. Executory Contracts and Unexpired Leases: If the debtor has any ongoing contracts or leases at the time of bankruptcy filing, they must disclose them here, along with relevant details. 10. Co-Debtors: If there are any co-debtors or individuals who share liability for the debts covered in the bankruptcy case, this section requires their identification and contact information. It is worth noting that there may be specific variations or updates to the Clark Nevada Summary of Schedules — Form 6CONTSU— - Post 2005, depending on the court or jurisdiction. However, the essence of the form remains consistent across different bankruptcy cases, focusing on complete financial transparency. Accurate completion and submission of the Clark Nevada Summary of Schedules — Form 6CONTSU— - Post 2005 is crucial to ensure compliance with bankruptcy laws and enable a fair evaluation of the debtor's financial status. This document provides an important tool for all parties involved in the bankruptcy process to assess and negotiate the best potential outcome.

Clark Nevada Summary of Schedules - Form 6CONTSUM - Post 2005

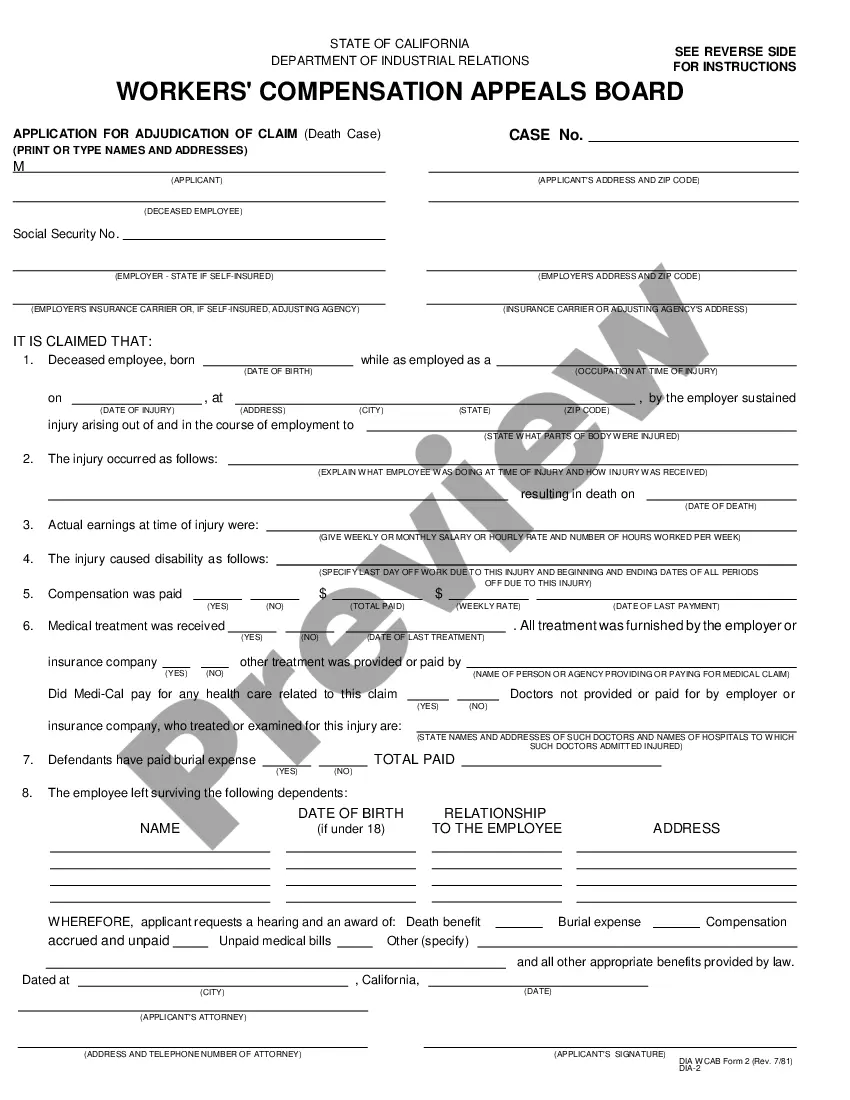

Description

How to fill out Clark Nevada Summary Of Schedules - Form 6CONTSUM - Post 2005?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Clark Summary of Schedules - Form 6CONTSUM - Post 2005, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Clark Summary of Schedules - Form 6CONTSUM - Post 2005 from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Clark Summary of Schedules - Form 6CONTSUM - Post 2005:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

After a Chapter 11 plan is confirmed by the court, the plan must be implemented and carried out, either by the debtor or by the successor to the debtor under the plan. If the plan calls for the debtor to be reorganized or for a new corporation to be formed, this function must be carried out first.

After you have decided to file for bankruptcy, the first step is to file a petition with the Bankruptcy Court. On the petition, all your of your debts and property must be listed as well as other schedules of assets and liabilities.

The schedules are a portion of the paperwork that's required to file for bankruptcy relief. They're actually a series of documents that every debtor (the person filing the bankruptcy case) prepares and submits to the bankruptcy court.

Under a Chapter 11 reorganization, a company usually keeps doing business and its stock and bonds may continue to trade in our securities markets. Since they still trade, the company must continue to file SEC reports with information about significant developments.

A Chapter 11 reorganization provides many benefits for troubled companies, including much-needed relief from unsustainable debt levels, the ability to unravel burdensome contracts, and breathing room to develop a plan.

How the Bankruptcy Process Works Step 1: Find a Good Attorney.Step 2: Conduct a Bankruptcy Counseling Session.Step 3: Filing for Bankruptcy With the Court.Step 4: Liquidation or Repayment.Step 5: Complete a Debtor Education Course.Step 6: Debt Discharge.

Creditors typically do not receive recovery until 30 to 90 days from the court's confirmation of the Plan of Reorganization.

Most Chapter 7 bankruptcy cases take between 4 - 6 months to complete after filing the case with the court. The order erasing eligible debts can be granted as early as 90 days from the date the case was filed. No-asset cases are typically closed a couple of weeks after the discharge date.

Bankruptcy may help you get relief from your debt, but it's important to understand that declaring bankruptcy has a serious, long-term effect on your credit. Bankruptcy will remain on your credit report for 7-10 years, affecting your ability to open credit card accounts and get approved for loans with favorable rates.

How Many Times Can You File for Bankruptcy? Although there's often a wait time to file another Chapter 7 or Chapter 13 bankruptcy case, there's no limit to how many times you can file.