Chicago Illinois Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

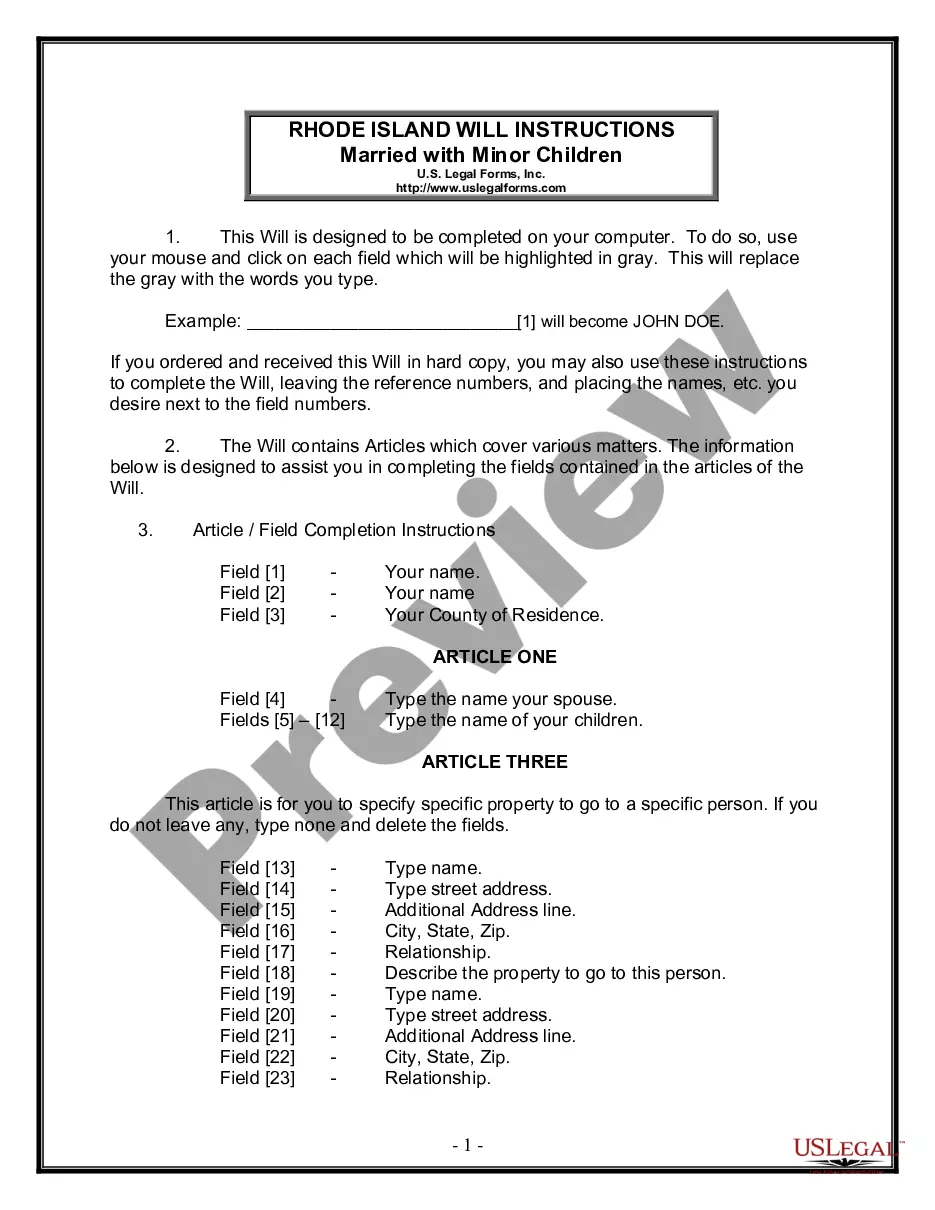

How to fill out Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Whether you intend to establish your business, engage in a contract, request an ID update, or address family-related legal issues, you must gather specific paperwork in accordance with your local laws and regulations.

Locating the appropriate documents may demand considerable time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally crafted and reviewed legal forms for any personal or commercial situation. All files are organized by state and area of use, making it quick and straightforward to select a document like Chicago Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005.

Documents available on our site are reusable. With an active subscription, you can access all of your previously purchased documents whenever needed from the My documents section of your account. Stop wasting time searching for updated official forms. Join the US Legal Forms platform and maintain your paperwork organized with the most extensive online collection of forms!

- Ensure the template meets your specific requirements and complies with state legal standards.

- Browse the form description and review the Preview if one is available on the page.

- Use the search box at the top to find another template specific to your state.

- Click Buy Now to purchase the document once you identify the suitable one.

- Select the subscription plan that best fits your needs to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Chicago Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 in your required file format.

- Print the document or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

Non-priority unsecured claims refer to debts that are not backed by collateral and do not have special legal protections when bankruptcy is filed. Creditors with Chicago Illinois Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 may receive payment only if there are remaining funds after paying higher priority claims. These claims can include personal loans, credit card debts, and medical bills. It is essential for debtors and creditors to understand this classification when navigating the bankruptcy process.

Yes, creditors can attempt to collect unsecured debt, but their methods depend on the laws and regulations in their jurisdiction. In cases involving Chicago Illinois Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, creditors typically pursue collections through communication and legal channels, as there is no collateral backing the debt. Understanding the collection process is important for both creditors and debtors to ensure fair treatment.

Nonpriority unsecured claims in Chapter 13 bankruptcy are those debts which do not have a priority status according to bankruptcy laws. During the repayment plan, these creditors will likely receive a portion of what is owed over a specified period. For individuals managing Chicago Illinois Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, understanding this process can provide clarity and aid in the efficient handling of financial recovery.

priority unsecured claim is a debt that does not gain special treatment in bankruptcy proceedings. These claims typically arise from personal loans or credit card debt and do not require collateral for security. For those examining Chicago Illinois Creditors Holding Unsecured Nonpriority Claims Schedule F Form 6F Post 2005, these claims may be eliminated during bankruptcy, allowing a fresh start.

Creditors that provide loans or credit without securing their repayment with collateral typically hold unsecured claims. This includes personal loans, credit cards, medical bills, and certain utility bills. In the context of Chicago Illinois Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, these creditors do not have legal rights to specific property in case of non-payment.

Typically, you have until the claims bar date to file a proof of claim, which is often set within a specified period after the bankruptcy filing. This deadline is crucial for you as a creditor because, after this date, claims may be disallowed. For Chicago Illinois creditors holding unsecured nonpriority claims, it is essential to stay informed about these dates to ensure your voice is heard in the bankruptcy proceedings.

The rights of an unsecured creditor include the ability to file a proof of claim and participate in any distributions from the bankruptcy estate if they act within the required time frames. Chicago Illinois creditors holding unsecured nonpriority claims have the right to object to claims filed by other creditors and advocate for their interests during the bankruptcy process. Educating yourself about your rights is essential to ensure fair treatment and maximize potential recoveries.

If an unsecured creditor does not file a proof of claim, they may lose their right to receive any repayment through the bankruptcy process. This is particularly important for Chicago Illinois creditors holding unsecured nonpriority claims, as failing to act can result in total loss of recovery. Therefore, it is vital to understand the filing requirements and deadlines to protect your financial interests.

If a creditor does not file proof of claim, they may not be entitled to any distribution in the bankruptcy case. This means Chicago Illinois creditors holding unsecured nonpriority claims will be ignored when it comes to debt repayment. However, creditors can still object to the treatment of their claims after the deadline, but they must act quickly and follow the procedures set by the court.