The Collin Texas Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 is a legal document that individuals filing for Chapter 7 bankruptcy in Collin County, Texas must complete. This form outlines the debtor's intentions regarding their secured and unsecured debts, such as whether they plan to surrender, reaffirm, or redeem certain assets. In Collin County, there are various types of Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005, depending on the debtor's specific circumstances. These may include: 1. Collin Texas Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 for Surrender: This form is used when a debtor plans to surrender certain secured assets, such as a vehicle or a property. By indicating their intention to surrender, the debtor acknowledges that they will no longer retain possession of the asset, and it will be handed over to the creditor. 2. Collin Texas Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 for Reaffirmation: This form is used when a debtor wishes to reaffirm a debt, meaning they want to keep a secured asset and continue making payments on it as agreed upon in the original contract. By reaffirming, the debtor takes on the responsibility of repaying the debt and preventing it from being discharged through bankruptcy. 3. Collin Texas Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 for Redemption: This form is used when a debtor wishes to redeem a secured asset, usually by paying the creditor the current fair market value of the asset instead of the full outstanding debt. This can be beneficial if the value of the asset has significantly decreased compared to the original loan amount. The Collin Texas Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 is an essential document in the bankruptcy process, as it helps determine the fate of a debtor's assets. By accurately completing this form, debtors can make informed decisions regarding their secured and unsecured debts, taking into consideration their financial situation and goals for the future.

Collin Texas Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

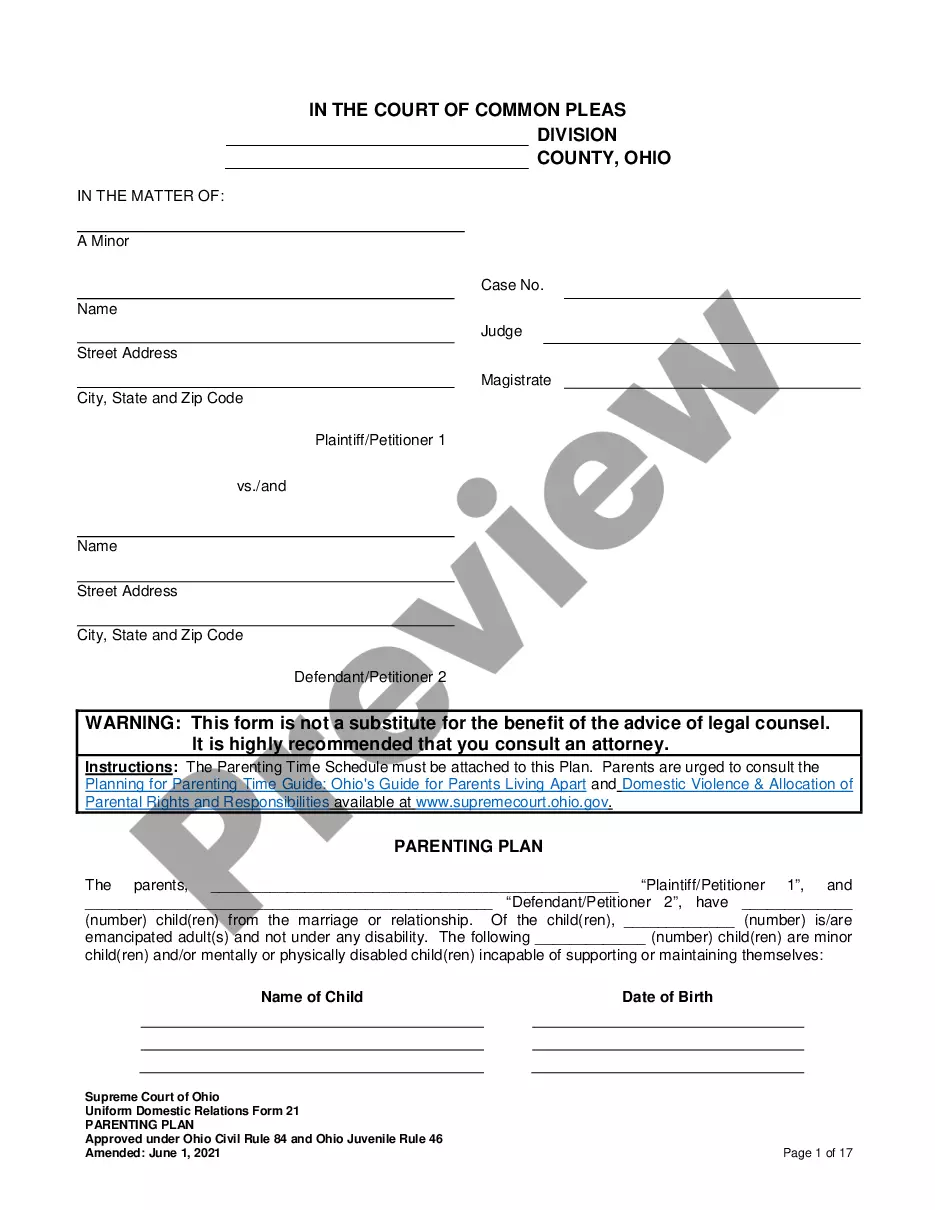

How to fill out Collin Texas Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

If you need to find a reliable legal document supplier to get the Collin Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it simple to get and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Collin Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Collin Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the Collin Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

The statement of financial affairs, or "SOFA," is a required form in a bankruptcy filing. This form delves into all of your personal matters so that the court can fully grasp the financial situation that is causing you to file. You'll fill out the SOFA if you file for a Chapter 7, Chapter 11, or Chapter 13 bankruptcy.

