Suffolk New York Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005: A Comprehensive Overview Suffolk County, located in the state of New York, has a legal process to address creditors who hold unsecured priority claims. These claims can arise in various circumstances, such as bankruptcy cases or financial disputes. Understanding the intricacies of Suffolk County Creditors Holding Unsecured Priority Claims is essential to navigate legal proceedings efficiently. Keywords: Suffolk New York, Creditors Holding Unsecured Priority Claims, Schedule E, Form 6E, post-2005, bankruptcy, legal process, unsecured claims, priority claims, financial disputes. Types of Suffolk New York Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005: 1. Bankruptcy Cases: Creditors that have filed claims against individuals or businesses who have filed for bankruptcy can be part of Suffolk County's unsecured priority claims. These claims may encompass unpaid wages, spousal/child support, tax debts, or claims arising from personal injury or death. 2. Foreclosure Proceedings: In cases where a property owner defaults on their mortgage payments, creditors holding unsecured priority claims could include parties seeking unpaid property taxes, utility bills, or liens on the property. These claims must be filed through Suffolk County's Schedule E — Form 6E for appropriate consideration. 3. Contractual Disputes: Suffolk County's unsecured priority claims can also involve disputes arising from breach of contract, nonpayment of goods or services, or unpaid loans. Creditors pursuing these claims must adhere to the guidelines provided by Schedule E — Form 6E for accurate documentation and evaluation. 4. Government Obligations: Creditors who have unpaid claims against government entities (local, state, or federal) can be categorized under Suffolk County's unsecured priority claims. These claims can include unpaid taxes, fines, or penalties owed to government agencies that are deemed a priority. 5. Divorce and Child Support Claims: Within Suffolk County's unsecured priority claims, creditors can include former spouses seeking unpaid alimony or child support payments. These claims are considered a priority to ensure the financial well-being of the affected family members. It's important to note that Suffolk County refers to Schedule E — Form 6E for post-2005 claims, which details the specific information and requirements creditors must provide when filing their unsecured priority claims. Adhering to this form helps streamline the legal process and ensures that all relevant information is considered during claim evaluation. In conclusion, Suffolk New York Creditors Holding Unsecured Priority Claims — Schedule — - Form 6E - Post 2005 encompasses various types of claims, including those related to bankruptcy, foreclosure proceedings, contractual disputes, government obligations, divorce, and child support. Understanding the specific requirements outlined in Schedule E — Form 6E is crucial for creditors seeking fair consideration of their claims within Suffolk County's legal framework.

Suffolk New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

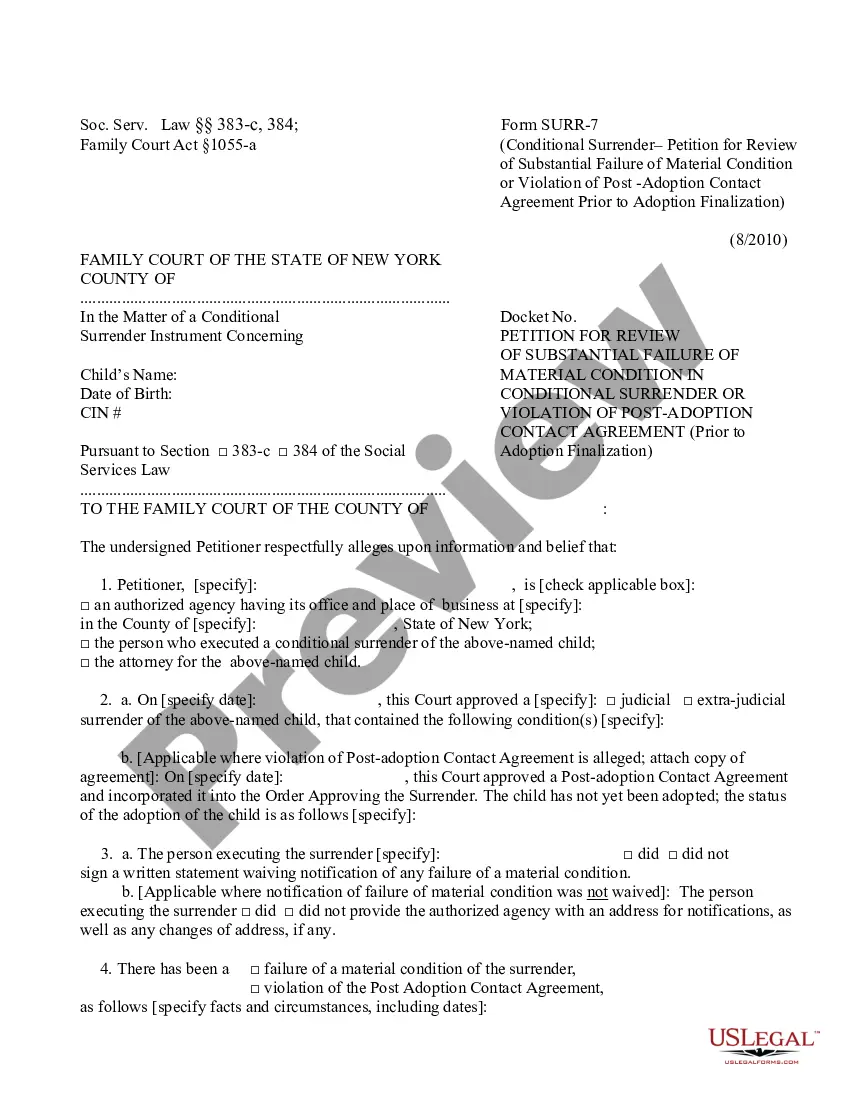

Description

How to fill out Suffolk New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

If you need to get a reliable legal document provider to get the Suffolk Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it simple to get and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Suffolk Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Suffolk Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Suffolk Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 - all from the comfort of your sofa.

Sign up for US Legal Forms now!