Santa Clara, California is a vibrant city located in the heart of Silicon Valley. It is known for its high-tech industry, world-renowned companies, and bustling economy. In a state where personal debt can be a significant concern, Santa Clara residents have the option to file for bankruptcy protection under Chapter 7 or Chapter 13 of the United States Bankruptcy Code. When filing for bankruptcy, individuals are required to document their financial situation, including their current expenditures, as part of the bankruptcy process. One of the key documents for this purpose is the Schedule J — Form 6J, which focuses specifically on the current expenditures of individual debtors. This form has been in use since 2005, following changes made to the bankruptcy laws. The Schedule J — Form 6J is a vital tool for debtors to outline their regular monthly expenses. It assists in determining the individual's ability to pay their debts and helps the bankruptcy court assess their financial position. By providing comprehensive and accurate information about their expenditures, debtors can present a clear picture of their financial status and demonstrate their need for bankruptcy relief. The types of Santa Clara California Current Expenditures of Individual Debtors — Schedule — - Form 6J - Post 2005 can vary based on individual circumstances. However, common categories generally include housing expenses (such as mortgage or rent payments, property taxes, and insurance), utilities (electricity, gas, water), transportation costs (including car payments, fuel, insurance, and maintenance), food, clothing, healthcare, childcare, education, and personal care expenses. Additionally, the Schedule J — Form 6J may include other discretionary expenses like recreation, entertainment, charitable contributions, and pet care. However, it is crucial to provide accurate and reasonable figures to ensure transparency and compliance with bankruptcy laws. In conclusion, Santa Clara, California, is a dynamic city where residents facing financial hardships have the opportunity to seek relief through bankruptcy filings. The Schedule J — Form 6— - Post 2005 plays a crucial role in documenting and detailing the current expenditures of individual debtors. By accurately disclosing their monthly expenses across various categories, debtors can present a comprehensive financial picture and aid the bankruptcy court in assessing their need for relief.

Santa Clara California Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

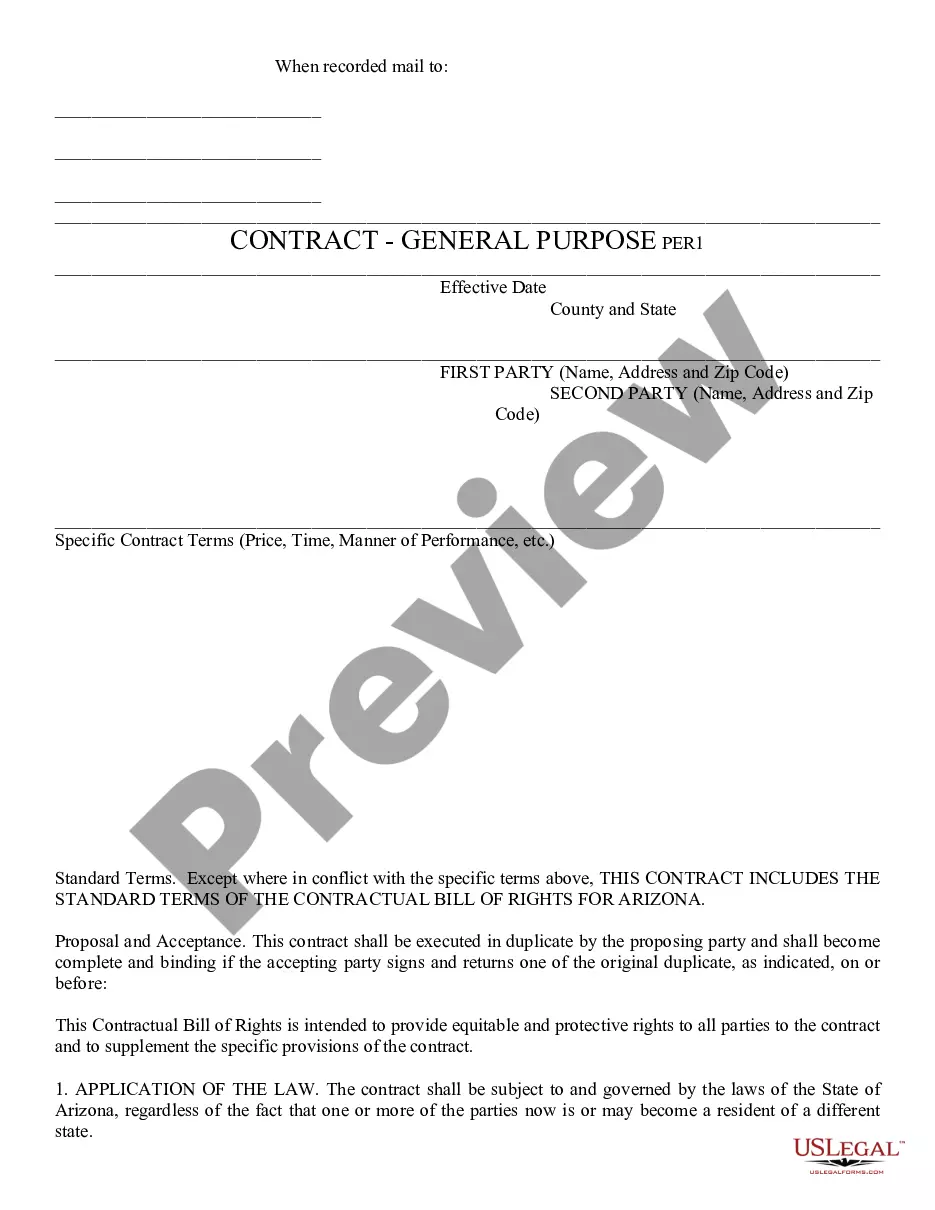

How to fill out Santa Clara California Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Santa Clara Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Santa Clara Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Santa Clara Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Santa Clara Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!