The San Diego California Restated Agreement and Plan of Merger by ABN AFRO North America, Inc., La Sale Interim Bank, and The Tasman Home Federal Savings and Loan Assoc. Of IL is a significant legal document that outlines the terms and conditions of a merger between these financial institutions. This merger aims to combine their resources, expertise, and clientele to enhance their competitive position in the market. The agreement sets forth various key provisions, including the structure of the merger, the allocation of stock and cash considerations, the rights and responsibilities of the involved parties, and the post-merger integration process. It also addresses issues such as corporate governance, regulatory compliance, accounting treatment, and potential risks associated with the merger. This particular agreement may have different types or variations based on the specific terms negotiated between ABN AFRO North America, Inc., La Sale Interim Bank, and The Tasman Home Federal Savings and Loan Assoc. Of IL. Some possible types of San Diego California Restated Agreement and Plan of Merger may include: 1. Asset Purchase Agreement: This type of merger involves the acquisition of specific assets or business divisions of one institution by another, rather than a complete merger of the entities. 2. Stock-for-Stock Merger: In this type of merger, the shareholders of the merging entities exchange their existing shares for new shares in the merged entity, according to a predetermined ratio or formula. 3. Cash Merger: This type of merger entails one entity acquiring another by offering cash compensation to the shareholders of the target institution. 4. Merger of Equals: This refers to a merger where both entities are of similar size and stature, and the resulting entity would have joint control and leadership from both organizations' management teams. It is important to note that the exact details and naming conventions of the San Diego California Restated Agreement and Plan of Merger may vary on a case-by-case basis, depending on the specific circumstances, transaction structure, and regulatory requirements.

