Queens, New York is one of the five boroughs of New York City and is located on the western portion of Long Island. It is the largest borough in terms of area and the second most populous borough, following Brooklyn. Queens is known for its rich cultural diversity, vibrant neighborhoods, and numerous attractions. In regard to creditors holding secured claims, Schedule D, Form 6D, Post 2005, it specifically refers to a section of bankruptcy forms that list the creditors who hold secured debts of an individual or business in Queens, New York. 1. Mortgage Lenders: One of the common types of secured claims in Queens, New York, listed on Schedule D, Form 6D, is mortgage lenders. Queens has a diverse housing market, ranging from luxurious residential properties to affordable apartments. Numerous financial institutions and lenders provide mortgages to homebuyers in Queens, holding a secured claim in the form of a mortgage lien on the property. 2. Auto Loan Companies: Another type of secured claim found in Queens, New York, are auto loan companies. With a significant number of residents relying on personal vehicles for commuting, auto loans are popular in Queens. Individuals who have financed their vehicles through loan companies must list these creditors on Schedule D, Form 6D, as they hold a secured claim on the vehicle's title until the loan is fully repaid. 3. Security Interest Holders: In addition to mortgage lenders and auto loan companies, Schedule D, Form 6D, also includes other secured claims held by security interest holders. These can include creditors who have a lien on specific personal or business property, such as equipment, inventory, or other valuable assets. These creditors may have provided financing based on the collateral's value, ensuring a secured claim. 4. Home Equity Line of Credit (HELOT) Lenders: Queens homeowners may also have Home Equity Lines of Credit (HELOT) as secured claims. A HELOT is a revolving line of credit secured by the equity in the borrower's home. It allows homeowners to borrow against the value of their property for various purposes, such as home improvements or debt consolidation. These obligations ought to be listed on Schedule D, Form 6D. In summary, Queens, New York, is home to various types of creditors holding secured claims, as detailed on Schedule D, Form 6D, Post 2005. These include mortgage lenders, auto loan companies, security interest holders, and HELOT lenders. It is essential for individuals or businesses filing for bankruptcy in Queens to accurately list these creditors to ensure the proper handling of their secured debts during the bankruptcy process.

Queens New York Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

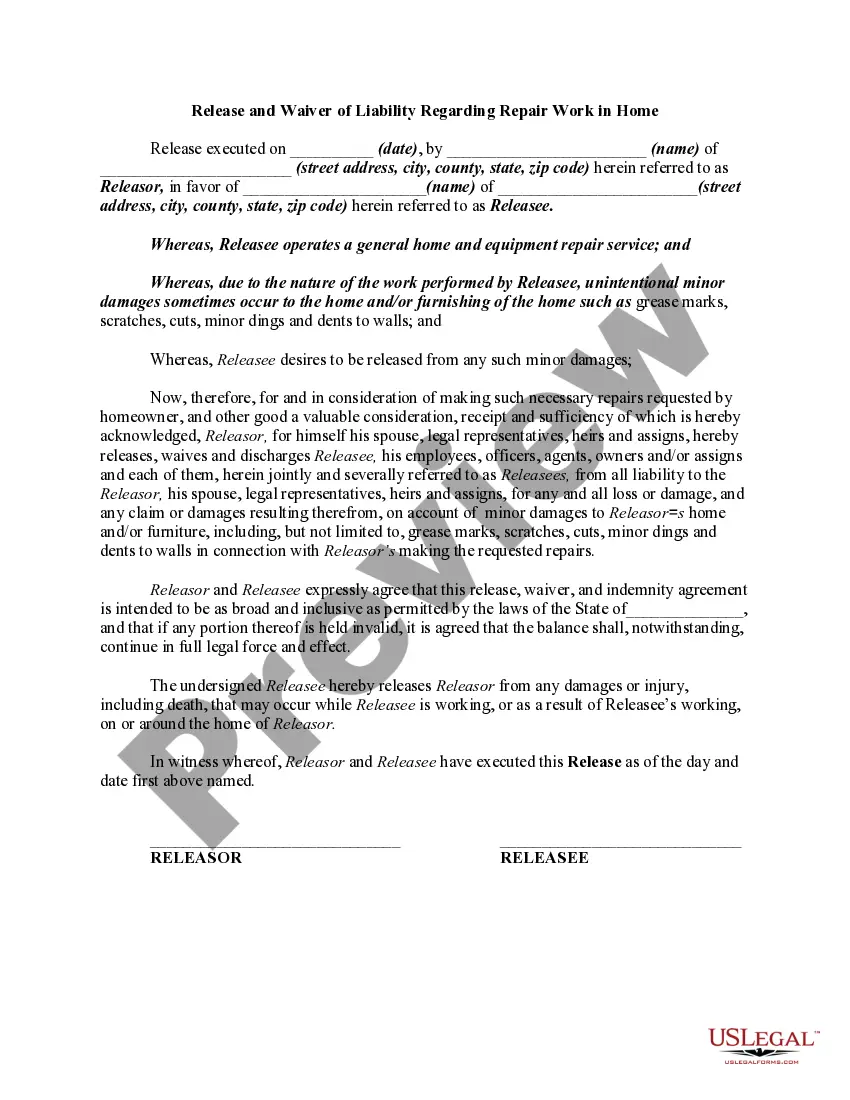

Description

How to fill out Queens New York Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Queens Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Queens Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!