San Diego, California, is a city on the Pacific coast known for its beautiful beaches, vibrant culture, and thriving economy. In the context of individual bankruptcy, Chapter 7 is a common option for debtors seeking relief from overwhelming financial burdens. When filing for Chapter 7 bankruptcy in San Diego, California, debtors are required to submit a Statement of Intention — Form 8, according to the guidelines set forth in the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) of 2005. The San Diego California Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005 serves as a crucial document wherein debtors declare their intentions regarding different types of assets they may possess. These assets could include personal property, real estate, motor vehicles, and other valuable possessions. Debtors must clearly state whether they intend to retain or surrender each asset listed in the form. There are various types or sections within the San Diego California Chapter 7 Individual Debtors Statement of Intention — Form — - Post 2005, which typically address specific categories of assets. These categories may include: 1. Personal Property: Debtors must specify their intentions regarding personal belongings such as furniture, electronics, jewelry, or any other valuable possessions they currently own or have an interest in. They can choose either to retain the property (reaffirm the debt), redeem it by paying its value in cash, or surrender it to the trustee. 2. Real Estate: If the debtor has any real estate properties, they need to state whether they intend to keep the property or surrender it. A certain set of rules and exemptions will apply depending on the specific circumstances of the debtor. 3. Motor Vehicles: Debtors must indicate their intentions regarding any vehicles they own, including cars, motorcycles, or recreational vehicles. They can choose to retain the vehicle by reaffirming the debt, redeem it if they are willing to pay its current value, or surrender it to the bankruptcy trustee. 4. Other Assets: Apart from personal property, real estate, and motor vehicles, debtors may possess other valuable assets, such as investments, stocks, or bonds. They must disclose their intentions regarding these assets as well. It is essential for debtors filing for Chapter 7 bankruptcy in San Diego, California, to carefully consider their options and understand the potential consequences of each decision made in the Statement of Intention — Form — - Post 2005. Seeking guidance from a qualified bankruptcy attorney can help debtors navigate this complex process and make informed choices aligned with their financial goals and circumstances.

San Diego California Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out San Diego California Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

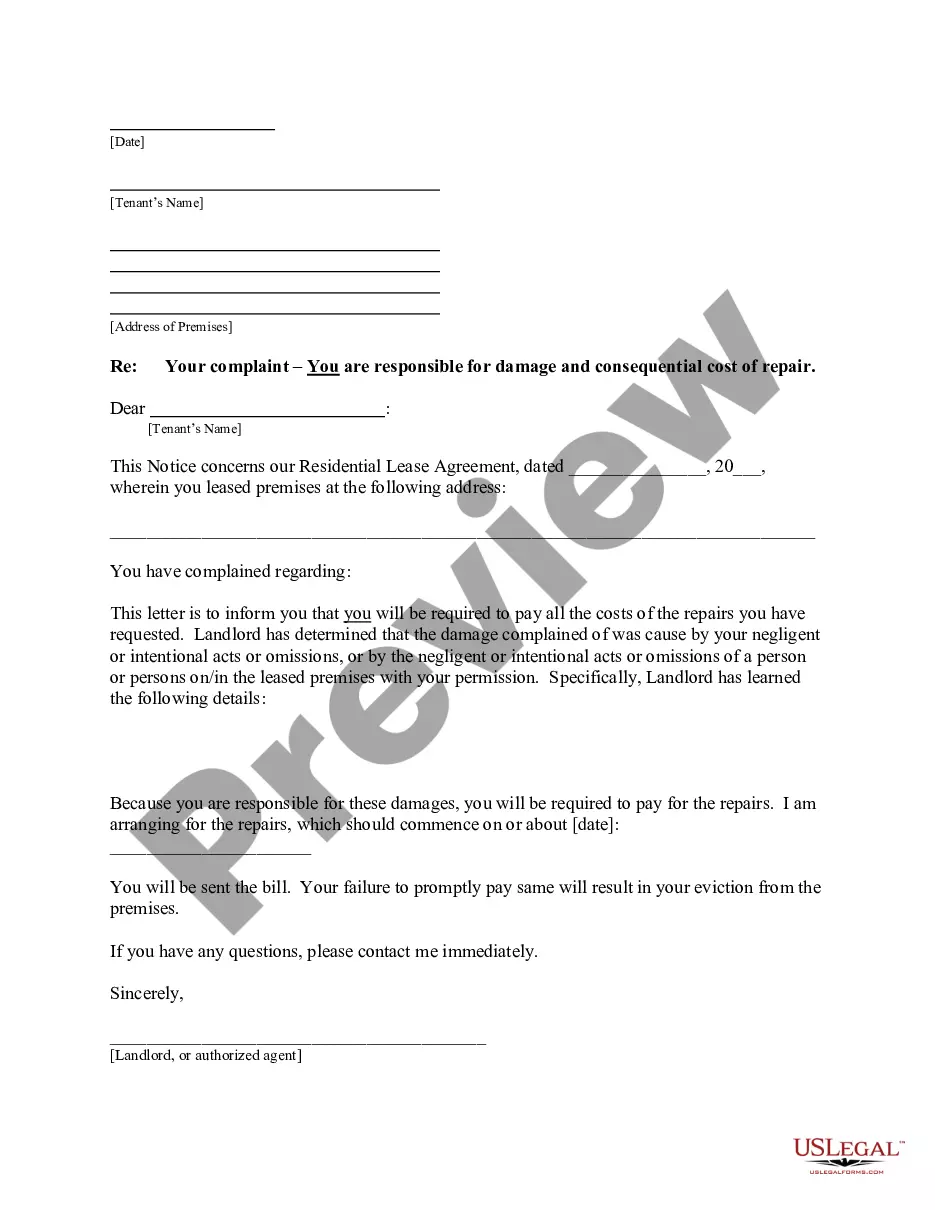

Draftwing forms, like San Diego Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005, to take care of your legal affairs is a difficult and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Diego Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting San Diego Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005:

- Make sure that your template is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the San Diego Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our service and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!