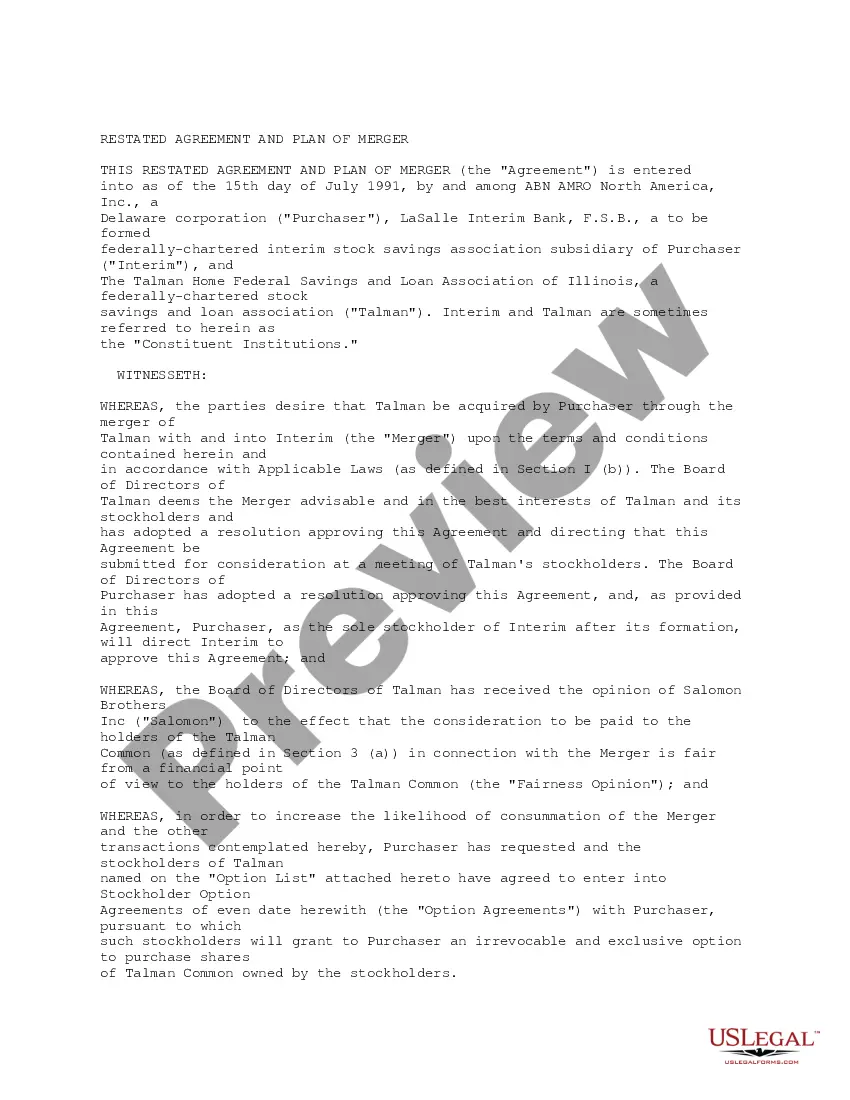

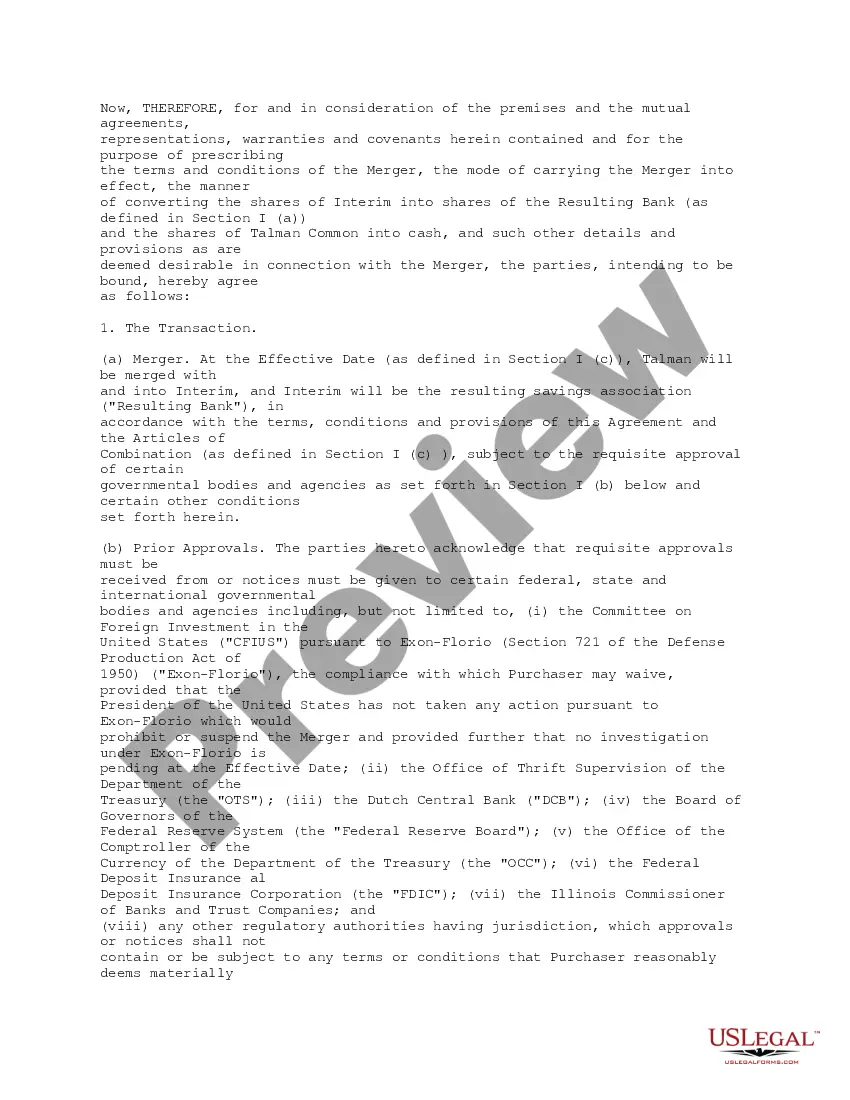

The Orange California Restated Agreement and Plan of Merger by ABN AFRO North America, Inc., La Sale Interim Bank, and The Tasman Home Federal Savings and Loan Assoc. Of IL is a legal document that outlines the terms and conditions of a merger between these three financial institutions. This agreement aims to combine their resources, expertise, and customer base to create a stronger and more competitive entity in the banking industry. One type of Orange California Restated Agreement and Plan of Merger could be focused on the consolidation of branch locations. This type of merger allows the involved parties to streamline their operations, reduce costs, and improve efficiency by eliminating duplicate branches or merging them into one central location. It also enables the new entity to provide a wider range of products and services to customers in Orange County, California. Another type of Orange California Restated Agreement and Plan of Merger could be focused on the integration of technology and digital banking platforms. In today's rapidly evolving financial landscape, the ability to offer modern and convenient banking solutions is crucial. This type of merger seeks to leverage the technological capabilities of each institution to enhance digital banking services, improve online and mobile platforms, and provide customers with a seamless and user-friendly banking experience. Furthermore, an Orange California Restated Agreement and Plan of Merger might involve the integration of wealth management divisions. This type of merger allows the new entity to offer a comprehensive suite of financial services, including investment advisory, estate planning, and wealth preservation strategies. By combining the expertise and resources of ABN AFRO North America, Inc., La Sale Interim Bank, and The Tasman Home Federal Savings and Loan Assoc. Of IL, the newly merged entity can attract high-net-worth individuals and provide tailored wealth management solutions to meet their unique needs. Overall, the Orange California Restated Agreement and Plan of Merger by ABN AFRO North America, Inc., La Sale Interim Bank, and The Tasman Home Federal Savings and Loan Assoc. Of IL represents a strategic initiative to create a stronger, more competitive financial institution in Orange County, California. Whether it focuses on branch consolidation, digital transformation, wealth management integration, or other aspects, this merger aims to benefit both the institutions involved and the customers they serve.

Orange California Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL

Description

How to fill out Orange California Restated Agreement And Plan Of Merger By ABN AMRO North America, Inc., La Salle Interim Bank, And The Talman Home Federal Savings And Loan Assoc. Of IL?

If you need to get a reliable legal document provider to get the Orange Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to locate and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Orange Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Orange Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less pricey and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or complete the Orange Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL - all from the convenience of your sofa.

Join US Legal Forms now!