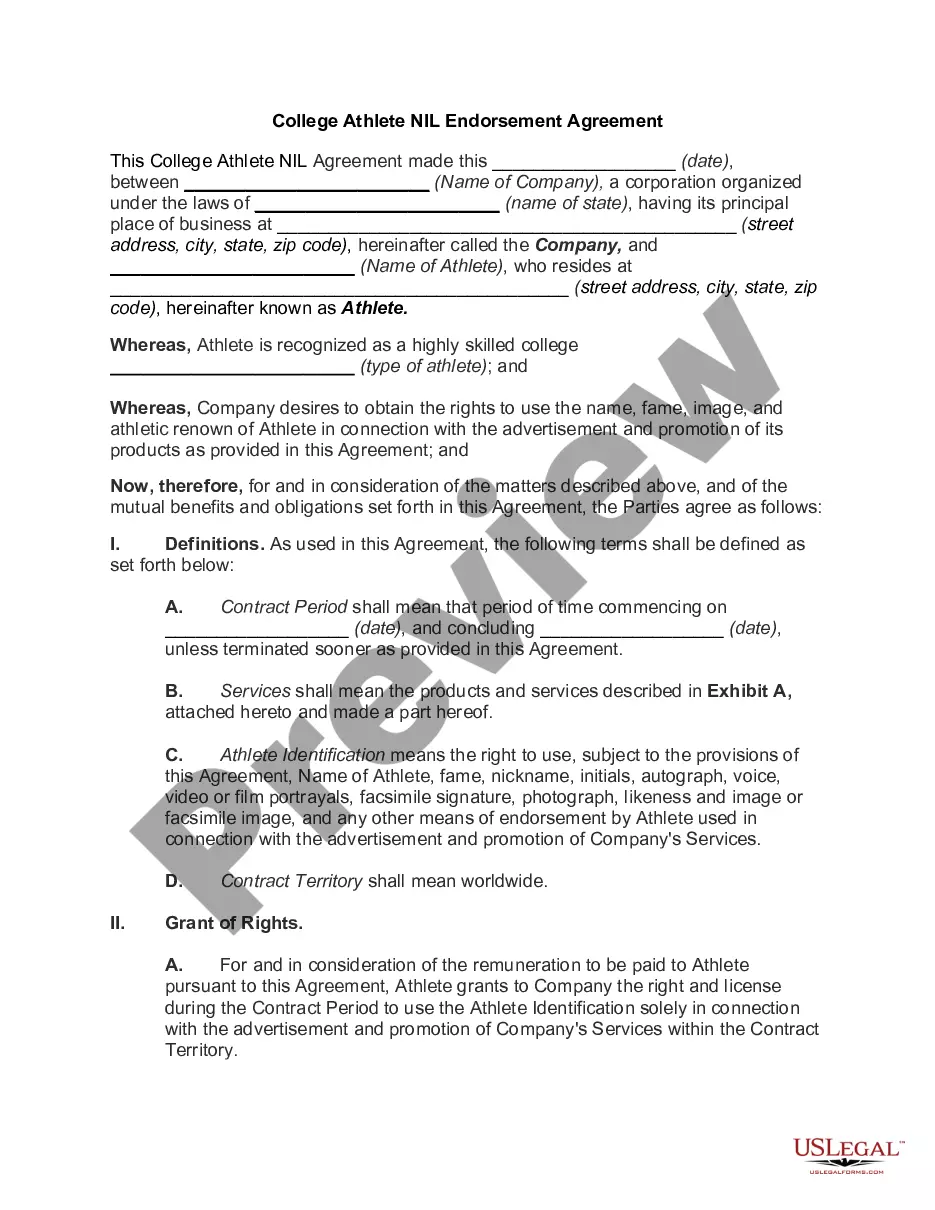

Harris Texas Co-Debtors — Schedule — - Form 6H - Post 2005 is a legal document that is required to be filed in bankruptcy cases in the state of Texas. It specifically addresses co-debtors and their financial obligations in the bankruptcy process. The purpose of this form is to provide a comprehensive list of all co-debtors involved in the bankruptcy case, including their contact information, relationship to the debtor, and details about their financial responsibilities. It serves as a crucial tool for the bankruptcy court to assess the overall financial situation and obligations of the debtor and their co-debtors. It's important to note that different types of co-debtors may exist in a bankruptcy case, and the Harris Texas Co-Debtors — Schedule — - Form 6H - Post 2005 caters to various types of co-debtors. Some different types of co-debtors that may be listed on this form include: 1. Spouse or Domestic Partner Co-Debtors: In cases where the debtor is married or in a domestic partnership, this form requires the disclosure of the spouse or domestic partner's financial information. This includes details about their income, assets, liabilities, and any joint debts they may have. 2. Business Co-Debtors: If the debtor owns a business and has other individuals or entities who are financially tied to the business, this form requires the disclosure of the co-debtors' information. This includes their role in the business, ownership percentage, and any personal guarantees or obligations related to the business's debts. 3. Co-Signed Debts Co-Debtors: This form also addresses co-debtors who have co-signed on loans or debts with the debtor. These co-debtors are typically individuals who share a financial liability for the debt but may not be directly involved in the bankruptcy case themselves. 4. Guarantor Co-Debtors: In certain situations, individuals or entities may have acted as guarantors for the debtor, meaning they have agreed to be responsible for the debt if the debtor defaults. This form requires the listing of these guarantor co-debtors and their respective obligations. By filing the Harris Texas Co-Debtors — Schedule — - Form 6H - Post 2005 accurately and thoroughly, debtors can provide the necessary information about their co-debtors and assist the bankruptcy court in determining the extent of their financial responsibilities. The form ensures transparency and accountability during the bankruptcy process, allowing all parties involved to understand the overall financial picture.

Harris Texas Co-Debtors - Schedule H - Form 6H - Post 2005

Description

How to fill out Harris Texas Co-Debtors - Schedule H - Form 6H - Post 2005?

If you need to get a trustworthy legal document provider to get the Harris Co-Debtors - Schedule H - Form 6H - Post 2005, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to search or browse Harris Co-Debtors - Schedule H - Form 6H - Post 2005, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Harris Co-Debtors - Schedule H - Form 6H - Post 2005 template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less costly and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or execute the Harris Co-Debtors - Schedule H - Form 6H - Post 2005 - all from the comfort of your home.

Join US Legal Forms now!