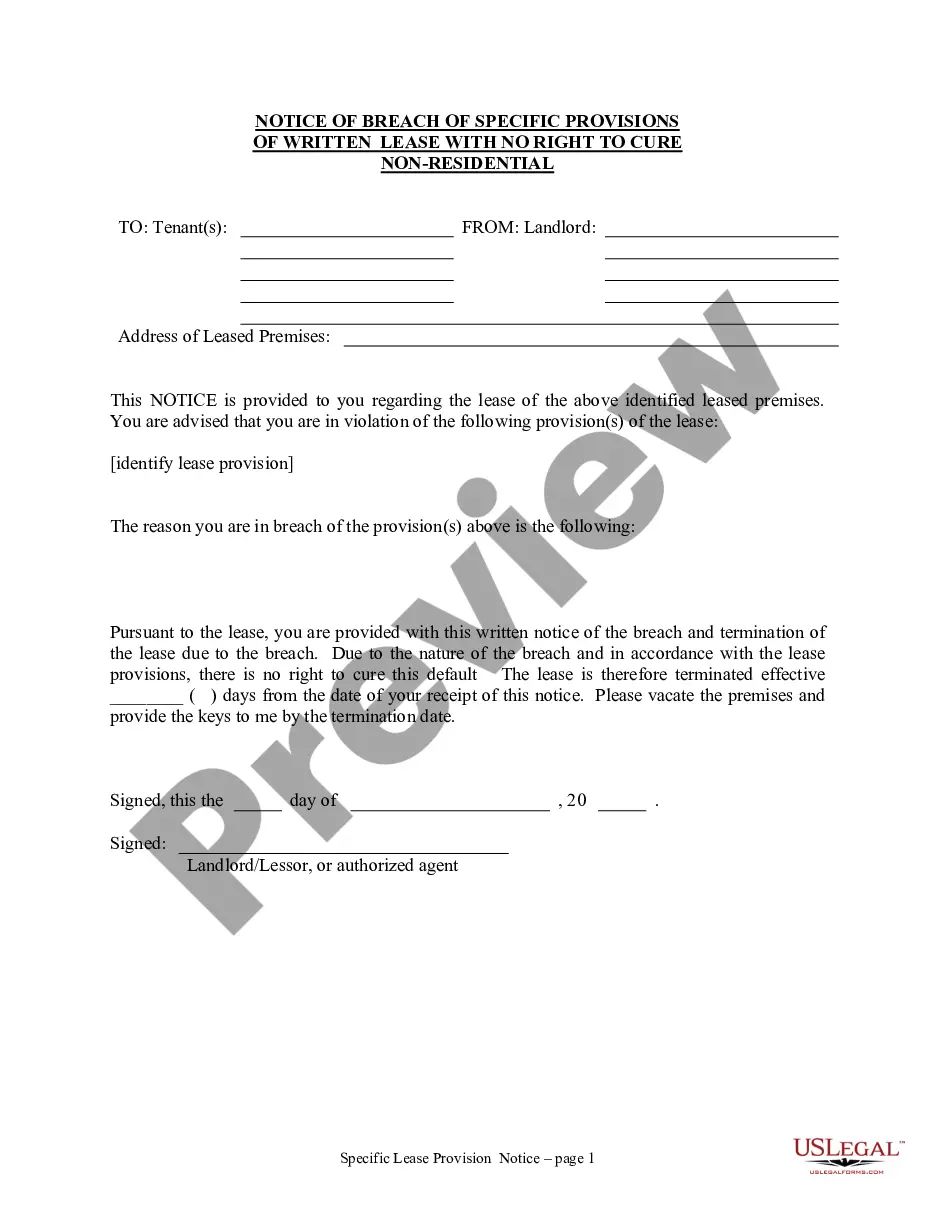

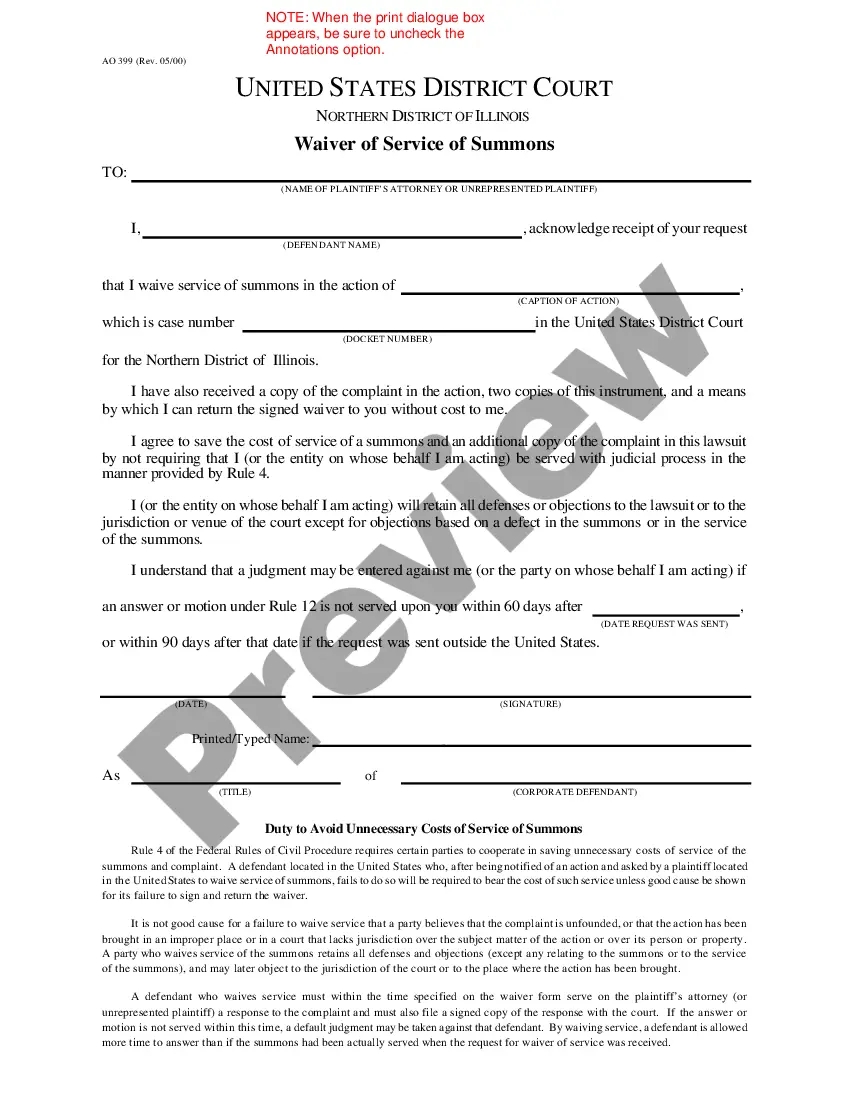

Allegheny Pennsylvania Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 is a legal document that provides a detailed overview of the income information of individual debtors in Allegheny County, Pennsylvania. This form is typically used post-2005, indicating its relevance in the modern era. — Individual Debtor's Current Income: This section of the form presents a comprehensive breakdown of the debtor's current income sources. It includes their wages, salary, self-employment income, rental income, dividends, and any other applicable income streams. — Spouse's Current Income: In case the debtor has a spouse or partner, this section records their current income sources. It accounts for wages, salary, self-employment income, rental earnings, dividends, and other income, providing a clear picture of the overall household income. — Contributions to Household Expenses: This part requires the debtor to outline the monthly expenses contributed towards the household. It covers mortgage or rent payments, utilities, groceries, transportation costs, healthcare expenses, and any other regular contributions to support the household. — Health Insurance Premiums: Debtors are also required to disclose the amount they pay for health insurance premiums. This section enables a thorough understanding of the individual's financial commitments concerning healthcare coverage. — Domestic Support Obligations: If the debtor has any domestic support obligations like child or spousal support, this section is used to record the monthly payments or contributions made. The form ensures that these obligations are taken into account during the bankruptcy proceedings. — Taxes: This section accounts for the debtor's federal, state, and local taxes paid during the previous year. It is crucial to determine the debtor's overall financial situation and obligations. — Payments to Secured Creditors: If the debtor has any secured debts, such as a mortgage or car loan, this section prompts them to provide the monthly sum paid to satisfy these obligations. — Other Payments: Here, debtors disclose any other regular monthly payments not covered in the previous sections. This can include payments towards student loans, credit card debts, personal loans, or other similar obligations. — Net Monthly Income: At the end of the form, the debtor calculates their net monthly income by subtracting the total monthly expenses and obligations from the total monthly income. This figure represents the residual income available after meeting financial obligations. Allegheny Pennsylvania Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 is an essential document for bankruptcy proceedings, ensuring that the court and involved parties have a comprehensive understanding of the debtor's income, expenses, and financial obligations.

Allegheny Pennsylvania Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005

Description

How to fill out Allegheny Pennsylvania Current Income Of Individual Debtors - Schedule I - Form 6I - Post 2005?

Draftwing paperwork, like Allegheny Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005, to take care of your legal affairs is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for a variety of scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Allegheny Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Allegheny Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005:

- Ensure that your form is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Allegheny Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!