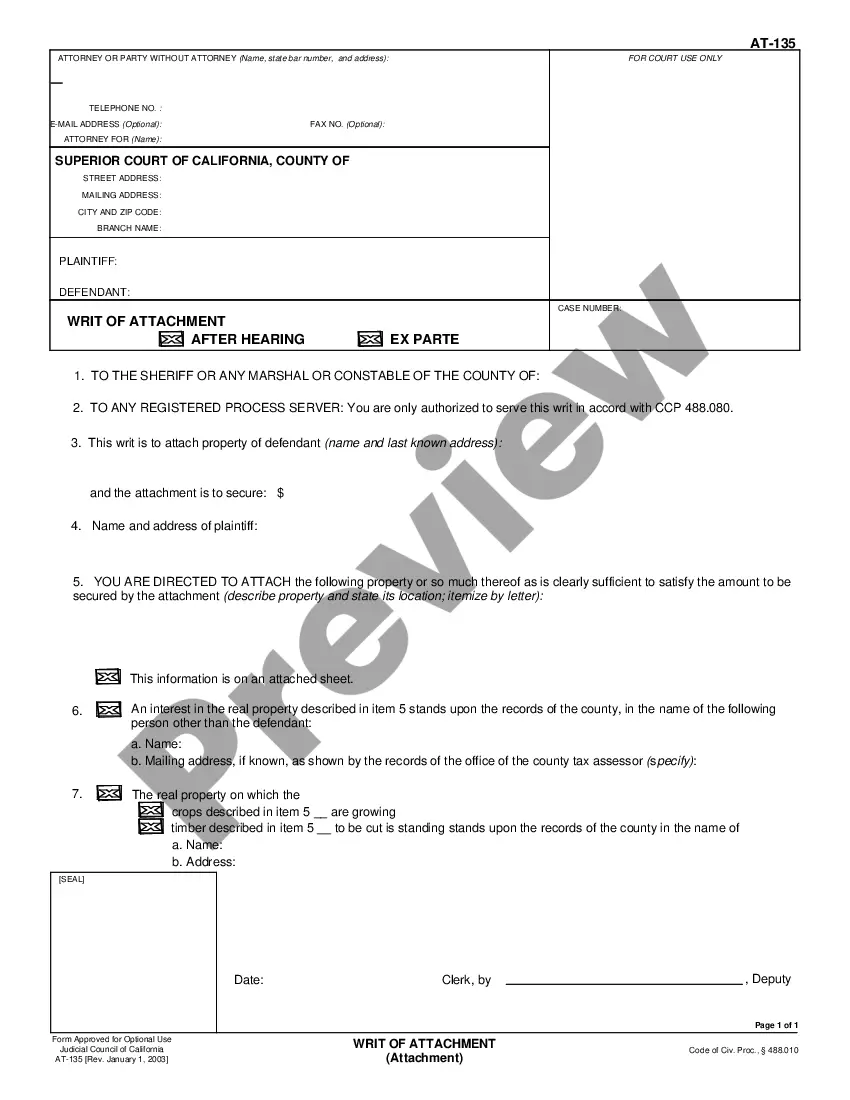

Hennepin County, located in Minnesota, utilizes a specific form called "Schedule I — Form 6— - Post 2005" to assess the current income of individual debtors. This document plays a vital role in understanding an individual's financial situation during bankruptcy proceedings. By completing this form, debtors disclose their income, including various sources of earnings and the amount received from each. It provides a comprehensive overview of an individual's income streams, enabling creditors and bankruptcy trustees to gain insights into their financial standing. The Schedule I — Form 6— - Post 2005 for Hennepin County includes several sections where debtors must provide detailed information about their income sources. These sections may include, but are not limited to: 1. Employment Income: Debtors are required to list all employment-related earnings, including wages, salaries, bonuses, and commissions. The form may inquire about the frequency of pay (weekly, bi-weekly, monthly, etc.) and specific details about the debtor's employer. 2. Business Income: If the individual operates a business, the form will ask for information regarding the self-employment income generated. This may involve income derived from sole proprietorship, partnerships, or any other type of self-owned business venture. 3. Rental and Real Estate Income: If the debtor owns any rental properties or generates income from real estate investments, they must disclose the details in this section. The form will inquire about the source, amount, and frequency of rental income received. 4. Interest, Dividends, and Investments: This section aims to capture income attributed to interest earned from bank accounts, stocks, bonds, or any other type of investment. Debtors will need to provide information about the source of income and the amount received. 5. Pension and Retirement Income: Debtors receiving income from pension plans, retirement accounts, or annuities are required to disclose these details. This information assists in understanding the individual's financial resources and their ability to repay debts. 6. Other Income Sources: In this section, debtors can specify any additional sources of income not covered by the previous categories. This may include alimony, child support, disability benefits, Social Security income, or any other form of regular income. By completing all sections of Schedule I — Form 6— - Post 2005, debtors provide a comprehensive overview of their current income to facilitate the bankruptcy process. Accurate and thorough disclosure is essential to ensure fairness and transparency in debt resolution proceedings. Note: It should be mentioned that the specific sections and requirements of Hennepin County's Schedule I — Form 6— - Post 2005 may vary slightly depending on updates or changes to the form over time.

Hennepin Minnesota Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005

Description

How to fill out Hennepin Minnesota Current Income Of Individual Debtors - Schedule I - Form 6I - Post 2005?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Hennepin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Hennepin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Hennepin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005:

- Ensure you have opened the right page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Hennepin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!