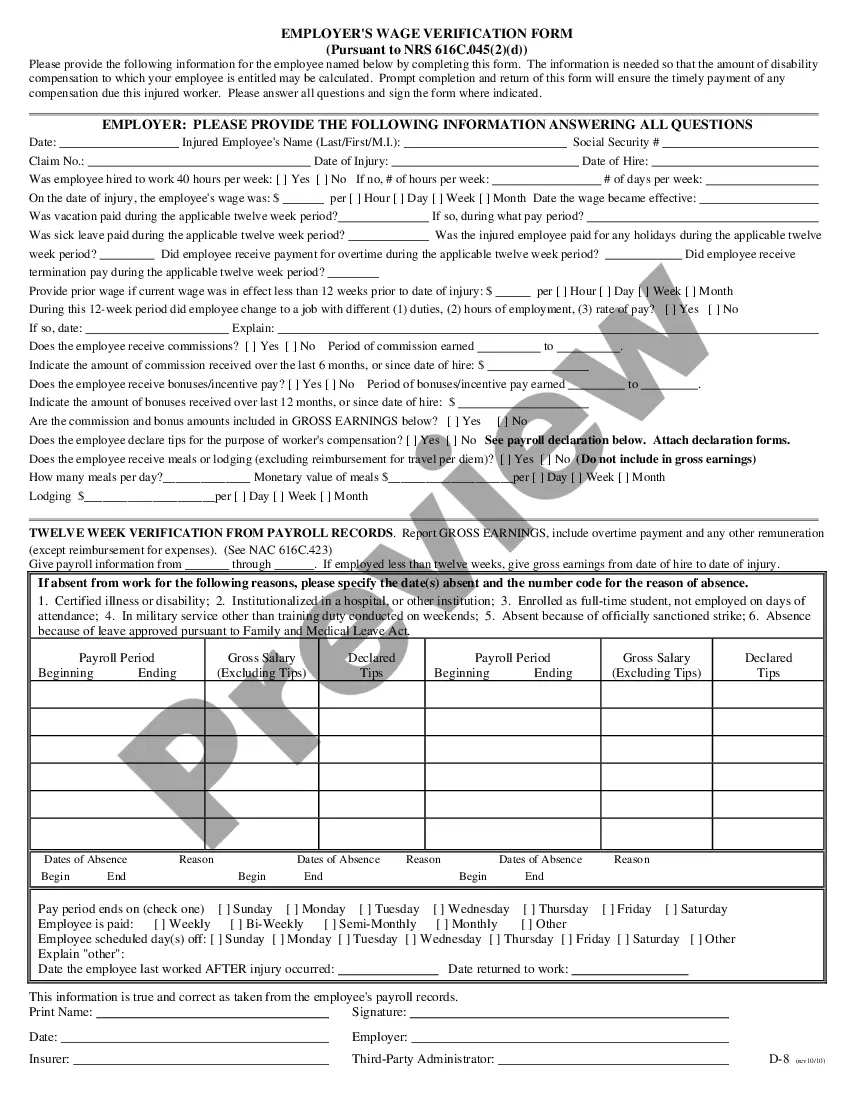

Houston, Texas Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 refers to a legal document that outlines the various unsecured priority claims held by creditors in Houston, Texas, following the year 2005. This form is commonly used in bankruptcy cases to identify and categorize the debts owed to creditors. Unsecured priority claims are debts that hold a higher priority in the repayment hierarchy compared to other types of debts. These claims are typically related to certain obligations that cannot be discharged or easily repaid in bankruptcy proceedings. The Schedule E — Form 6E is specifically designed to provide a comprehensive list of these claims, helping both the debtor and the court track and manage the obligations. Types of Houston, Texas Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 can be categorized as follows: 1. Tax Claims: These are claims related to unpaid federal, state, or local taxes owed by the debtor. They include income taxes, property taxes, sales taxes, and other tax obligations that have not been fulfilled. 2. Domestic Support Claims: This category includes claims arising from alimony, child support, or other obligations related to family law matters. These claims hold a high priority as they provide financial support to dependents. 3. Employee Wage and Benefit Claims: Claims arising from unpaid wages, commission, vacation pay, and employee benefit contributions fall under this category. Unpaid pension and retirement plan contributions may also be included. 4. Claims for Contributions to Employee Benefit Plans: These claims pertain to unpaid contributions the debtor owes to employee benefit plans, such as health insurance, retirement plans, or other employee welfare plans. 5. Claims for Grain Producers' Unpaid Storage or Deposit: If the debtor is involved in the grain producing industry and has unpaid storage or deposit obligations, these claims may be included under this category. These are just a few examples of the types of unsecured priority claims that may be listed on Schedule E — Form 6E in Houston, Texas bankruptcy cases post-2005. It's important to note that this list is not exhaustive, and different cases may have additional or unique types of claims depending on the specific circumstances.

Houston Texas Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

How to fill out Houston Texas Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Houston Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Houston Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 from the My Forms tab.

For new users, it's necessary to make several more steps to get the Houston Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005:

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!