Los Angeles California Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 is a crucial aspect of bankruptcy filings in the city of Los Angeles, California. This form is used by individual debtors to disclose their monthly expenses and necessary expenditures to the bankruptcy court. It provides a detailed breakdown of their budget and helps determine their ability to repay debts or qualify for a particular bankruptcy chapter. There are various types of Los Angeles California Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005, including: 1. Housing Expenses: This category includes monthly payments for rent or mortgage, property taxes, homeowners or renters insurance, utilities (water, gas, electricity), and maintenance fees. 2. Vehicle Expenses: Here, debtors disclose their car loan or lease payments, insurance costs, fuel, maintenance, and registration fees. 3. Food and Groceries: Debtors provide information on their monthly expenditures related to groceries, dining out, and essential household supplies. 4. Personal Care: This category covers expenses such as toiletries, haircuts, grooming, and other personal hygiene items. 5. Health Care: Debtors list their health insurance premiums, prescription drugs, doctor visits, dentist appointments, and other medical expenses. 6. Childcare and Education: This section includes expenses for daycare, school tuition, uniforms, textbooks, and extracurricular activities for the debtor's children. 7. Utility Expenses: Debtors outline their monthly costs for internet services, cable or satellite TV, phone bills, and cell phone plans. 8. Insurance: This category pertains to premiums for life insurance, disability insurance, or any other insurance policy held by the debtor. 9. Taxes and Other Deductions: Debtors disclose any tax withholding, as well as any court-ordered deductions or other legal obligations. 10. Other Necessary Expenses: This section allows debtors to list any additional necessary expenses not covered in the above categories, such as expenses related to legal obligations, transportation, public transportation fares, or domestic support obligations. By providing a comprehensive breakdown of their expenses, debtors can demonstrate to the bankruptcy court their capability to meet essential needs while seeking financial relief. Los Angeles California Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 is a tool that helps ensure transparency and fairness in bankruptcy proceedings, enabling debtors to manage their finances more effectively during challenging times.

Los Angeles California Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Los Angeles California Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Los Angeles Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Los Angeles Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Los Angeles Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005:

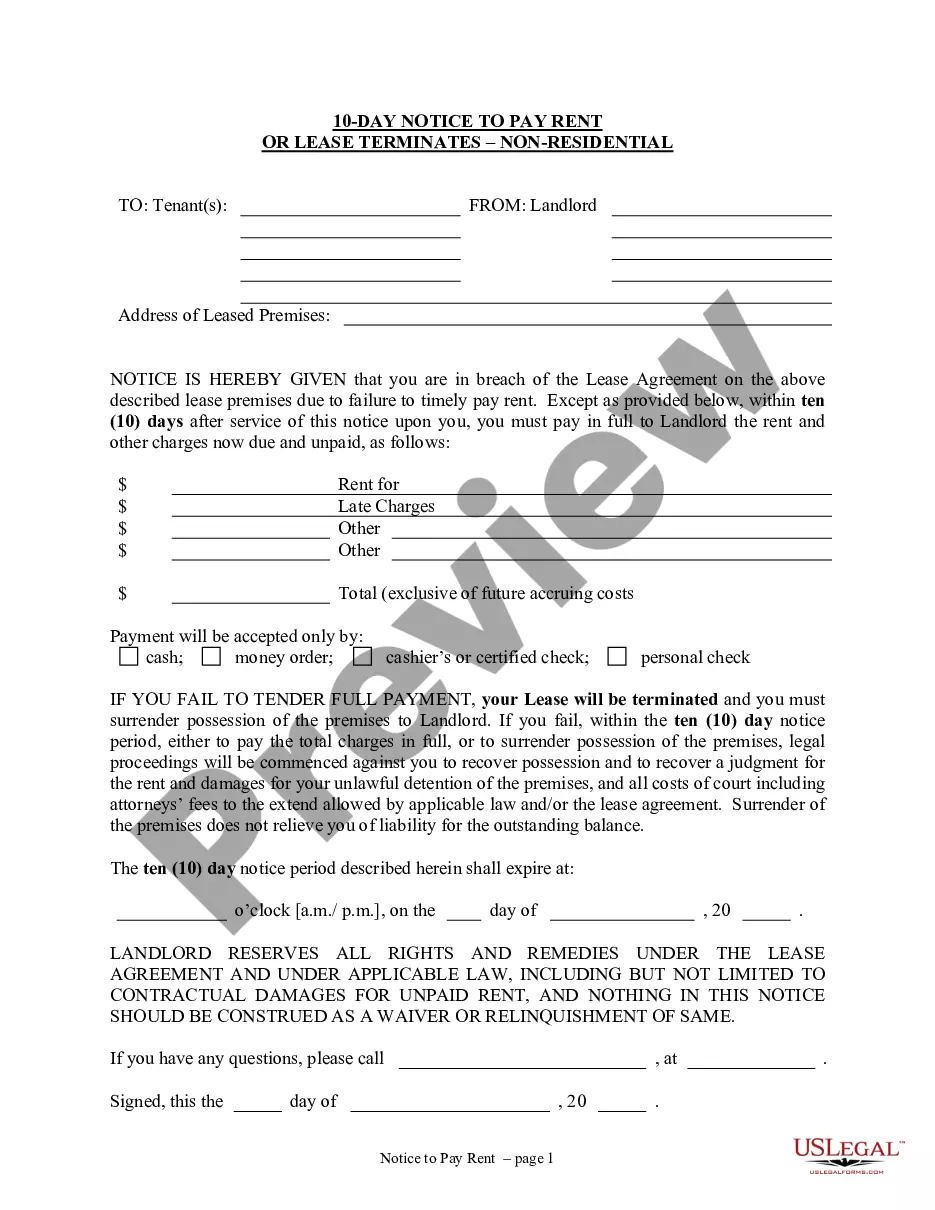

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!