Maricopa Arizona Co-Debtors — Schedule — - Form 6H - Post 2005 is a provision related to bankruptcy cases filed in Maricopa County, Arizona, after 2005. This specific form is used to provide detailed information about co-debtors in bankruptcy cases. In a bankruptcy case, a co-debtor is someone who is jointly responsible for the debt with the primary debtor or is liable for the debt in case of default. In Maricopa County, this form is essential for listing all co-debtors involved in the case. Form 6H, or Schedule H, is a section of the bankruptcy petition that primarily focuses on co-debtors. It requires the filer to disclose the identities of co-debtors, provide their relationship to the primary debtor, and furnish information about any court judgments or bankruptcy filings against the co-debtors. Post-2005 indicates that this provision is applicable to bankruptcy cases filed after 2005, suggesting that there might be some variations in the requirements or information needed to be compared to pre-2005 filings. Types of Maricopa Arizona Co-Debtors — Schedule — - Form 6H - Post 2005: 1. Individual Co-Debtors: These are individuals who have cosigned loans or debts with the primary debtor. This can include family members, friends, or business partners who may also share responsibility for the debt. 2. Joint Co-Debtors: In some cases, debts may be jointly acquired by multiple individuals, such as spouses who jointly apply for a loan or own an asset together. Joint co-debtors are equally responsible for the debt. 3. Corporate Co-Debtors: In certain bankruptcy cases, corporations or business entities may be listed as co-debtors. This typically happens when the primary debtor is a business and there are shareholders or partners liable for the debt. It's crucial to accurately complete Maricopa Arizona Co-Debtors — Schedule — - Form 6H - Post 2005 to comply with bankruptcy regulations and ensure all relevant co-debtors are properly accounted for. This form helps the court assess the full extent of indebtedness and may impact the discharge or repayment plans in the bankruptcy case.

Maricopa Arizona Co-Debtors - Schedule H - Form 6H - Post 2005

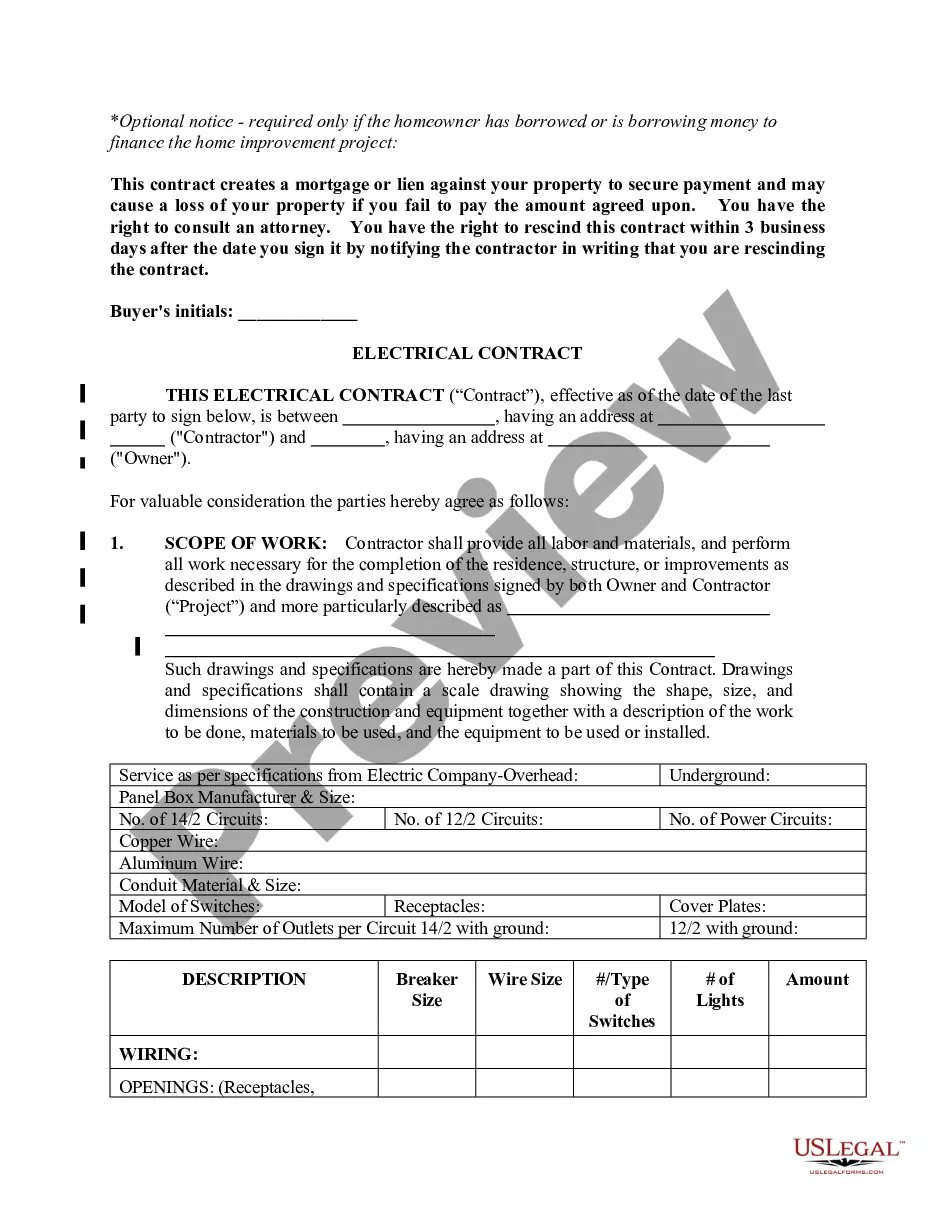

Description

How to fill out Maricopa Arizona Co-Debtors - Schedule H - Form 6H - Post 2005?

Drafting papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Maricopa Co-Debtors - Schedule H - Form 6H - Post 2005 without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Maricopa Co-Debtors - Schedule H - Form 6H - Post 2005 on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Maricopa Co-Debtors - Schedule H - Form 6H - Post 2005:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!