The Bexar Texas Stock Option and Award Plan is a comprehensive program designed to incentivize employees of companies based in Bexar County, Texas. This plan offers various stock option and award options to eligible participants, typically to reward their contribution towards the company’s growth and success. Under the Bexar Texas Stock Option and Award Plan, employees are granted the opportunity to purchase company stock at a predetermined price known as the exercise price. This option allows employees to acquire company shares in the future, offering them potential gains as the stock price appreciates over time. In addition to stock options, the plan also includes different types of equity awards as a form of compensation or recognition. These awards can include restricted stock units (RSS), where employees are granted company shares that vest over a specified period, or performance-based equity grants such as performance stock units (Plus) or performance stock options (SOS). These awards are typically tied to achieving certain performance targets, ensuring that employees are motivated to drive the company's growth and profitability. The Bexar Texas Stock Option and Award Plan may also include provisions for stock appreciation rights (SARS), which grant employees the right to receive the appreciation in the company stock value in cash or additional stock. This allows employees to participate in the company's success without directly purchasing shares. Furthermore, the Bexar Texas Stock Option and Award Plan may have different tiers or levels, categorizing participants based on factors such as job position, seniority, or employment tenure. This approach ensures that the plan accommodates the diverse needs and contributions of employees across various roles within the organization. Implementing the Bexar Texas Stock Option and Award Plan can be advantageous for companies as it attracts and retains talented employees, aligns their interests with the company's long-term success, and provides them with financial incentives to perform at their best. By utilizing these stock options and awards, companies can foster a motivated and engaged workforce, which can ultimately contribute to the overall growth and prosperity of Bexar County-based businesses.

Bexar Texas Stock Option and Award Plan

Description

How to fill out Bexar Texas Stock Option And Award Plan?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Bexar Stock Option and Award Plan, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Bexar Stock Option and Award Plan from the My Forms tab.

For new users, it's necessary to make some more steps to get the Bexar Stock Option and Award Plan:

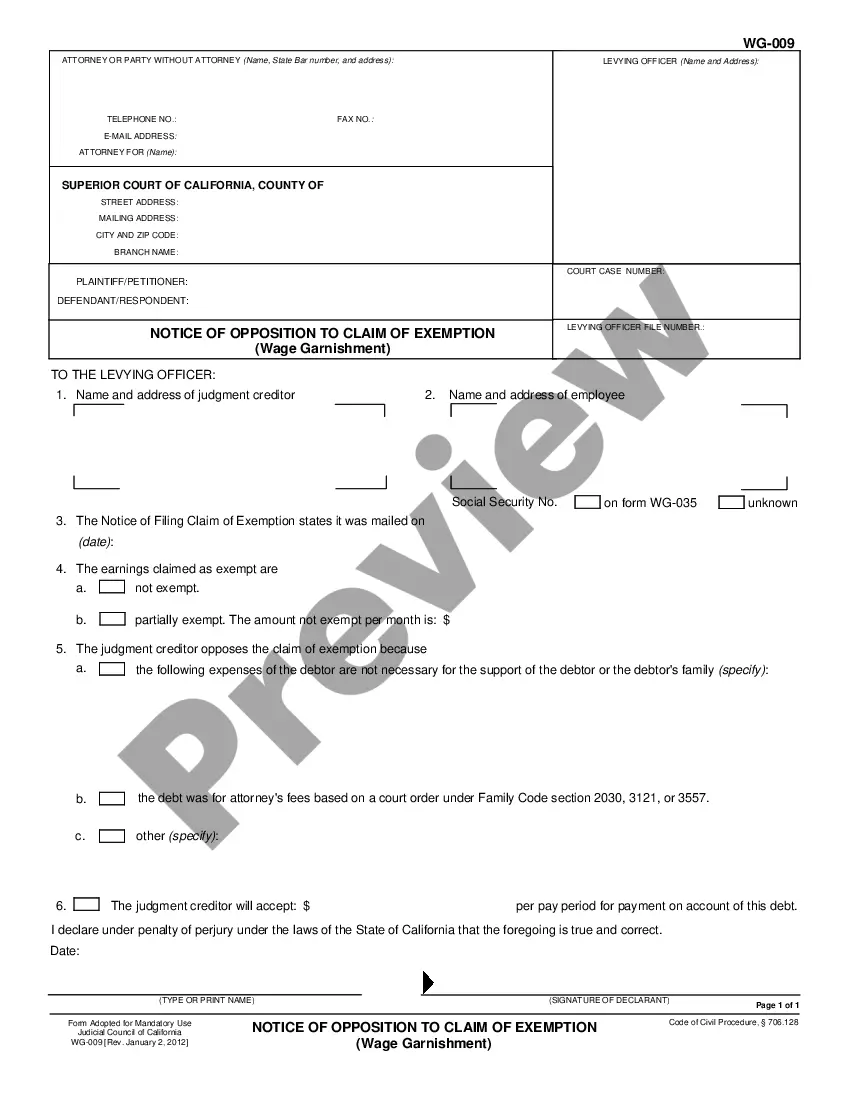

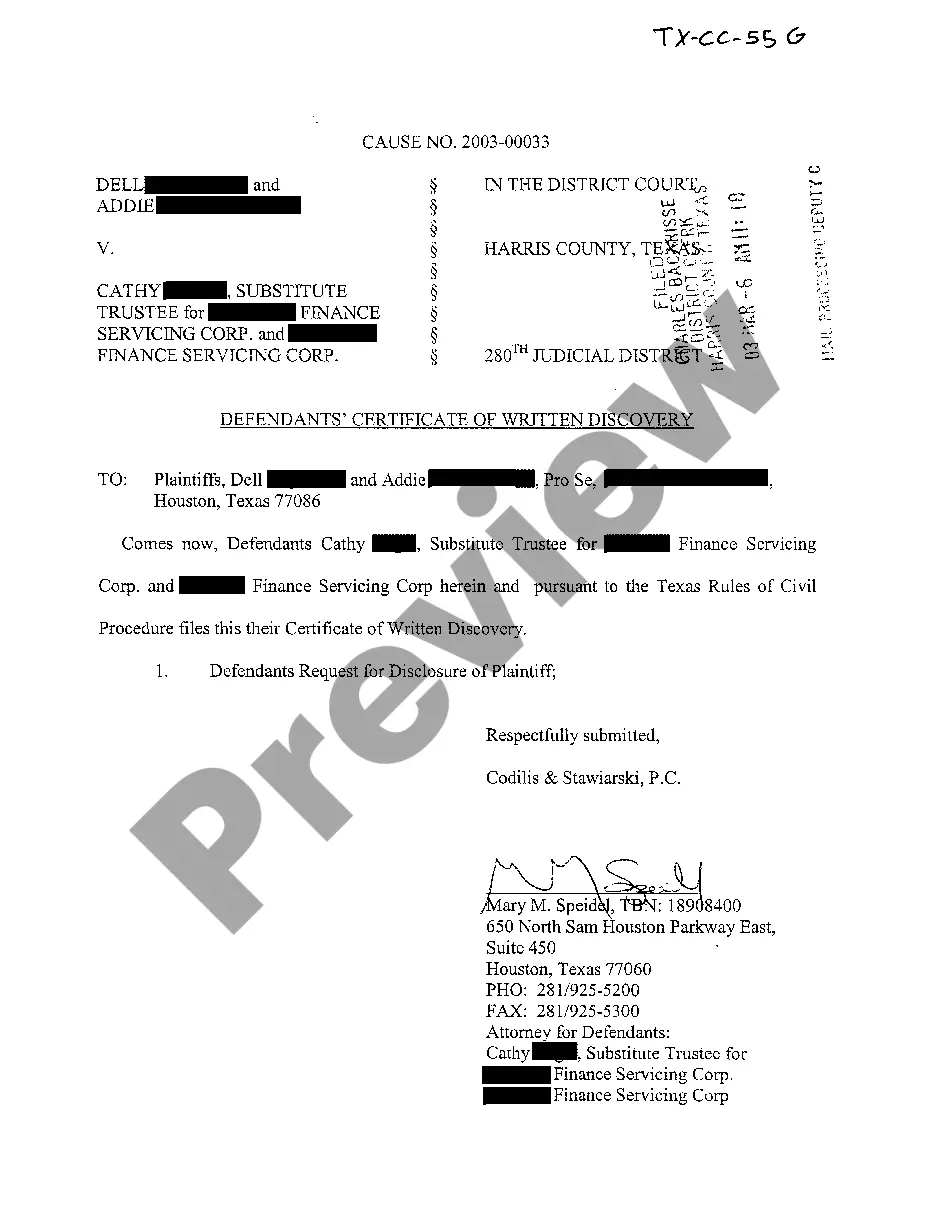

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

A share option is where the employee is granted a right to acquire shares at the end of an agreed option period for a price at the date the option is granted. The main reason for using employee share incentive plans is to recruit, retain and motivate employees.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Total stock compensation expense is calculated by taking the number of stock options granted and multiplying by the fair market value on the grant date.

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ESOPs give the sponsoring companythe selling shareholderand participants various tax benefits, making them qualified plans.

What Is a Stock Option? An employer-granted stock option is the right to purchase a company's stock in the future at a fixed price. As the company's stock price appreciates, the option's value also appreciates.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.