San Diego California Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL

Description

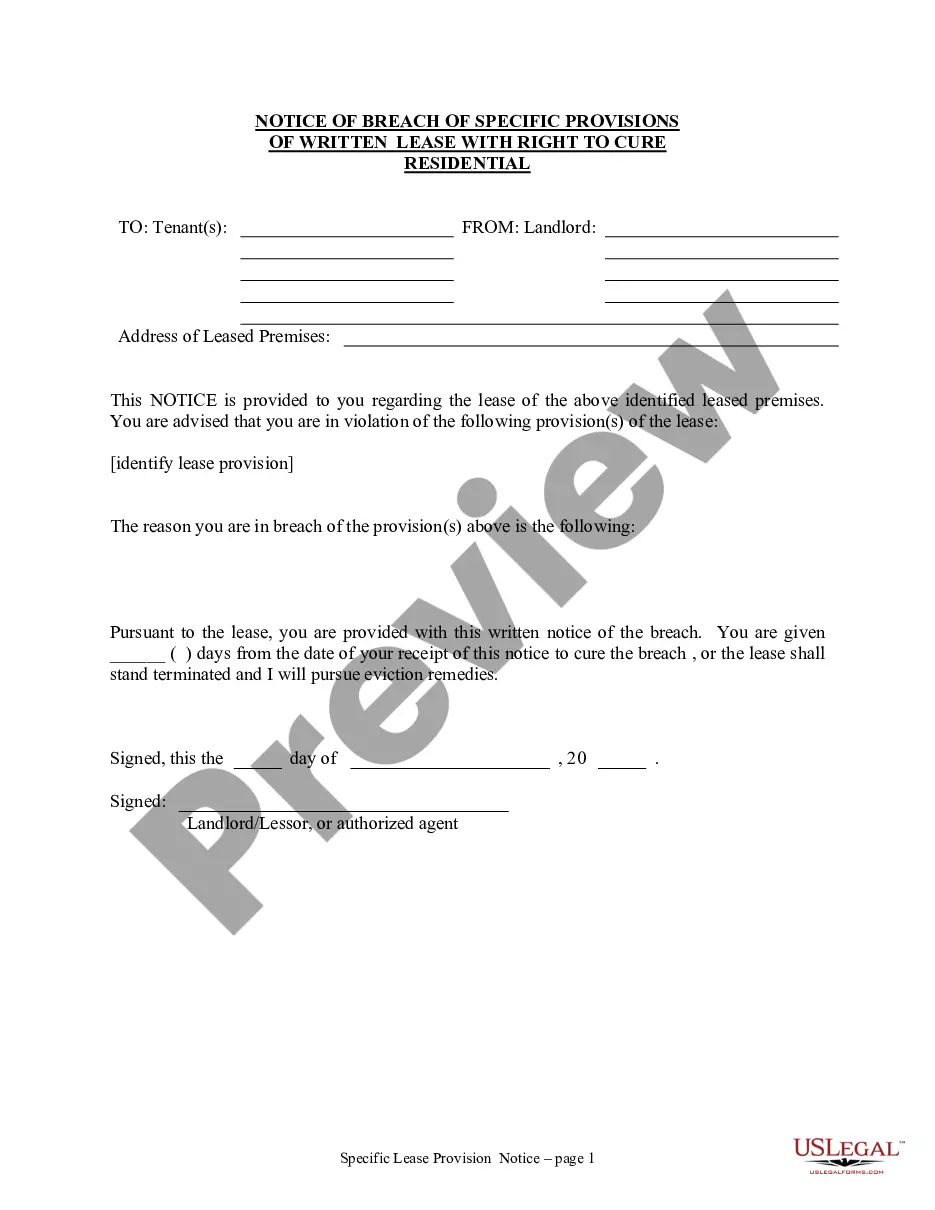

How to fill out San Diego California Restated Agreement And Plan Of Merger By ABN AMRO North America, Inc., La Salle Interim Bank, And The Talman Home Federal Savings And Loan Assoc. Of IL?

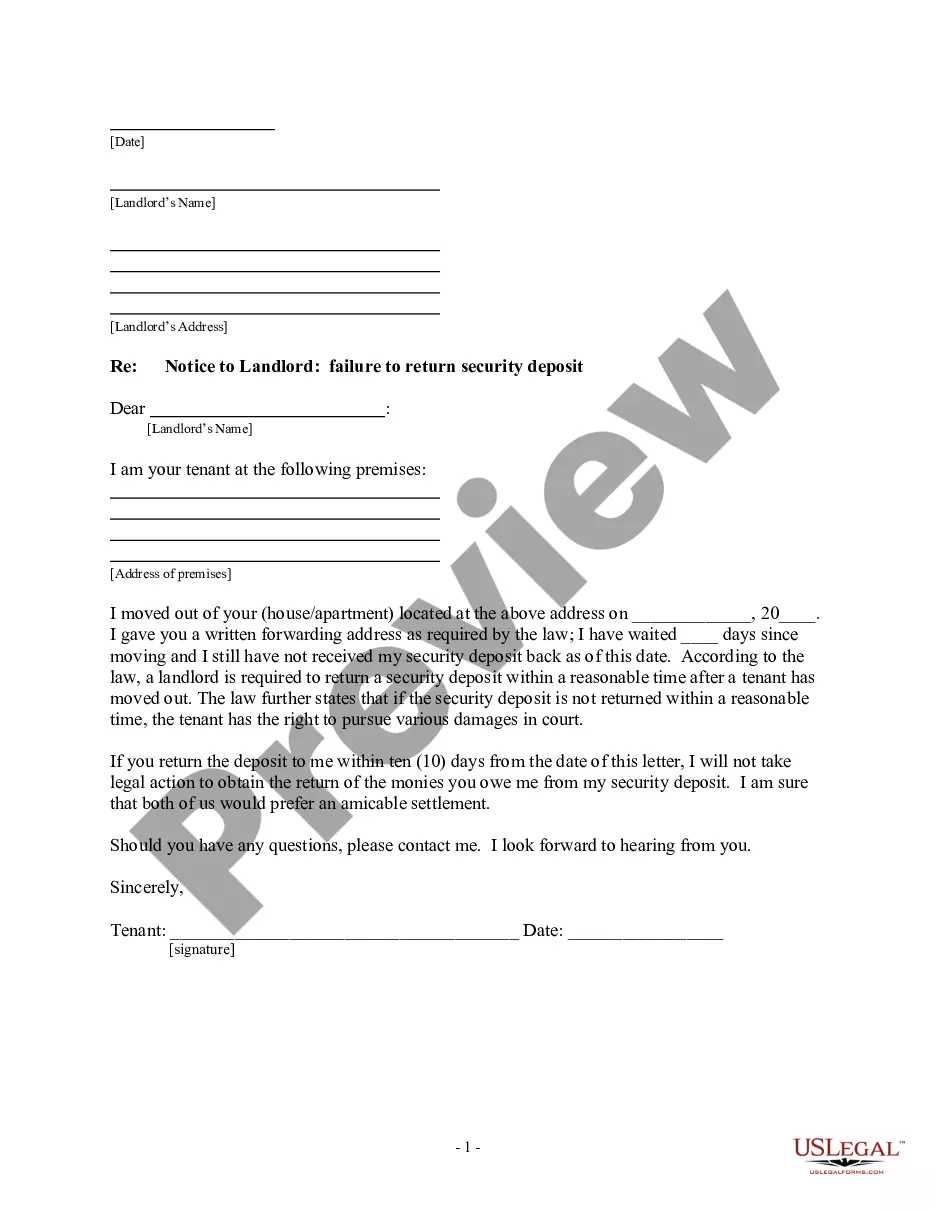

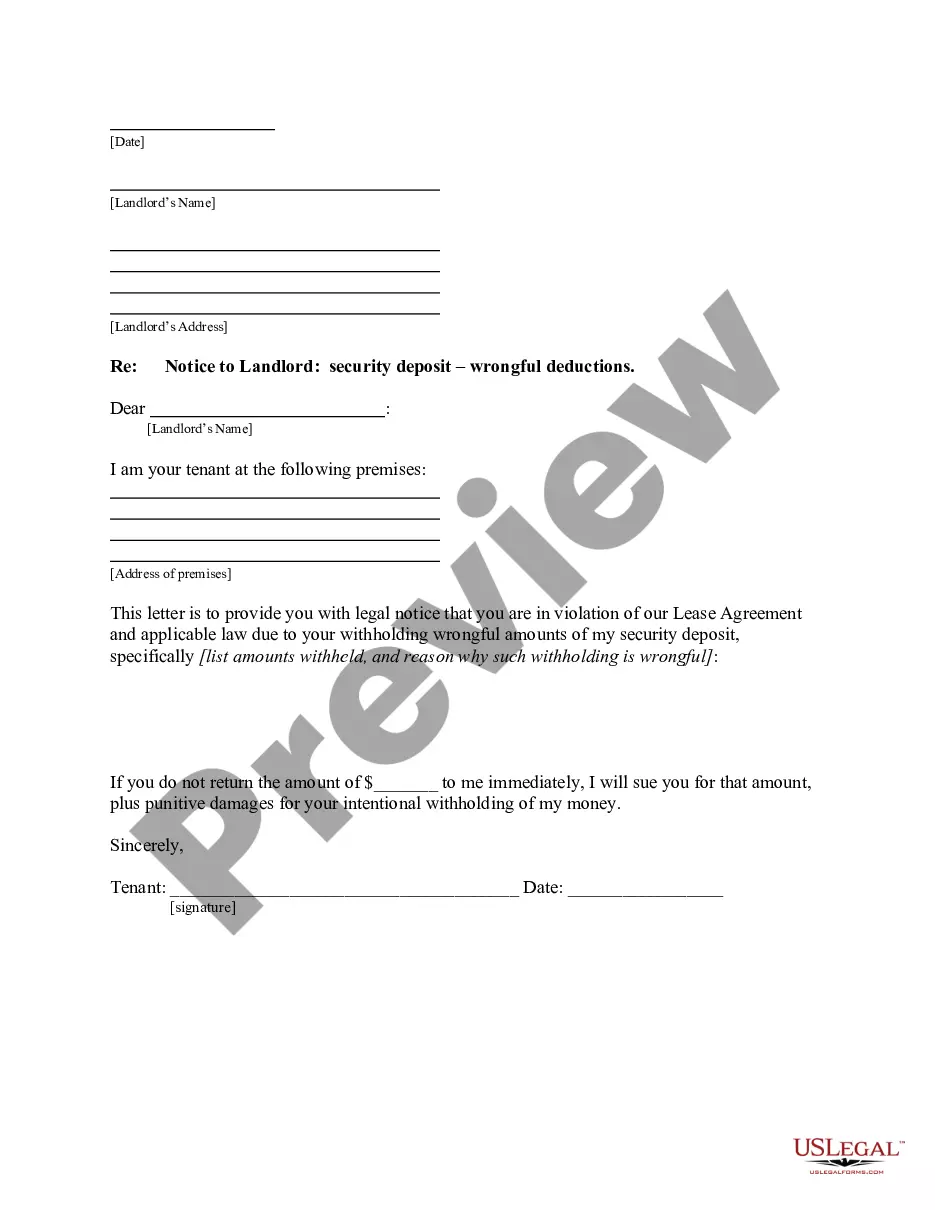

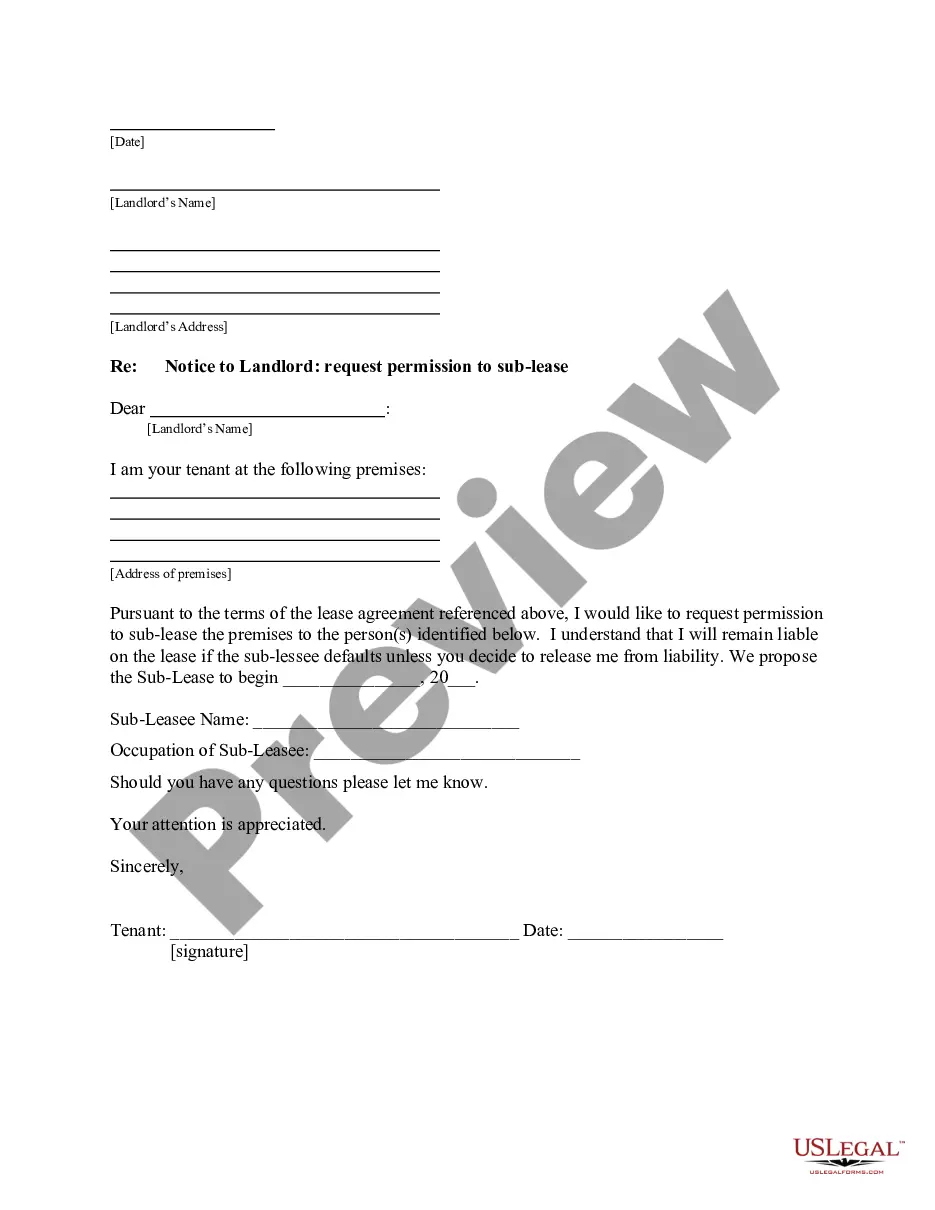

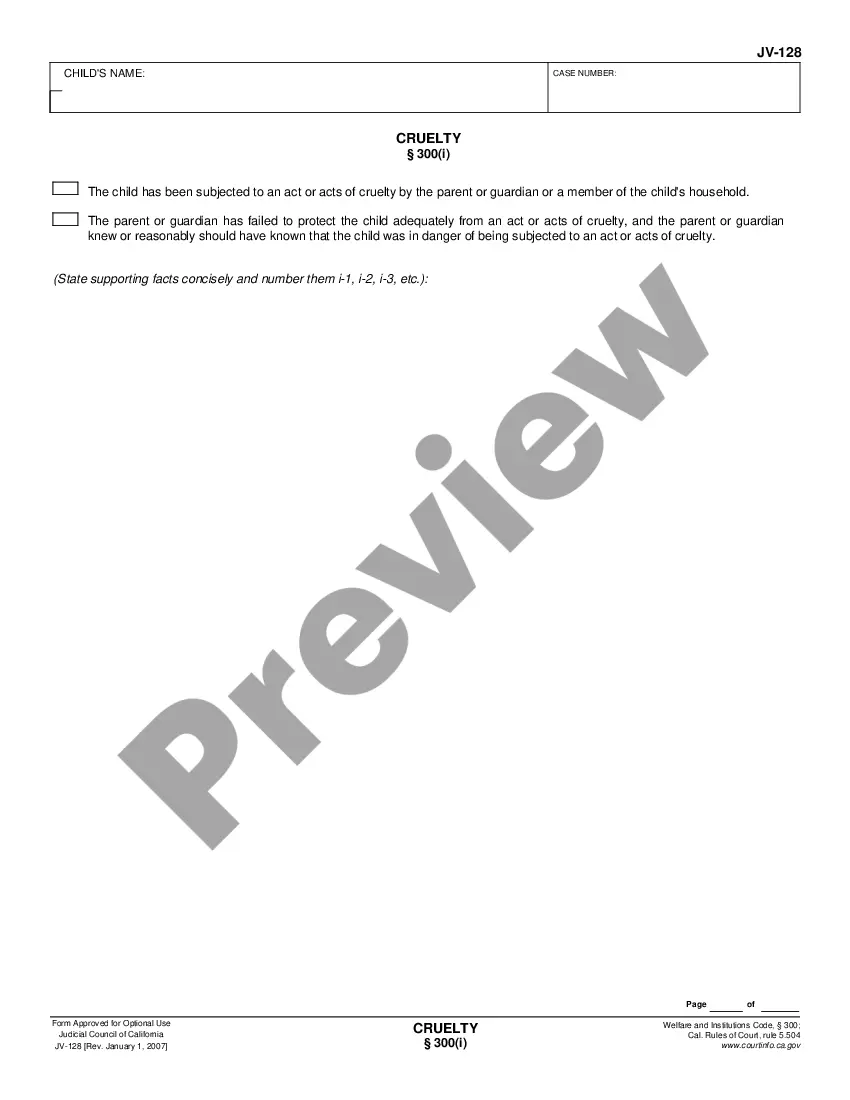

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the latest version of the San Diego Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Diego Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A bank might decide to acquire another bank to expand its business reach and improve its market share. Acquisitions also help banks become more efficient in their operations.

Meaning of bank acquisition in English the buying of a bank by another, usually larger, bank: Top prices in recent bank acquisitions have been for about twice book value.

Market estimates place a merger's timeframe for completion between six months to several years. In some instances, it may take only a few months to finalize the entire merger process. However, if there is a broad range of variables and approval hurdles, the merger process can be elongated to a much longer period.

If your bank is acquired by another bank where you already have deposits, your balances will be insured separately for six months from the date of the merger?meaning your combined balances can be over the FDIC insurance limit for six months.

You can go about your regular banking activities just as you did before. Keep in mind that if you have deposits at both banks before they merge, your account could end up over the threshold of being insured by the FDIC up to $250,000 at one institution.

HISTORICAL PERSPECTIVE ON TRENDS IN BANK MERGER ACTIVITY. ?The Merger Movement in Banking, 1919-1933?). With a population of banks totaling above 25,000, the Bank Merger Rate was in the range of 0.6% to 1.4% in the early 1900's. To put in perspective, the Bank Merger Rate was 3.3% with 164 bank mergers in 2021.

If a bank merges with another institution, it may affect your banking. You might get new bank accounts, but they should be similar to your former accounts. Branches and ATMs may temporarily close, but you might have more options when a merger is complete.

A bank merger occurs when at least two financial institutions join together under a single charter. Usually, one institution will take over in name during a bank merger. But in rare instances, banks may create a newly chartered bank with a different name.

A bank merger helps your institution scale up quickly and gain a large number of new customers instantly. Not only does an acquisition give your bank more capital to work with when it comes to lending and investments, but it also provides a broader geographic footprint in which to operate.

No two bank acquisitions are exactly the same so the time-frame can significantly vary from one case to the next. However, most institutions can expect the general time range for a full acquisition process to be about six months to one year.