Finally, you can state that you intend to retain the property which means you simply remain current on your payments or the creditor can repossess it.

A Chapter 7 bankruptcy will generally discharge your unsecured debts, such as credit card debt, medical bills and unsecured personal loans. The court will discharge these debts at the end of the process, generally about four to six months after you start.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

For businesses. When a troubled business is unable to pay its creditors, it may file (or be forced by its creditors to file) for bankruptcy in a federal court under Chapter 7. A Chapter 7 filing means that the business ceases operations unless those operations are continued by the Chapter 7 trustee.

Usually a chapter 7 bankruptcy is dismissed if the client didn't tell the lawyer that they owned something valuable, like a car, house or business.

The Statement of Intention for Individuals Filing Under Chapter 7 tells your creditor whether you plan to keep your lease, or if you're buying property, whether you want to surrender it, buy it from the creditor, or pursue other options for keeping it.

Use this form to tell the court about any Social Security or federal Individual Taxpayer Identification numbers you have used. Do not file this form as part of the public case file. This form must be submitted separately and must not be included in the court's public electronic records.

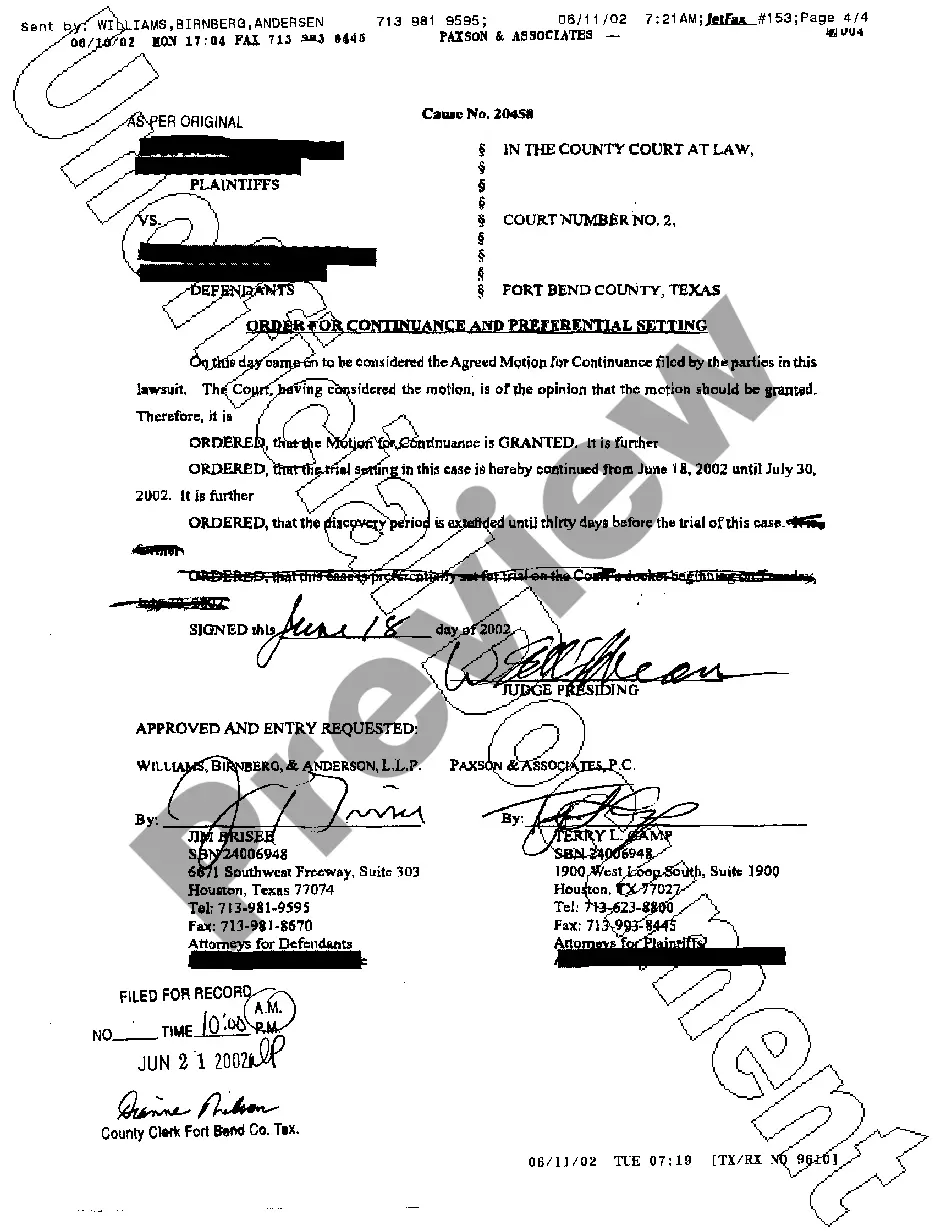

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets.