Lima, Arizona is a town located in Pima County, Arizona, United States. It is a small community with a population of approximately [number] residents. When it comes to bankruptcy, Lima, Arizona follows the federal guidelines set forth by the U.S. Bankruptcy Court. One important aspect of bankruptcy filings is the form called "Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005." This particular form is used to provide a detailed overview of an individual's current income and monthly expenses. In Lima, Arizona, this form is an essential part of the bankruptcy process as it helps the court determine the debtor's ability to repay their debts. By accurately documenting their income and expenses, debtors must provide a transparent picture of their financial situation. The Lima, Arizona Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 consists of various sections, each requiring specific information. Some key components of this form include: 1. Personal Information: The debtor must provide their name, address, social security number, and other identifying details. 2. Monthly Income Details: Debtors are required to disclose all sources of income, including employment wages, self-employment earnings, rental income, retirement benefits, and any other form of regular income. Supporting documents such as pay stubs or profit and loss statements may be required. 3. Deductions from Income: This section allows debtors to list necessary monthly expenses, such as rent or mortgage payments, utilities, car payments, insurance premiums, childcare costs, and healthcare expenses. Debtors are also required to list any monthly obligations such as alimony or child support payments. 4. Total Surplus Income: Debtors must calculate their total income, subtract their allowed expenses, and determine if there is any surplus income that could be used to repay creditors. 5. Certification and Signature: At the end of the form, debtors must sign and certify that all the information provided is accurate to the best of their knowledge. It is important to note that while this form is standard across the United States, specific local rules and procedures may apply in Lima, Arizona. It is essential for individuals considering bankruptcy in Lima, Arizona to consult with a qualified bankruptcy attorney to ensure compliance with all regulations and requirements. Different types of Lima, Arizona Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 may include specific variations for different bankruptcy chapters, such as Chapter 7 or Chapter 13. Additionally, there may be adaptations based on local court practices or specific requirements set by the U.S. Bankruptcy Court in Arizona.

Pima Arizona Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005

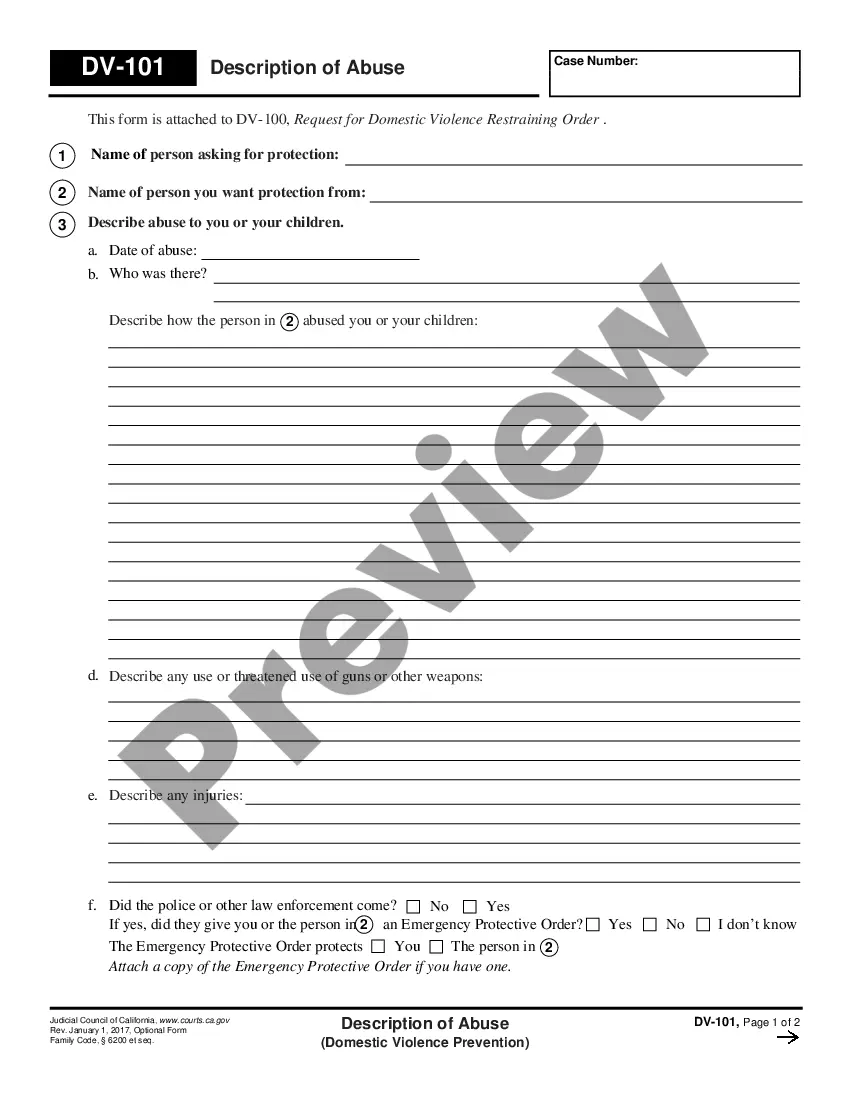

Description

How to fill out Pima Arizona Current Income Of Individual Debtors - Schedule I - Form 6I - Post 2005?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Pima Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Pima Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!