Santa Clara, California is a vibrant city located in the heart of Silicon Valley. It is home to numerous high-tech companies, prestigious universities, and a diverse population. In terms of bankruptcy proceedings, there may be various types of Santa Clara California Creditors Holding Secured Claims — Schedule — - Form 6D - Post 2005. These could include: 1. Automotive Lenders: These creditors may hold secured claims on vehicles owned by individuals or businesses in Santa Clara, California. They may have lent money to finance the purchase of cars, trucks, or other automobiles. 2. Mortgage Lenders: Mortgage lenders are another type of creditor that may hold secured claims in Santa Clara. These creditors have provided loans for the purchase of real estate properties, such as homes or commercial buildings, and hold a lien on the property as security. 3. Equipment Lenders: This category encompasses creditors who have extended loans to individuals or businesses to acquire equipment or machinery. They may hold secured claims on items like industrial machinery, tools, or specialized equipment used in various industries. 4. Personal Property Lenders: These creditors hold secured claims on personal property such as jewelry, art, or luxury items. They may have provided loans or lines of credit to individuals or entities in Santa Clara, California, using the personal property as collateral. 5. Financial Institutions: Banks and other financial institutions in Santa Clara may have extended secured loans to borrowers, whereby collateral is offered to secure the debt. These secured claims may include home equity lines of credit, personal loans secured with assets, or business loans backed by property or assets. 6. Technology Lenders: Given Santa Clara's thriving technology industry, there may be specific creditors specializing in lending funds for technology-related purchases. These lenders could include companies that finance the acquisition of software, hardware, or technology services for businesses operating in the area. It is essential to consult the specific Santa Clara California Creditors Holding Secured Claims — Schedule — - Form 6D - Post 2005 to understand the detailed list of creditors and their claims within the bankruptcy proceedings. Proper legal guidance should be sought when dealing with bankruptcy cases and the intricacies associated with secured claims.

Santa Clara California Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

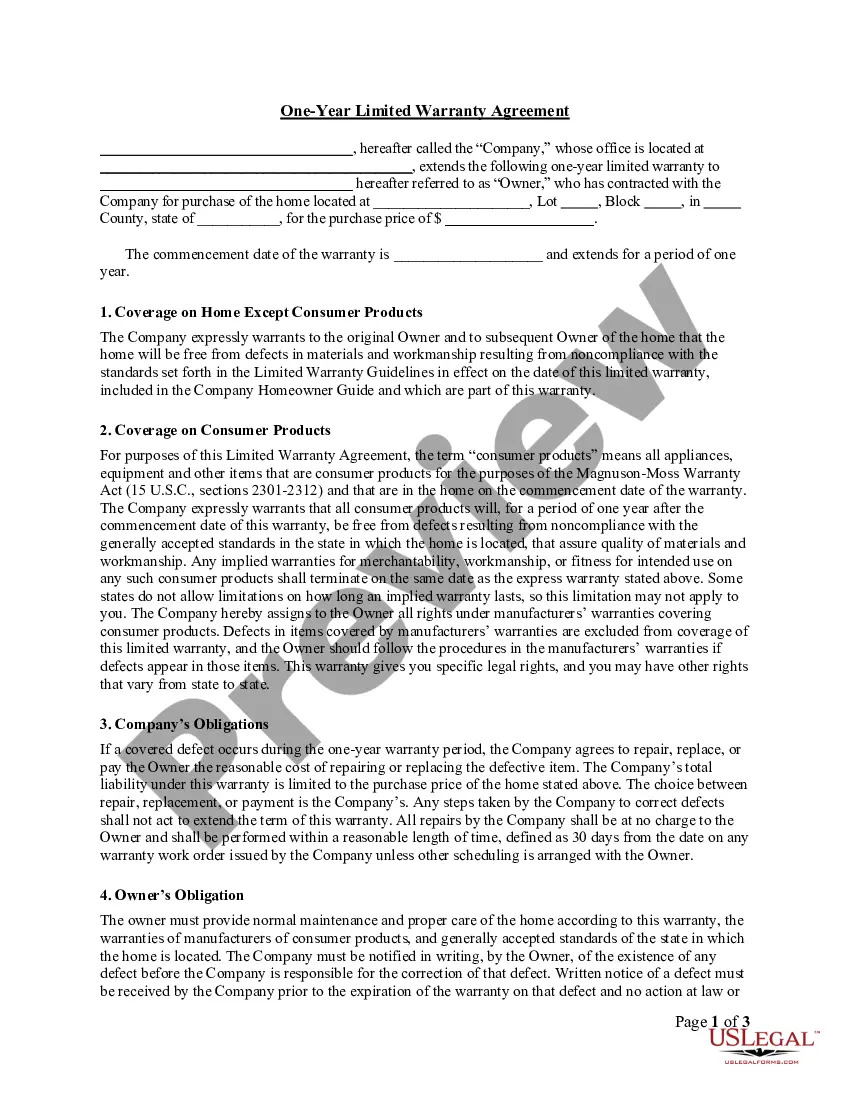

Description

How to fill out Santa Clara California Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Santa Clara Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Santa Clara Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Santa Clara Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Santa Clara Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!