Maricopa, Arizona is a city located in Pinal County, Arizona, United States. It is known for its fast-growing population and vibrant community. In the domain of financial matters, individuals or corporations may need to complete a Statement of Financial Affairs — Form 7, which is an essential legal document in certain situations. The Maricopa Arizona Statement of Financial Affairs — Form 7 is typically used during bankruptcy proceedings. When an individual or business files for bankruptcy, they are required to disclose detailed financial information by completing this form. It provides a comprehensive overview of their current financial situation, including assets, liabilities, income, and expenses. This document plays a crucial role in determining the debtor's ability to repay their debts and helps establish a fair resolution for all involved parties. Different types of Maricopa Arizona Statement of Financial Affairs — Form 7 may exist based on specific circumstances or bankruptcy chapters. This includes Chapter 7 bankruptcy, Chapter 11 bankruptcy, and Chapter 13 bankruptcy, each with its own unique requirements. Chapter 7 bankruptcy is primarily for individuals or couples seeking debt relief through liquidation, while Chapter 11 bankruptcy is typically utilized by businesses aiming to reorganize their debts. Chapter 13 bankruptcy allows individuals with a steady income to create a repayment plan over three to five years to satisfy their debts. In completing the Maricopa Arizona Statement of Financial Affairs — Form 7, individuals or entities need to provide accurate and detailed information. This may include a breakdown of their assets, such as real estate, vehicles, investments, and bank accounts, along with any outstanding debts or liabilities, such as loans, mortgages, credit card debts, or tax obligations. Additionally, individuals are required to disclose their income sources, monthly expenses, and any recent financial transactions. It is vital to ensure the accuracy and completeness of the Maricopa Arizona Statement of Financial Affairs — Form 7, as incomplete or false information may have severe legal consequences. Working with an experienced bankruptcy attorney or financial professional can help navigate the complexities of this form and ensure compliance with all relevant bankruptcy laws and regulations. Overall, the Maricopa Arizona Statement of Financial Affairs — Form 7 is an essential document in bankruptcy proceedings, serving to provide a comprehensive snapshot of an individual's or business's financial situation. Properly completing this form is crucial to facilitating the bankruptcy process and determining the appropriate resolution to offer relief to the debtor and their creditors.

Maricopa Arizona Statement of Financial Affairs - Form 7

Description

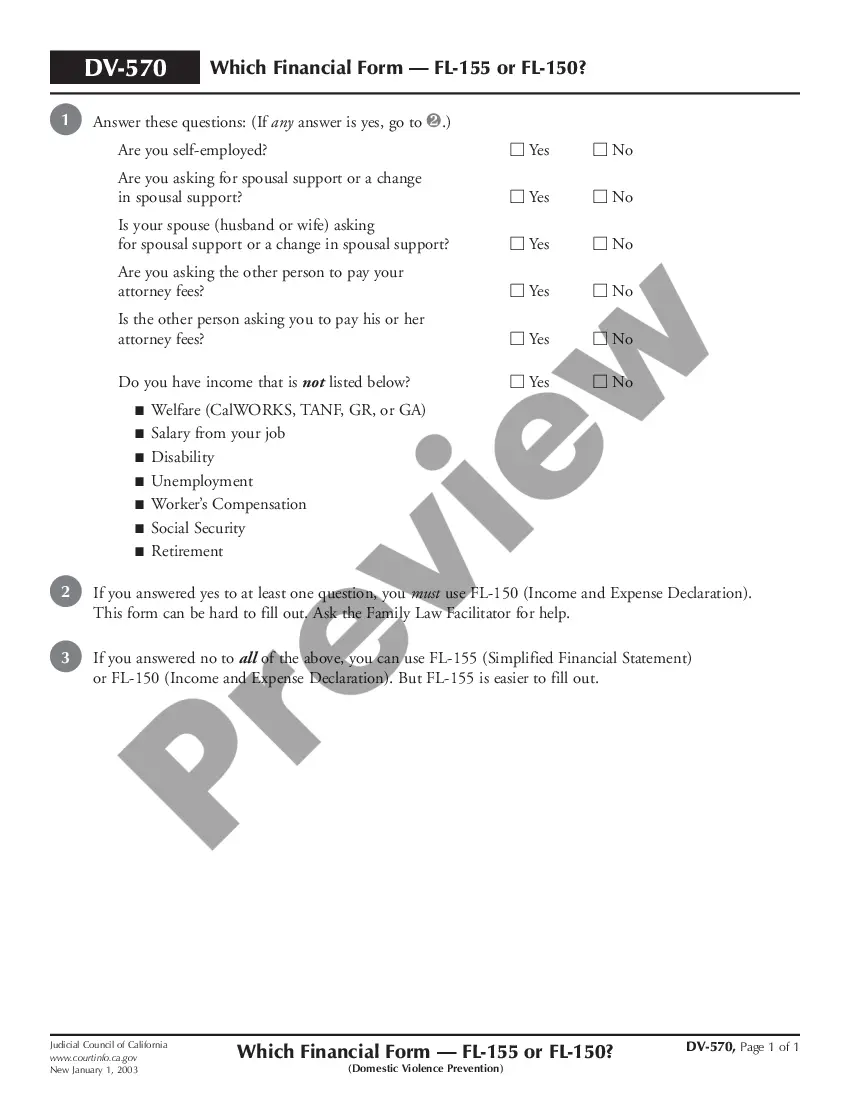

How to fill out Maricopa Arizona Statement Of Financial Affairs - Form 7?

If you need to find a reliable legal form provider to find the Maricopa Statement of Financial Affairs - Form 7, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to get and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to search or browse Maricopa Statement of Financial Affairs - Form 7, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Maricopa Statement of Financial Affairs - Form 7 template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Maricopa Statement of Financial Affairs - Form 7 - all from the comfort of your sofa.

Join US Legal Forms now!