Harris Texas Creditors Holding Unsecured Nonpriority Claims — Schedule — - Form 6F - Post 2005 is a legal document used in bankruptcy cases to identify and classify creditors who are owed nonpriority debts that are not backed by collateral. This form is specific to cases filed after 2005 and is crucial in the bankruptcy process. The Schedule F — Form 6F provides detailed information about the creditors holding unsecured nonpriority claims in Harris County, Texas. It helps the bankruptcy court establish a comprehensive overview of all outstanding debts and allows them to prioritize the allocation of available assets to pay off creditors. Some relevant keywords associated with Harris Texas Creditors Holding Unsecured Nonpriority Claims — Schedule — - Form 6F - Post 2005 are: 1. Bankruptcy: This form is part of the bankruptcy filing process and is utilized to address and settle outstanding debts during bankruptcy proceedings. 2. Unsecured claims: These are debts or obligations that do not have any collateral or property securing them, making them riskier for creditors. 3. Creditors: These are individuals or entities to whom debts are owed. Creditors holding unsecured nonpriority claims are referenced in this document. 4. Nonpriority claims: Nonpriority claims are debts that are not given priority for repayment in bankruptcy proceedings. They are often discharged or settled after higher priority debts have been satisfied. 5. Harris County, Texas: This refers to the specific jurisdiction in which the bankruptcy case is filed. Harris County is one of the most populous counties in Texas. It is important to note that while the overall purpose of Harris Texas Creditors Holding Unsecured Nonpriority Claims — Schedule — - Form 6F - Post 2005 remains the same, there may be variations in format or additional requirements based on specific bankruptcy cases within Harris County. However, the underlying objective is always to accurately represent and allocate debts in accordance with bankruptcy laws and procedures.

Harris Texas Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

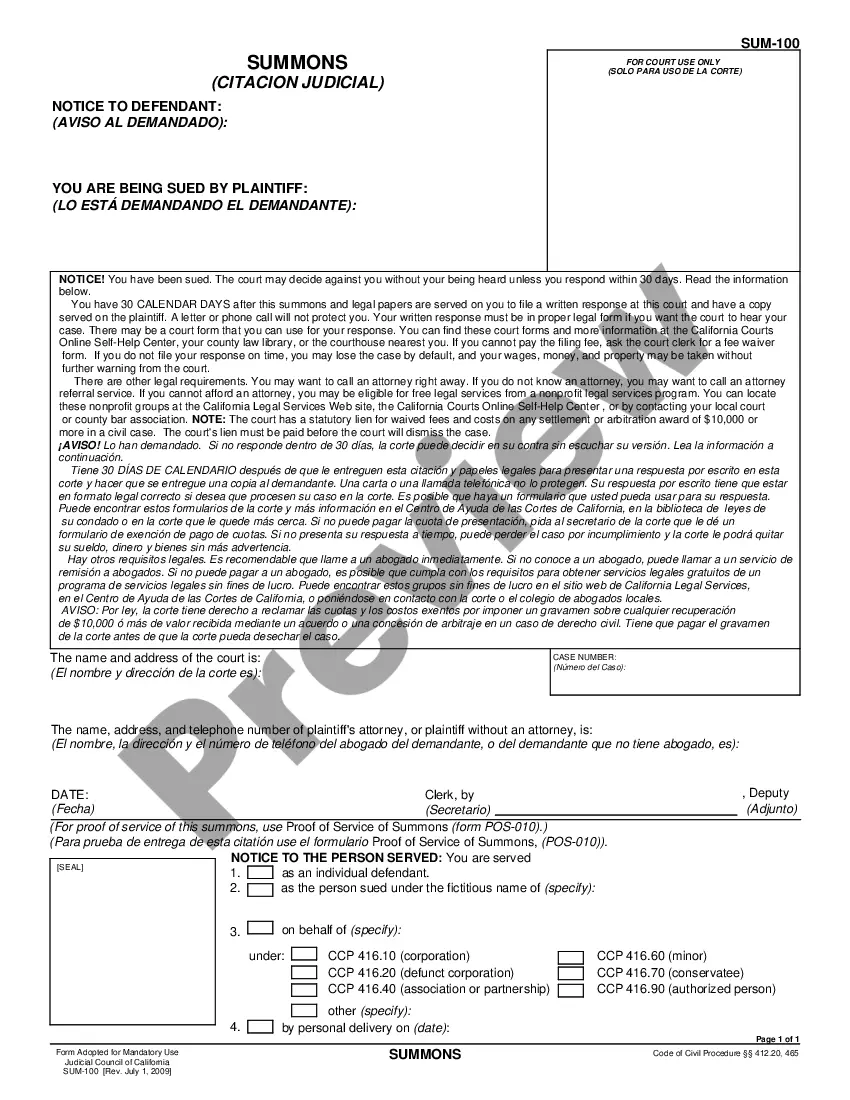

How to fill out Harris Texas Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Drafting documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Harris Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Harris Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Harris Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

The schedules are a portion of the paperwork that's required to file for bankruptcy relief. They're actually a series of documents that every debtor (the person filing the bankruptcy case) prepares and submits to the bankruptcy court.

A list of creditors that hold secured claims, meaning they have an interest in the property. The list includes the creditor's name, address, amount of the debt, and date of when the debt was incurred.

Most Unsecured Debts Are Nonpriority If a debt isn't entitled to priority treatment, it's general, nonpriority unsecured debt. The bankruptcy trustee won't pay anything to creditors unless money remains after all higher priority debts and obligations get paid.

If you're filing for Chapter 13 bankruptcy, the trustee will look for expenses that appear too high. The court will use Schedule J to make sure you have enough money to make your monthly Chapter 13 plan payments.

Some debts are called priority debts because if you do not pay them you could face serious consequences. Priority debts should always be dealt with BEFORE your non-priority debts. Priority debts include: mortgage repayments and loans secured on your home.

This chapter of the Bankruptcy Code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

SCHEDULED CLAIM. A claim scheduled by the debtor in its Schedules of Assets and Liabilities. SCHEDULES OF ASSETS AND LIABILITIES. Schedules a debtor must file with the Bankruptcy Court setting forth its assets and liabilities as of the petition date. SECURED CLAIM.

Priority creditors get paid before other creditors in bankruptcy. The following are some of the most common types of priority claims: alimony. child support. certain tax obligations, and.

On Schedule E/F, you'll list all of your debts that aren't secured by property. In other words, all debts that you didn't already list on Schedule D: Creditors Who Have Claims Secured by Property. You'll list your priority unsecured debts first, followed by your nonpriority, unsecured debts.

General unsecured claims are claims that are not secured by collateral and do not have priority: Examples include credit card debts, student loans, medical bills, and the unsecured portion of an under-secured creditor's claim.

Interesting Questions

More info

Our lawyers are highly trained and skilled to manage this type of transaction. Please send any questions you have about our services or the laws described above to: Melody Chatterley-Rouse Corporate Services Manager AICPA c. 2319 E. 56th St.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.