The Cuyahoga Ohio Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 is a legal document that plays a significant role in the bankruptcy process. When an individual files for Chapter 7 bankruptcy in Ohio's Cuyahoga County, they are required to complete this form, which outlines their intentions regarding various types of property and debt. This form is specifically designed for individuals who filed for bankruptcy after the year 2005, as there have been some changes in bankruptcy laws and regulations. It is crucial to use the correct and updated form to ensure compliance with legal requirements. The Cuyahoga Ohio Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 covers different aspects of the debtor's property and debt. Some key categories included in this form are: 1. Secured debts: This section pertains to any secured debts that the debtor may have, such as mortgages or car loans. Here, the debtor must indicate whether they intend to surrender the collateral (property used to secure the debt) or redeem it by paying the fair market value to the creditor. 2. Lease agreements: If the debtor has any ongoing lease agreements for vehicles or personal property, they must indicate whether they plan to assume or reject the lease. Assuming the lease means that they will continue making payments and keep the property, while rejecting it allows them to return the property to the lessor. 3. Personal property: Debtors must specify their plans for personal property, such as household goods, appliances, and electronics. They can choose to either exempt the property (keep it) or abandon it (surrender it). 4. Other executory contracts and unexpired leases: This section covers contracts or leases that have ongoing obligations or duties, such as rental contracts for commercial properties or service agreements. The debtor must state whether they wish to assume, reject, or assign these contracts. 5. Intention to reaffirm debts: Debtors may have secured debts that they wish to reaffirm, meaning they want to continue paying them despite filing for bankruptcy. This section allows them to declare their intention to reaffirm specific debts. By accurately completing the Cuyahoga Ohio Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005, debtors provide valuable information to the bankruptcy court, creditors, and their legal representatives. It helps establish a clear plan for handling assets and obligations, allowing for an efficient and fair resolution of the bankruptcy case. In summary, the Cuyahoga Ohio Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 is a critical document for those filing for bankruptcy in Cuyahoga Ohio. It covers various aspects of property and debt, ensuring debtors' intentions regarding different types of obligations are clearly communicated. Use of the correct form is essential to comply with post-2005 bankruptcy regulations.

Cuyahoga Ohio Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Cuyahoga Ohio Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Cuyahoga Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the latest version of the Cuyahoga Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Cuyahoga Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A statement of affairs is a statement which shows assets on one side and the liabilities on the other, just as in case of a balance sheet. It is prepared in single entry system to ascertain the amount of capital. Accountancy.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

Use this form to tell the court about any Social Security or federal Individual Taxpayer Identification numbers you have used. Do not file this form as part of the public case file. This form must be submitted separately and must not be included in the court's public electronic records.

What is normally required before a reorganization plan can be implemented? A) The plan must be presented by the company and confirmed by the court. B) The plan must be voted on, and accepted separately by, each class of creditors and each class of stockholders, then confirmed by the court.

Finally, you can state that you intend to retain the property which means you simply remain current on your payments or the creditor can repossess it.

A statement of affairs is a document created by an insolvency practitioner to sum up the financial situation of a company in a manner intelligble to creditors and shareholders.

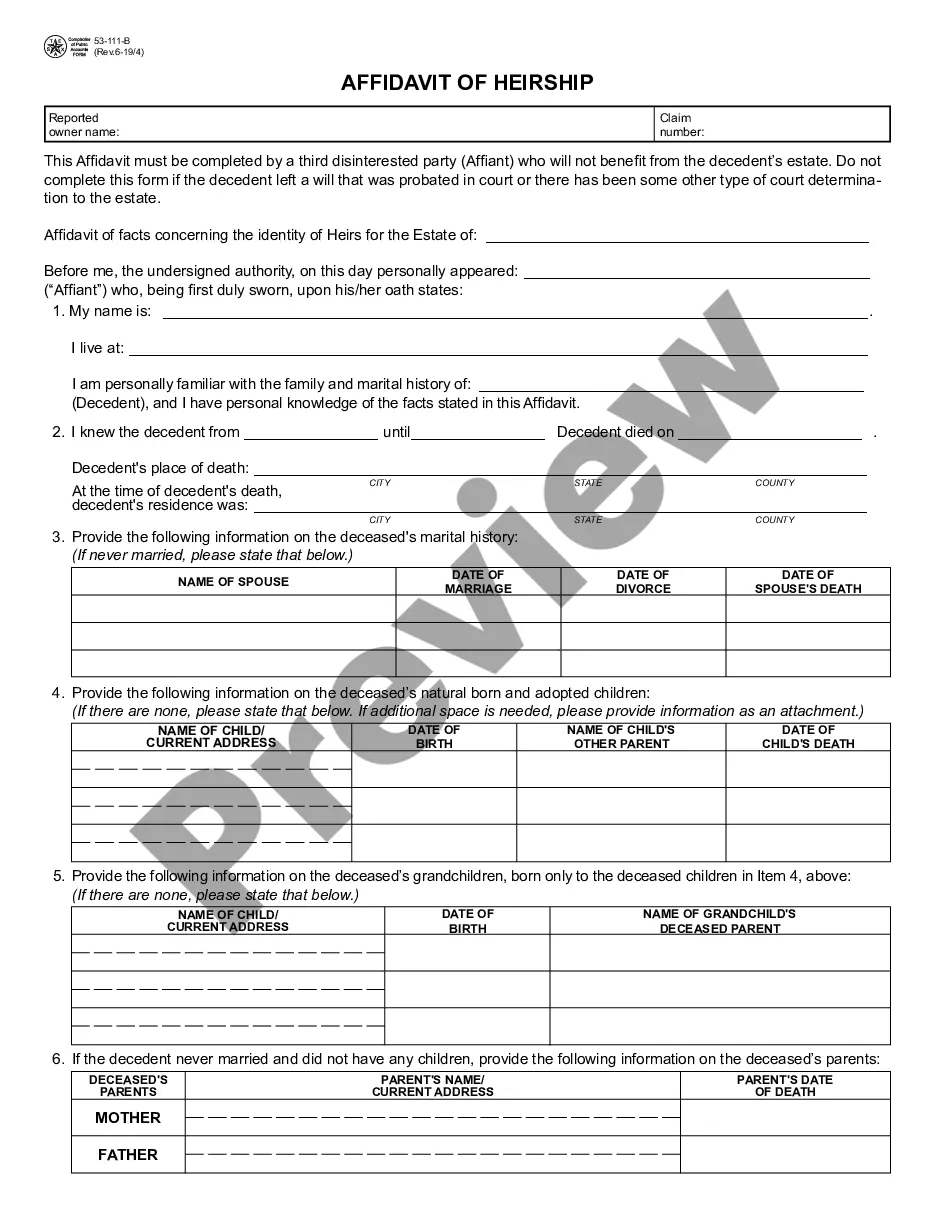

The Statement of Intention for Individuals Filing Under Chapter 7 tells your creditor whether you plan to keep your lease, or if you're buying property, whether you want to surrender it, buy it from the creditor, or pursue other options for keeping it.

The statement of financial affairs, or "SOFA," is a required form in a bankruptcy filing. This form delves into all of your personal matters so that the court can fully grasp the financial situation that is causing you to file. You'll fill out the SOFA if you file for a Chapter 7, Chapter 11, or Chapter 13 bankruptcy.

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets.